Energizer 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ENR 2003 ANNUAL REPORT Page 13

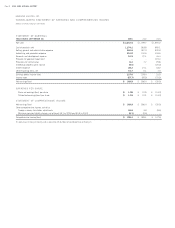

Segment profit excludes the SWS inventory write-up, which is discussed

in further detail in Note 3 to the Consolidated Financial Statements.

For the six months ended September 30, 2003, Razors and Blades

sales were $433.0, an increase of $110.8 compared to the same

period last year, with nearly all of the increase from incremental sales

of the new Intuition™ and QUATTRO™ products, much of which

represents retail pipeline fill. For existing products, favorable currency

translation was nearly offset by declines in existing product sales in

countries where new products were launched.

Segment profit for the six months was $40.1, an increase of $14.1 on

higher sales and favorable currency impact of $3.4, partially offset by

significantly higher advertising, promotion, selling and marketing

expense in support of Intuition™ and, to a lesser extent, QUATTRO™.

During the latter half of September 2003, SWS had significant pipeline fill

for QUATTRO™ and relatively low advertising and promotion expense as the

QUATTRO™ media campaign did not begin until October. Looking forward

into fiscal 2004, SWS will provide significant advertising and market sup-

port for QUATTRO™ and Intuition™, particularly in the December quarter.

Older product sales will likely be negatively impacted by newer product

sales, however the amount of such decline is not possible to predict.

GENERAL CORPORATE AND OTHER EXPENSES

General corporate and other expenses increased $14.7 in 2003 reflect-

ing costs of integrating the SWS business of $6.3, as well as lower

pension income and higher management, legal and project expenses,

partially offset by lower compensation costs related to incentive plans

and stock price.

General corporate and other expenses increased $21.8 in 2002 com-

pared to 2001 primarily due to higher compensation costs related to

company earnings and stock price. Energizer recorded expense of $8.7

in 2002 to increase compensation liabilities tied to Energizer stock price

as the stock price increased, compared to recorded income of $3.0 on

such liabilities in 2001 as the stock price declined. In May 2002,

Energizer entered into an option arrangement with a financial institution

to substantially mitigate additional charges or income associated with

such liabilities going forward. See further discussion in Note 17 to the

Consolidated Financial Statements.

As a percent of sales, general corporate and other expenses were 2.2%

in 2003, 2.0% in 2002 and 0.8% in 2001.

RESTRUCTURING CHARGES

In the fourth quarter of 2003, Energizer recorded restructuring provisions

of $1.3, primarily for production staff reductions of the Razors and Blades

segment. The provisions included $1.2 for cash severance payments and

$0.1 for other cash charges. A total of 16 employees will be terminated in

early fiscal 2004 related to this restructuring action. These reductions

were not contemplated at the date of the SWS acquisition. These provi-

sions were largely offset by a $1.1 reversal of last year’s provision due to

a reduction in planned actions related to the 2002 restructuring plan.

Nine employees originally planned for termination will not be terminated

under the plan.

In March 2002, Energizer adopted a restructuring plan to reorganize

certain European selling, management, administrative and packaging

activities. The total cost of this plan was $6.7 before taxes. These

restructuring charges consist of $5.2 for cash severance payments,

$1.0 of other cash charges and $0.5 in enhanced pension benefits. As

of September 30, 2003, 45 employees have been terminated and 10

remain to be terminated by December 31, 2003. The 2002 restructur-

ing plan yielded pre-tax savings of $2.5 in 2003 and should ultimately

save $4.5 annually.

Because of a continued migration of consumer demand from carbon

zinc to alkaline batteries, Energizer undertook and completed in the

fourth quarter of fiscal 2001 a comprehensive study of its carbon zinc

manufacturing plant locations and capacities. Energizer also reviewed its

worldwide operations in light of competitive market conditions and avail-

able technologies and techniques. During fiscal 2001, Energizer adopted

restructuring plans to eliminate carbon zinc capacity, and to reduce and

realign certain selling, production, research and administrative functions.

The total cost associated with this plan was $33.4 before taxes, of which

$29.8, or $19.4 after-tax, was recorded in the fourth quarter of fiscal

2001. In the first quarter of fiscal 2002, Energizer ceased production

and terminated substantially all of its employees at its Mexican carbon

zinc production facility. Energizer also continued execution of other

previously announced restructuring actions. Energizer recorded provisions

for restructuring of $1.4, as well as related costs for accelerated depreci-

ation and inventory obsolescence of $2.6, which was recorded in cost

of products sold in the first quarter of fiscal 2002. In addition, Energizer

recorded net reversals of previously recorded restructuring charges of

$0.4 during the fourth quarter of fiscal 2002.

The 2001 restructuring plans improved Energizer’s operating efficien-

cy, downsized and centralized corporate functions, and decreased

costs. One carbon zinc production facility in Mexico was closed. A

total of 539 employees were terminated, consisting of 340 production

and 199 sales, research and administrative employees, primarily in