Energizer 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2003 ANNUAL REPORT Page 33

In 2001, Energizer recorded a provision for goodwill impairment of

$119.0, for which there is no associated tax benefit. See further

discussion in Note 7.

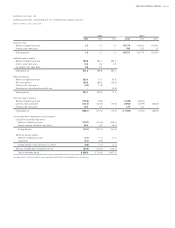

The deferred tax assets and deferred tax liabilities recorded on the

balance sheet as of September 30 are as follows and include current

and non-current amounts:

SEPTEMBER 30, 2003 2002

Depreciation and property differences $(92.6) $(74.2)

Pension plans (36.6) (43.2)

Other tax liabilities, non-current (33.6) (28.1)

Gross deferred tax liabilities (162.8) (145.5)

Deferred tax assets:

Accrued liabilities 93.8 72.0

Tax loss carryforwards and tax credits 32.6 38.1

Intangible assets 39.3 48.3

Postretirement benefits other than pensions 33.9 34.6

Inventory differences 13.9 3.5

Other tax assets, non-current 8.2 7.1

Gross deferred tax assets 221.7 203.6

Valuation allowance (27.3) (32.5)

Net deferred tax assets $ 31.6 $25.6

Tax loss carryforwards of $1.0 expired in 2003. Future expiration of tax

loss carryforwards and tax credits, if not utilized, are as follows: 2004,

$1.3; 2005, $2.3; 2006, $4.1; 2007, $6.1; 2008, $7.6; thereafter or

no expiration, $11.2. The valuation allowance is primarily attributed to

certain accrued liabilities, tax loss carryforwards and tax credits outside

the United States. The valuation allowance decreased $5.2 in 2003 pri-

marily due to tax loss carryforwards and tax credits utilized in 2003 and

projected utilization in future years that are deemed more likely than not.

At September 30, 2003, approximately $191.5 of foreign subsidiary

net earnings was considered permanently invested in those businesses.

Accordingly, U.S. income taxes have not been provided for such

earnings. It is not practicable to determine the amount of unrecognized

deferred tax liabilities associated with such earnings.

9. EARNINGS PER SHARE

For each period presented below, basic earnings per share is based on

the average number of shares outstanding during the period. Diluted

earnings per share is based on the average number of shares used for

the basic earnings per share calculation, adjusted for the dilutive effect

of stock options and restricted stock equivalents. In fiscal 2001, the

potentially dilutive securities were not included in the dilutive earnings

per share calculation due to their anti-dilutive effect.

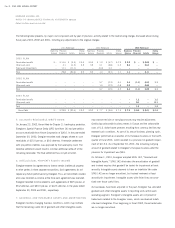

The following table sets forth the computation of basic and diluted

earnings per share:

FOR THE YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Numerator:

Net earnings for basic and

dilutive earnings per share $ 169.9 $ 186.4 $ (39.0)

Denominator:

Weighted-average shares - basic 85.9 91.0 92.6

Effect of dilutive securities

Stock options 1.6 1.2 1.0

Restricted stock equivalents 0.7 0.6 0.5

Total dilutive securities 2.3 1.8 1.5

Weighted-average shares - diluted 88.2 92.8 94.1

Basic net earnings/(loss) per share $ 1.98 $ 2.05 $ (0.42)

Diluted net earnings/(loss) per share $ 1.93 $ 2.01 $ (0.42)

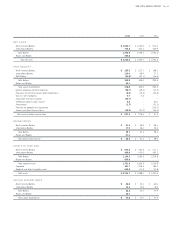

10. STOCK-BASED COMPENSATION

Energizer’s 2000 Incentive Stock Plan (the Plan) was adopted by the

Board of Directors in March 2000 and approved by shareholders, with

respect to future awards which may be granted under the Plan, at the

2001 Annual Meeting of Shareholders. Under the Plan, awards to pur-

chase shares of Energizer’s common stock (ENR stock) may be granted

to directors, officers and key employees. A maximum of 15.0 million

shares of ENR stock was approved to be issued under the Plan. At

September 30, 2003, 2002 and 2001, respectively, there were 4.9

million, 6.1 million and 6.6 million shares available for future awards.

Options that have been granted under the Plan have been granted at the

market price on the grant date and generally vest ratably over three to

five years. Awards have a maximum term of 10 years.

Restricted stock and restricted stock equivalent awards may also be

granted under the Plan. During 2003 and 2002, the Board of Directors

approved the grants of up to 40,000 and 20,000 restricted stock equiv-

alents, respectively to a group of officers, key employees and directors

upon their purchase of an equal number of shares of ENR stock within

a specified period. The Board approved the grants of similar restricted

stock equivalents in prior years. The restricted stock equivalents vest

three years from their respective dates of grant and convert into unre-

stricted shares of ENR stock at that time, or at the recipient’s election,

will convert at the time of the recipient’s retirement or other termination

of employment. During fiscal 2003, 2002 and 2001, respectively,

10,000, 37,700 and 120,885 restricted stock equivalents had been

granted based on the activity of the Board of Directors described above.