Energizer 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

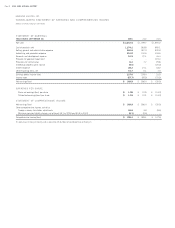

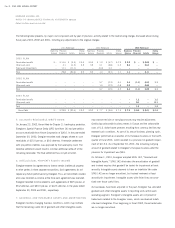

The Consolidated Statement of Earnings includes results of SWS

operations for the final six months of fiscal 2003. The following table

represents Energizer’s pro forma consolidated results of operations as

if the acquisition of SWS had occurred at the beginning of each period

presented. Such results have been prepared by adjusting the historical

Energizer results to include SWS results of operations and incremental

interest and other expenses related to acquisition debt. The pro forma

results do not include any cost savings that may result from the combi-

nation of Energizer and SWS operations, nor one-time items related to

acquisition accounting, including the SWS inventory write-up discussed

above. The pro forma results may not necessarily reflect the consolidat-

ed operations that would have existed had the acquisition been

completed at the beginning of such periods nor are they necessarily

indicative of future results.

UNAUDITED PRO FORMA FOR THE YEAR

ENDED SEPTEMBER 30, 2003 2002

Net sales $ 2,544.5 $ 2,364.8

Net earnings 226.2 195.4

Basic earnings per share 2.63 2.15

Diluted earnings per share 2.56 2.11

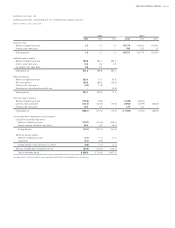

4. RESTRUCTURING ACTIVITIES

In the fourth quarter of 2003, Energizer recorded restructuring provi-

sions of $1.3, primarily for production staff reductions of the Razors and

Blades segment. The provisions included $1.2 for cash severance pay-

ments and $0.1 for other cash charges. A total of 16 employees will be

terminated in early fiscal 2004 related to this restructuring action. These

reductions were not contemplated at the date of the SWS acquisition.

These provisions were largely offset by income of $1.1 resulting from a

reduction in planned actions related to the 2002 restructuring plan.

In March 2002, Energizer adopted a restructuring plan to reorganize

certain European selling, management, administrative and packaging

activities. The total cost of this plan was $6.7 before taxes. These

restructuring charges consist of $5.2 for cash severance payments,

$1.0 of other cash charges and $0.5 in enhanced pension benefits.

As of September 30, 2003, 45 employees have been terminated and

10 remain to be terminated by December 31, 2003. A total of nine

employees originally planned for termination will not be terminated

under the plan.

Because of a continued migration of consumer demand from carbon

zinc to alkaline batteries, Energizer completed in the fourth quarter of

fiscal 2001 a comprehensive study of its carbon zinc manufacturing

plant locations and capacities. Energizer also reviewed its worldwide

operations in light of competitive market conditions and available

technologies and techniques. During fiscal 2001, Energizer adopted

restructuring plans to eliminate carbon zinc capacity, and to reduce and

realign certain selling, production, research and administrative functions.

The total cost associated with this plan was $33.4 before taxes, of

which $29.8, or $19.4 after-tax, was recorded in the fourth quarter of

fiscal 2001. In the first quarter of fiscal 2002, Energizer ceased produc-

tion and terminated substantially all of its employees at its Mexican

carbon zinc production facility. Energizer also continued execution of

other previously announced restructuring actions. Energizer recorded

provisions for restructuring of $1.4, as well as related costs for acceler-

ated depreciation and inventory obsolescence of $2.6, which was

recorded in cost of products sold in the first quarter of fiscal 2002.

In addition, Energizer recorded net reversals of previously recorded

restructuring charges of $0.4 during the fourth quarter of fiscal 2002.

The 2001 restructuring plans improved Energizer’s operating efficiency,

downsized and centralized corporate functions, and decreased costs.

One carbon zinc production facility in Mexico was closed. A total of 539

employees were terminated, consisting of 340 production and 199

sales, research and administrative employees, primarily in the United

States and South and Central America.

The restructuring charges for the 2001 plan consisted of non-cash fixed

asset impairment charges of $10.6 for the closed carbon zinc plant and

production equipment, enhanced pension benefits for certain terminated

U.S. employees of $8.3, cash severance payments of $7.6, other cash

charges of $4.2, and $2.6 of other related costs for accelerated depreci-

ation and inventory obsolescence recorded in cost of products sold.

The carrying value of assets held for disposal under restructuring plans

was $1.3 at September 30, 2003.

ENR 2003 ANNUAL REPORT Page 29