Energizer 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2003 ANNUAL REPORT Page 31

With the acquisition of SWS, additional indefinite-lived trademarks and

additional tradenames, technology, patents and customer-related intangi-

bles with lives ranging from five to 15 years were incorporated into

Energizer’s financial statements.

As part of the implementation of SFAS 142, Energizer completed transi-

tional tests in the first quarter of fiscal 2002, which resulted in no

impairment. As part of its business planning cycle in the fourth quarter

of fiscal 2003 and fiscal 2002, Energizer completed its impairment test

of goodwill and intangibles, which resulted in no significant impairment.

The fair value of the reporting unit was estimated using the discounted

cash flow method.

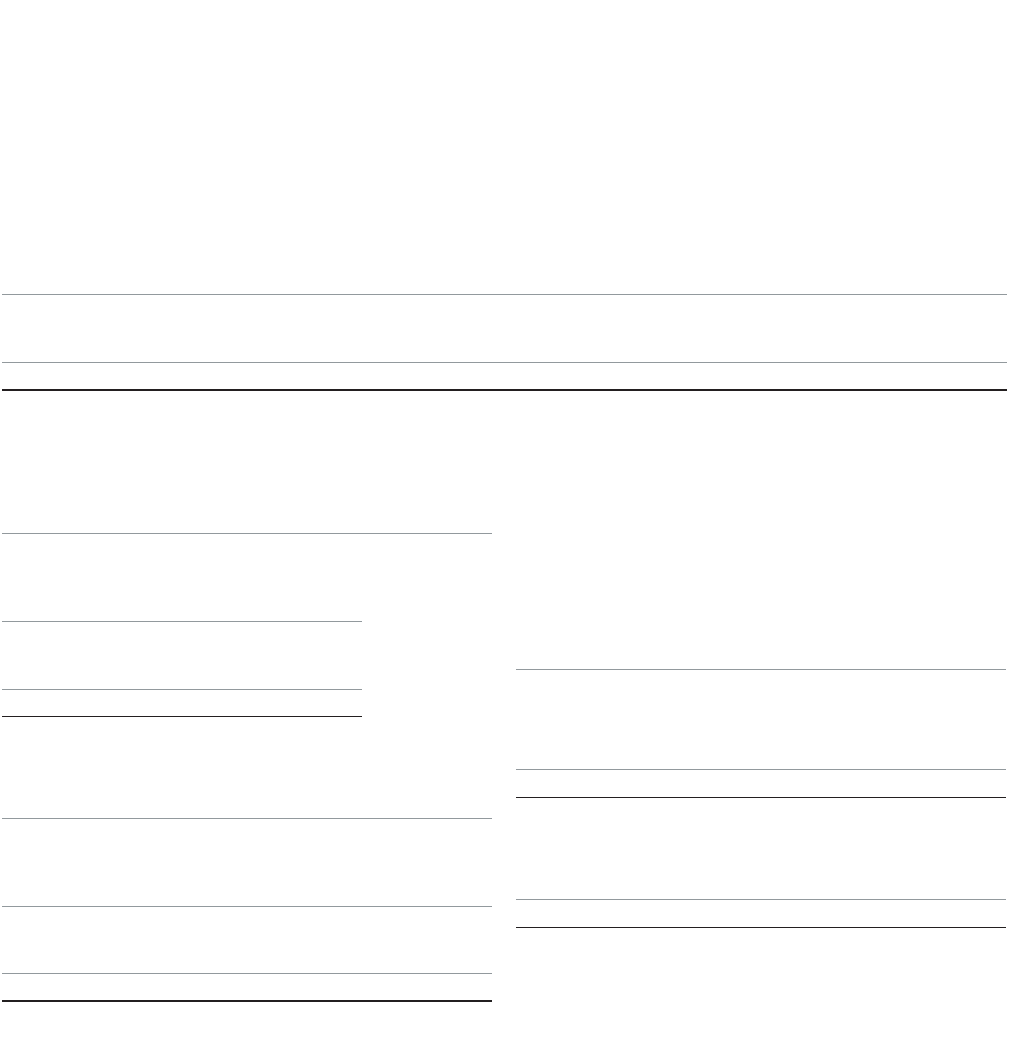

During the year ended September 30, 2003, Energizer recorded goodwill

related to the SWS acquisition of $281.6. A portion of goodwill related to

the SWS acquisition that is allocated to the United States and certain other

countries will be deductible for tax purposes. The following table represents

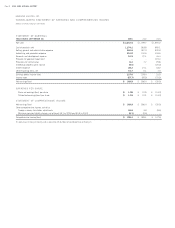

the carrying amount of goodwill by segment at September 30, 2003:

North America International Razors and

Battery Battery Blades Total

Balance at October 1, 2002 $ 24.7 $ 12.7 $ – $ 37.4

Acquisition of SWS ––281.6 281.6

Cumulative translation adjustment –0.6 10.6 11.2

Balance at September 30, 2003 $ 24.7 $ 13.3 $ 292.2 $ 330.2

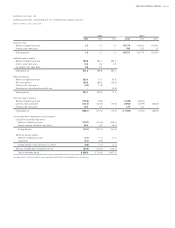

The amount of intangible assets acquired from the SWS acquisition is as

follows:

Wtd-Average

Amount Amortization

Acquired Period (in years)

To be amortized:

Tradenames $ 10.5 9.8

Technology and patents 34.3 11.1

Customer-related 6.4 10.0

51.2

Indefinite-lived:

Tradenames 182.2

Total acquired intangible assets $ 233.4

Total intangible assets at September 30, 2003 are as follows:

Gross Accumulated

Carrying Amount Amortization Net

To be amortized:

Tradenames $ 10.7 $ (0.5) $ 10.2

Technology and patents 34.7 (1.6) 33.1

Customer-related 6.5 (0.6) 5.9

51.9 (2.7) 49.2

Indefinite-lived:

Tradenames 625.5 (365.9) 259.6

Total intangible assets $ 677.4 $ (368.6) $ 308.8

The estimated amortization expense for amortizable intangible assets is

$5.0 for each of the years ended September 30, 2004 through 2008.

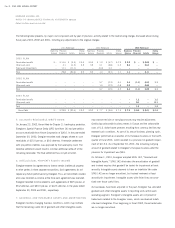

As required by SFAS 142, the results for periods prior to fiscal 2002

were not restated in the accompanying Consolidated Statement of

Earnings. A reconciliation between net earnings and earnings per share

reported by Energizer and net earnings and earnings per share as

adjusted to reflect the impact of SFAS 142 is provided below:

YEAR ENDED SEPTEMBER 30, 2001

NET EARNINGS/(LOSS)

As reported $ (39.0)

Goodwill amortization, net of tax 12.1

Intangible asset amortization, net of tax 3.0

Adjusted net loss $ (23.9)

BASIC AND DILUTED EARNINGS/(LOSS) PER SHARE (A)

As reported $ (0.42)

Goodwill amortization, net of tax 0.13

Intangible asset amortization, net of tax 0.03

Adjusted basic loss per share $ (0.26)

Basic shares 92.6

Diluted shares 94.1

(A) For fiscal year 2001, the potentially dilutive securities were not included in the dilutive earnings per

share calculation due to their anti-dilutive effect.