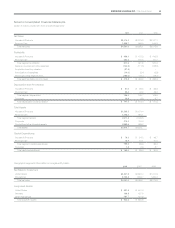

Energizer 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC. 2008 Annual Report 33

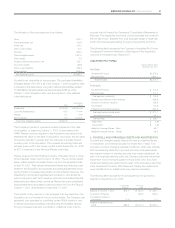

In 2007 and 2006, $4.3 and $5.7, respectively, of tax benefits related

to prior years’ losses were recorded. These benefits related to foreign

countries where our subsidiary subsequently began to generate earn-

ings and could reasonably expect future profitability sufficient to utilize

tax loss carryforwards prior to expiration. Improved profitability in Mexico

in 2007 and 2006 account for the bulk of the benefits recognized.

Adjustments were recorded in each of the three years to revise

previously recorded tax accruals to reflect refinement of tax attribute

estimates to amounts in filed returns, settlement of tax audits and

changes in estimates related to uncertain tax positions in a number

of jurisdictions. Such adjustments increased the income tax provision

by $1.1 in 2008 and decreased the income tax provision by $7.9 and

$10.9 in 2007 and 2006, respectively. Also, legislation enacted in Ger-

many reduced the tax rate applicable to the Company’s subsidiaries in

Germany for fiscal 2008 and beyond. Thus, an adjustment of $9.7 was

made to reduce deferred tax liabilities in fiscal 2007.

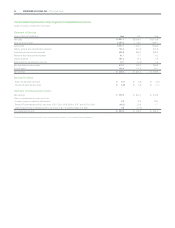

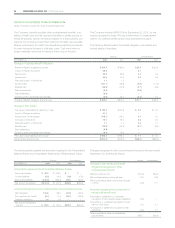

The deferred tax assets and deferred tax liabilities recorded on the bal-

ance sheet as of September 30 for the years indicated are as follows

and include current and noncurrent amounts:

2008 2007

Deferred tax liabilities:

Depreciation and property differences $(108.1) $ (71.0)

Intangible assets (528.4) (39.4)

Pension plans (11.3) (33.8)

Other tax liabilities (16.3) (9.8)

Gross deferred tax liabilities (664.1) (154.0)

Deferred tax assets:

Accrued liabilities 119.0 73.3

Deferred and stock-related compensation 89.2 92.3

Tax loss carryforwards and tax credits 15.2 21.2

Intangible assets 32.4 35.3

Postretirement benefits other than pensions 5.4 10.6

Inventory differences 23.7 19.4

Other tax assets 18.1 19.0

Gross deferred tax assets 303.0 271.1

Valuation allowance (9.1) (4.9)

Net deferred tax (liabilities)/assets $(370.2) $112.2

There were no material tax loss carryforwards that expired in 2008.

Future expirations of tax loss carryforwards and tax credits, if not

utilized, are as follows: 2009, $0; 2010, $0.2; 2011, $0.2; 2012,

$1.3; thereafter or no expiration, $13.5. The valuation allowance

is attributed to tax loss carryforwards and tax credits outside the U.S.

The valuation allowance increased $4.2 in 2008 due primarily to the

Playtex acquisition.

At September 30, 2008, approximately $650 of foreign subsidiary

retained earnings was considered indefinitely invested in those busi-

nesses. U.S. income taxes have not been provided for such earnings.

It is not practicable to determine the amount of unrecognized deferred

tax liabilities associated with such earnings.

The Company adopted the provisions of FIN 48 on October 1, 2007.

At the date of adoption of FIN 48, the Company had $34.5 of unrecog-

nized tax benefits in the financial statements, excluding the unrecognized

tax benefit from the Playtex acquisition. Of this amount, the impact of

the cumulative change in accounting principle at adoption of FIN 48

was immaterial.

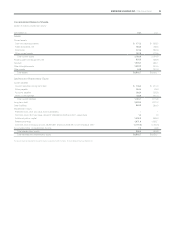

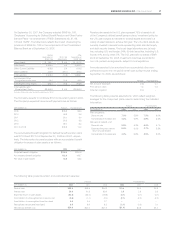

Unrecognized tax benefits activity for the year ended September 30,

2008 is summarized below:

2008

Unrecognized tax benefits, beginning of year $34.5

Additions based on current year tax positions and acquisitions 14.3

Reductions for prior year tax positions (1.8)

Unrecognized tax benefits, end of year $47.0

Included in the unrecognized tax benefits noted above are $43.5 of

uncertain tax positions that would affect the Company’s effective tax

rate, if recognized. The Company does not expect any significant

increases or decreases to their unrecognized tax benefits within twelve

months of this reporting date. In the Consolidated Balance Sheets,

unrecognized tax benefits are classified as other liabilities (non-current)

to the extent that payment is not anticipated within one year.

Prior to the adoption of FIN 48, only interest expense on underpay-

ments of income taxes was included in the income tax provision.

Penalties were classified as an operating expense in arriving at pre-tax

income. Upon adoption of FIN 48, the Company elected a new

accounting policy, as permitted by FIN 48, to also classify accrued

penalties related to unrecognized tax benefits in the income tax provi-

sion. The Company has accrued approximately $5.8 of interest and

$0.7 of penalties in the income tax provision. Interest was computed

on the difference between the tax position recognized in accordance

with FIN 48 and the amount previously taken or expected to be taken

in the Company’s tax returns.

The Company files income tax returns in the U.S. federal jurisdiction,

various city, state, and more than 40 foreign jurisdictions where the

Company has operations. U.S. federal income tax returns for tax years

ended September 30, 2003 and after remain subject to examination

by the Internal Revenue Service. With few exceptions, the Company is

no longer subject to state and local income tax examinations for years

before September 30, 2002. The status of international income tax

examinations varies by jurisdiction. The Company does not anticipate

any material adjustments to its financial statements resulting from tax

examinations currently in progress.

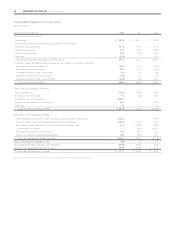

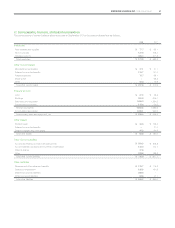

6. RESTRUCTURING AND RELATED CHARGES

The Company continually reviews its Household Products and Per-

sonal Care business models to identify potential improvements and

cost savings. A project commenced in 2006 to improve effectiveness

and reduce costs of European packaging, warehouse and distribution

activities, including the closing of the Company’s battery packaging

facility in Caudebec, France, as well as consolidation of warehouse

and distribution activities. The Company also commenced a project to

integrate Household Products and Personal Care commercial manage-

ment, sales and administrative functions in certain European countries.

In 2008, 2007 and 2006, total pre-tax charges related to these projects

were $3.2, $18.2 and $37.4, respectively. Virtually all of the costs in

2008 and 2007 were reflected in SG&A expense. Total pre-tax charges

related to the projects were $37.4 in fiscal 2006, and include exit costs