Energizer 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 20 ENR 2003 ANNUAL REPORT

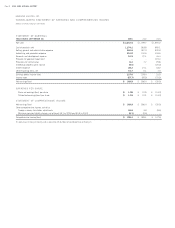

STATEMENT OF EARNINGS DATA

FOR THE YEAR ENDED SEPTEMBER 30, 2003(a) 2002 2001 2000 1999

Net sales $ 2,232.5 $ 1,739.7 $ 1,694.2 $ 1,927.7 $ 1,878.5

Depreciation and amortization (b) 83.2 57.4 79.8 82.0 94.9

Earnings from continuing operations before income taxes (c) 237.6 278.4 31.5 279.2 248.2

Income taxes 67.7 92.0 70.5 99.0 88.4

Earnings/(loss) from continuing operations (d) 169.9 186.4 (39.0) 180.2 159.8

Net earnings/(loss) 169.9 186.4 (39.0) 181.4 80.0

Earnings/(loss) per share from continuing operations:

Basic $ 1.98 $2.05 $ (0.42) $ 1.88 $ 1.56

Diluted $ 1.93 $2.01 $ (0.42) $ 1.87 $ 1.56

Average shares outstanding (e)

Basic 85.9 91.0 92.6 96.1 102.6

Diluted 88.2 92.8 94.1 96.3 102.6

BALANCE SHEET DATA

SEPTEMBER 30, 2003(a) 2002 2001 2000 1999

Working capital $ 515.6 $353.3 $ 288.1 $ 401.7 $ 478.1

Property at cost, net 701.2 455.7 476.1 485.4 472.8

Additions (during the period) 73.0 40.7 77.9 72.8 69.2

Depreciation (during the period) 80.5 57.4 58.6 57.9 68.4

Total assets 2,732.1 1,588.1 1,497.6 1,793.5 1,833.7

Long-term debt 913.6 160.0 225.0 370.0 1.9

(a) Schick-Wilkinson Sword was acquired March 28, 2003. See Note 3 to the Consolidated Financial Statements.

(b) Energizer adopted Statement of Financial Accounting Standards 142 at the beginning of fiscal year 2002, which eliminated

amortization of goodwill and certain intangible assets. See Note 7 to the Consolidated Financial Statements.

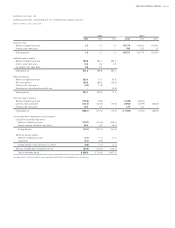

(c) Earnings/(loss) from continuing operations before income taxes were (reduced)/increased due to the following items:

FOR THE YEAR ENDED SEPTEMBER 30, 2003 2002 2001 2000 1999

Provisions for restructuring and related costs $(0.2) $ (10.3) $ (29.8) $ – $ (9.9)

Acquisition inventory valuation (89.7) ––– –

Early debt payoff (20.0) – – – –

Kmart accounts receivable write-down –(15.0) – – –

Gain on sale of property 5.7 6.3 – – –

Intellectual property rights income 8.5 –20.0 – –

Provision for goodwill impairment –– (119.0) – –

Loss on disposition of Spanish affiliate –– – (15.7) –

Costs related to spin-off –––(5.5) –

Total $ (95.7) $ (19.0) $ (128.8) $ (21.2) $ (9.9)

(d) Net earnings/(loss) from continuing operations were (reduced)/increased due to the following items:

FOR THE YEAR ENDED SEPTEMBER 30, 2003 2002 2001 2000 1999

Provisions for restructuring and related costs, net of tax $–$(7.8) $ (19.4) $ – $ (8.3)

Acquisition inventory valuation, net of tax (58.3) ––– –

Early debt payoff, net of tax (12.4) –– ––

Kmart accounts receivable write-down, net of tax –(9.3) – – –

Gain on sale of property, net of tax 5.7 5.0 – – –

Tax benefits recognized related to prior years’ losses 12.2 6.7 – – –

Intellectual property rights income, net of tax 5.2 –12.3 – –

Provision for goodwill impairment, net of tax ––(119.0) – –

Loss on disposition of Spanish affiliate, net of tax ––– (15.7) –

Costs related to spin-off, net of tax –––(3.3) –

Capital loss tax benefits –– – 24.4 16.6

Total $ (47.6) $(5.4) $ (126.1) $ 5.4 $ 8.3

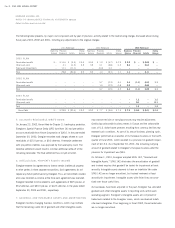

(e) Basic earnings per share for 2003, 2002 and 2001 is based on the weighted-average number of shares outstanding during the

period. Diluted earnings per share for 2003, 2002 and 2001 is based on the weighted-average number of shares used in the basic

earnings per share calculation, adjusted for the dilutive effect of stock options and restricted stock equivalents. In fiscal 2001, the

potentially dilutive securities were not included in the dilutive earnings per share calculation due to their anti-dilutive effect. In fiscal

years 2000 and 1999, earnings per share was based on the weighted-average number of shares outstanding of Ralston common

stock prior to the spin-off, adjusted in 2000 for the distribution of one share of Energizer stock for three shares of Ralston stock.

ENERGIZER HOLDINGS, INC.

SUMMARY SELECTED HISTORICAL FINANCIAL INFORMATION

(Dollars in millions except per share data)