Energizer 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENR 2003 ANNUAL REPORT Page 39

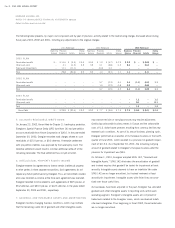

creditworthiness, but does not generally require collateral. Energizer’s

largest customer had obligations to Energizer with a carrying value of

$61.2 at September 30, 2003. While the competitiveness of the retail

industry presents an inherent uncertainty, Energizer does not believe a

significant risk of loss from a concentration of credit risk exists with

respect to accounts receivable.

Financial Instruments Energizer’s financial instruments include cash

and cash equivalents, short-term and long-term debt, foreign currency

contracts, and interest rate swap agreements. Due to the nature of cash

and cash equivalents and short-term borrowings, including notes

payable, carrying amounts on the balance sheet approximate fair value.

At September 30, 2003 and 2002, the fair market value of fixed rate

long-term debt was $336.9 and $200.0, respectively, compared to its

carrying value of $375.0 and $175.0, respectively. The book value of

Energizer’s variable rate debt approximates fair value. The fair value of

the long-term debt is estimated using yields obtained from independent

pricing sources for similar types of borrowing arrangements.

The fair value of foreign currency contracts is the amount that Energizer

would receive or pay to terminate the contracts, considering first, quoted

market prices of comparable agreements, or in the absence of quoted

market prices, such factors as interest rates, currency exchange rates and

remaining maturities. Based on these considerations, Energizer would

make a total net payment of $0.2 and zero for outstanding foreign curren-

cy contracts at September 30, 2003 and 2002, respectively. However,

these payments are unlikely due to the fact that Energizer enters into for-

eign currency contracts to hedge identifiable foreign currency exposures,

and as such would generally not terminate such contracts.

18. ENVIRONMENTAL AND LEGAL MATTERS

Government Regulation and Environmental Matters The operations of

Energizer, like those of other companies engaged in the battery and shaving

products businesses, are subject to various federal, state, foreign and local

laws and regulations intended to protect the public health and the environ-

ment. These regulations primarily relate to worker safety, air and water

quality, underground fuel storage tanks and waste handling and disposal.

Energizer has received notices from the U.S. Environmental Protection

Agency, state agencies and/or private parties seeking contribution, that it

has been identified as a “potentially responsible party” (PRP) under the

Comprehensive Environmental Response, Compensation and Liability

Act, and may be required to share in the cost of cleanup with respect to

seven federal “Superfund” sites. It may also be required to share in the

cost of cleanup with respect to a state-designated site. Liability under the

applicable federal and state statutes which mandate cleanup is strict,

meaning that liability may attach regardless of lack of fault, and joint

and several, meaning that a liable party may be responsible for all of

the costs incurred in investigating and cleaning up contamination at a

site. However, liability in such matters is typically shared by all of the

financially viable responsible parties, through negotiated agreements.

Negotiations with the U.S. Environmental Protection Agency, the state

agency that is involved on the state-designated site, and other PRPs are

at various stages with respect to the sites. Negotiations involve determi-

nations of the actual responsibility of Energizer and the other PRPs at

the site, appropriate investigatory and/or remedial actions, and allocation

of the costs of such activities among the PRPs and other site users.

The amount of Energizer’s ultimate liability in connection with those sites

may depend on many factors, including the volume and toxicity of mate-

rial contributed to the site, the number of other PRPs and their financial

viability, and the remediation methods and technology to be used.

In addition, Energizer undertook certain programs to reduce or eliminate

the environmental contamination at the rechargeable battery facility in

Gainesville, Florida, which was divested in November 1999.

Responsibility for those programs was assumed by the buyer at the time

of the divestiture. In 2001, the buyer, as well as its operating subsidiary

which owns and operates the Gainesville facility, filed petitions in bank-

ruptcy. In the event that the buyer and its affiliates become unable to

continue the programs to reduce or eliminate contamination, Energizer

could be required to bear financial responsibility for such programs as

well as for other known and unknown environmental conditions at the

site. Under the terms of the Reorganization Agreement between Energizer

and Ralston Purina Company, however, which has been assumed by an

affiliate of The Nestle Corporation, Ralston’s successor is obligated to

indemnify Energizer for 50% of any such liabilities in excess of $3.0.

Under the terms of the Stock and Asset Purchase Agreement between

Pfizer, Inc. and Energizer, relating to the acquisition of the SWS busi-

ness, environmental liabilities related to pre-closing operations of that

business, or associated with properties acquired, are generally retained

by Pfizer, subject to time limitations varying from two years to 10 years

following closing with respect to various classes or types of liabilities,

minimum thresholds for indemnification by Pfizer, and maximum limita-

tions on Pfizer’s liability, which thresholds and limitations also vary with

respect to various classes or types of liabilities.

Many European countries, as well as the European Union, have been

very active in adopting and enforcing environmental regulations. In

many developing countries in which Energizer operates, there has not

been significant governmental regulation relating to the environment,