Energizer 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2003 ANNUAL REPORT Page 3

organization and global scale. Following the acquisition, we realigned

our organizational structure and now operate in three distinct business

segments: North America Battery, International Battery, and Razors

and Blades.

BUSINESS OUTLOOK

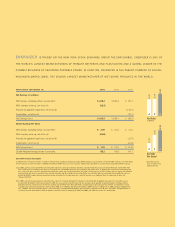

The outlook for our Batteries and Lighting Products business remains

cloudy as a result of competitive dynamics. This year, lower everyday

pricing coupled with residual promotional activity eroded overall category

pricing in the U.S. battery market. Although it remains unclear whether

the category has reached long-term pricing and promotional stability,

the price realignment may reduce “high/low” selling, resulting in lower

promotions and less volatility.

In this uncertain climate, our company is well positioned to optimize our

performance within a healthier battery category. This is still a good busi-

ness to be in, marked by growing demand, brand strength and solid cash

flow. We remain convinced that our broad product portfolio will allow us

to compete effectively going forward.

Our Razors and Blades business, with high-quality products and a

defensible market position, provides a solid opportunity to grow sales

and margins. The launches of Intuition™ and QUATTRO™ are being well

received in the marketplace and should continue to build momentum.

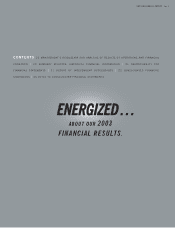

SHARE REPURCHASE UPDATE

In the first half of the year, we were able to repurchase 5 million shares

of common stock at an average price of $26.53 per share, completing

the May 2002 authorization. Since our spin-off in April 2000 through

November 18, 2003, we have repurchased 14.0 million shares. In July,

the Board of Directors issued a new authorization to repurchase an

additional 10 million shares, and we plan to opportunistically make pur-

chases subject to management’s discretion and corporate objectives.

BOARD OF DIRECTORS AND MANAGEMENT CHANGES

We continue to seek added independence and seasoned oversight in the

makeup of our Board of Directors. During the year, John Roberts, retired

managing partner of the Mid-South Region of Arthur Andersen LLP, and

John E. Klein, president and chief executive officer of Bunge North

America, Inc., were appointed to the Board.

We also want to acknowledge the valued contributions of H. Fisk

Johnson who resigned from the Board due to the demands of his

position and a potential conflict of interest arising from competition

between S.C. Johnson’s shaving products business and our SWS

business. In addition, Sheridan Garrison has chosen not to stand for

re-election after three-plus years of service. His last meeting will be

January 2004, and we thank him for his exceptional service to this

new public company.

After 41 years of service, Pat Mannix will retire as an officer of the

company on March 31, 2004. He has held positions in many areas of

executive management and his leadership has contributed greatly to

the company’s success. He will be missed both personally and profes-

sionally by his Energizer colleagues.

IN CONCLUSION

Energizer is a small company and we intend to continue looking at

ourselves as a small company, one that has to watch its pennies and

focus squarely on its two main businesses – batteries and razors.

We’re not trying to hit home runs ... we would rather hit singles and

win the game over time.

We are cash-flow driven and this fundamental focus gives us the

resources to take advantage of opportunities, to invest in new product

launches and to maintain a strong balance sheet. In today’s relatively

low interest environment, we continue to seek acquisition opportunities

that would fit within our organization.

Our management team stepped up quickly and decisively to the SWS

opportunity, and brings a high level of integrity to any decision we

make. The SWS management team, with a similar leadership style and

culture, is a welcome and valued addition.

J. PATRICK MULCAHY

Chief Executive Officer

Energizer Holdings, Inc.

November 18, 2003