Energizer 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 36 ENR 2003 ANNUAL REPORT

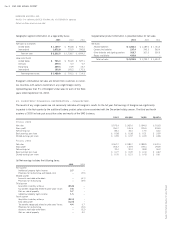

The accumulated benefit obligation and fair value of plan assets for the

pension plans with accumulated benefit obligations in excess of plan

assets were $117.7 and $48.9, respectively, as of September 30,

2003 and $61.3 and $41.3, respectively, as of September 30, 2002.

Pension assets consist primarily of listed common stocks and bonds.

The U.S. plan held 1.5 million and 1.7 million shares of ENR stock at

September 30, 2003 and 2002, respectively, with a market value of

$55.0 and $52.6, respectively.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued

(Dollars in millions, except per share data)

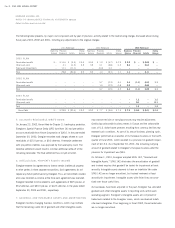

The following table presents pension and postretirement expense:

Pension Postretirement

SEPTEMBER 30, 2003 2002 2001 2003 2002 2001

Service cost $ 20.5 $ 16.7 $ 16.7 $ 0.2 $ 0.1 $ 0.2

Interest cost 29.0 26.9 24.9 3.1 3.6 6.1

Expected return on plan assets (45.5) (48.9) (46.9) –– –

Amortization of unrecognized prior service cost (0.1) ––(2.4) (2.4) (0.3)

Amortization of unrecognized transition asset 0.3 0.3 0.3 –––

Recognized net actuarial (gain)/loss 2.0 (1.3) (3.3) –––

Net periodic benefit cost/(income) $ 6.2 $ (6.3) $ (8.3) $ 0.9 $ 1.3 $ 6.0

The following table presents assumptions, which reflect weighted-averages for the component plans, used in determining the above information:

Pension Postretirement

SEPTEMBER 30, 2003 2002 2003 2002

Discount rate 5.8% 6.2% 6.1% 6.5%

Expected return on plan assets 8.1% 8.3% – –

Compensation increase rate 4.4% 4.7% – –

Assumed healthcare cost trend rates have been used in the valuation of

postretirement health insurance benefits for the 2001 valuation. The

trend rate used for those periods was 6.5%. Due to the amendment to

the postretirement plan discussed above, cost trend rates no longer

materially impact the plan.

12. DEFINED CONTRIBUTION PLAN

Energizer sponsors a defined contribution plan, which extends participation

eligibility to substantially all United States employees. Energizer matches

50% of participants’ before-tax contributions up to 6% of eligible

compensation. In addition, participants can make after-tax contributions

into the plan. The participant’s first 1% of eligible compensation after-tax

contribution is matched with a 325% Energizer contribution to the

participant’s pension plan. Amounts charged to expense during fiscal

2003, 2002 and 2001 were $3.5, $4.0 and $3.8, respectively, and

are reflected in selling, general and administrative expense in the

Consolidated Statement of Earnings.

As of March 29, 2003, United States employees of the newly acquired

SWS business were eligible to participate in the Energizer defined contribu-

tion plan, but, as mandated by the terms of the Stock and Asset Purchase

Agreement with Pfizer, Inc. relating to the acquisition of SWS (the

Acquisition Agreement), until January 1, 2004, Energizer is required to

match 100% of the first 3% of compensation contributed and 50% of the

next 3% of compensation contributed, consistent with the terms of the

Pfizer-sponsored defined contribution plan in which they had previously

participated. Contributions can be on either a before-tax or after-tax basis.

Amounts charged to expense by Energizer for the six months it owned SWS

were $0.9. Commencing January 1, 2004, United States SWS employees

will receive matching contributions in accordance with the terms of

Energizer’s defined contribution plan, but, as dictated by the terms of the

Acquisition Agreement, will also receive, until April 1, 2005, an additional

contribution of 3.5% of compensation to the participant’s pension plan.

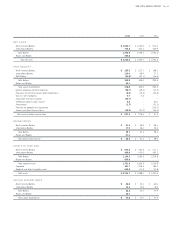

13. DEBT

Notes payable at September 30, 2003 and 2002 consisted of notes

payable to financial institutions with original maturities of less than one

year of $66.1 and $94.6, respectively, and had a weighted-average

interest rate of 3.7% and 3.8%, respectively.

In September 2003, Energizer prepaid $160.0 in long-term debt with

interest rates ranging from 7.8% to 8.0% and maturity dates in 2005,

2007 and 2010. The payment of the debt was funded with short-term

borrowings and available cash. Energizer recorded a $20.0 pre-tax

charge, or $12.4 after-tax, related to this prepayment, which is recorded

in other financing, net in the Consolidated Statement of Earnings.