Energizer 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

be in the 33-35% range. Shifts of earnings from lower to higher tax

rate countries or higher losses in countries where tax benefits cannot

be recognized could increase future tax rates. Conversely, favorable

country earnings mix, improving profits in previous loss countries or

reduced foreign losses could reduce future tax rates. Additionally, future

tax rates may reflect benefit of reversal of deferred tax valuation

allowances if favorable foreign earnings trends are sustained.

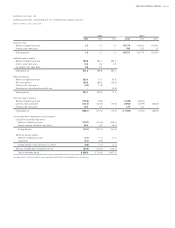

LIQUIDITY AND CAPITAL RESOURCES

Cash flow from operations totaled $442.1 in 2003, an increase of

$236.0 from 2002 operating cash flows of $206.1. The increase

is due to cash generated from working capital changes of $201.9

compared to cash outflows for working capital in 2002 of $53.7,

partially offset by lower cash flow from earnings before working

capital changes. The most significant working capital changes were:

1) a $148.0 reduction in inventory, reflecting the conversion of high

cost acquired SWS inventory to lower cost SWS inventory manufac-

tured after acquisition as well as other inventory reductions; and 2)

a $136.2 cash flow improvement in other current assets, primarily

related to the level of sales of accounts receivable by Energizer's

non-consolidated SPE; partially offset by 3) unfavorable cash flow

from increases in accounts receivable in 2003. Cash flow from

operations before changes in working capital were $240.2 in 2003

compared to $259.8 in 2002. The decrease was mainly due to

lower net earnings caused by the $58.3 after-tax SWS inventory

write-up discussed previously, partially offset by higher earnings for

the remainder of the business.

Cash flow from operations of $206.1 in 2002 decreased $112.0,

compared to 2001. Cash outflows related to working capital were

$53.7 in 2002 compared to net cash generated from working capital of

$127.9 in 2001, creating a $181.6 unfavorable cash flow comparison

related to working capital changes. The most significant working capital

changes were: 1) an unfavorable cash flow comparison of $156.3,

primarily related to the level of sales of accounts receivable by

Energizer's non-consolidated SPE; 2) a $90.2 reduction in inventory

in 2001 with a minimal corresponding decrease in 2002; partially

offset by 3) improved cash flows related to other working capital items.

Unfavorable cash flow from working capital changes were partially

offset by higher operating cash flow before changes in working capital.

Working capital was $515.6 and $353.3 at September 30, 2003

and 2002, respectively, reflecting the addition of the SWS business.

Capital expenditures totaled $73.0, $40.7 and $77.9 in 2003, 2002

and 2001, respectively. These expenditures were funded by cash flow

from operations. Capital expenditures increased in 2003 as a result of

the acquisition of SWS. Capital expenditures decreased in 2002 as

several major projects were completed in late 2001 and early 2002.

Capital expenditures of approximately $115.0 are anticipated in

2004, as Energizer will reflect a full year of SWS operations and

planned battery expenditures are anticipated to increase modestly.

Such expenditures are expected to be financed with funds generated

from operations.

Total long-term debt outstanding, including current maturities was

$933.6 at September 30, 2003. Energizer maintains total committed

debt facilities of $1,258.3, of which $319.2 remained available as

of September 30, 2003.

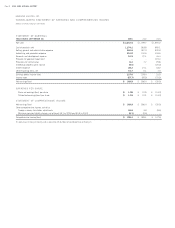

A summary of Energizer’s significant contractual obligations at

September 30, 2003 is shown below. See Note 19 to the Consolidated

Financial Statements for discussion of letters of credit, loan guarantees

and guarantees for the purchase of goods used in production.

MORE

LESS THAN 1-3 3-5 THAN 5

TOTAL 1 YEAR YEARS YEARS YEARS

Long-term debt,

including current

maturities $ 933.6 $ 20.0 $ 168.6 $ 155.0 $ 590.0

Notes payable 66.1 66.1 – – –

Operating leases 97.3 14.5 22.4 15.1 45.3

Total $ 1,097.0 $ 100.6 $ 191.0 $ 170.1 $ 635.3

Under the terms of Energizer’s debt facilities, the ratio of Energizer’s

total indebtedness to its Earnings Before Interest, Taxes, Depreciation

and Amortization (EBITDA) (as defined by the facility agreement and

pro forma in the current year) cannot be greater than 3.5 to 1, and the

ratio of its current year pro forma EBIT to total interest expense must

exceed 3.5 to 1. Energizer’s ratio of total indebtedness to its pro forma

EBITDA was 2.3 to 1, and the ratio of its pro forma EBIT to total

interest expense was 8.2 to 1 as of September 30, 2003. Additional

restrictive covenants exist under current debt facilities. Failure to comply

with the above ratios or other covenants could result in acceleration

of maturity, which could trigger cross defaults on other borrowings.

Energizer believes that covenant violations resulting in acceleration of

maturity is unlikely. Energizer’s fixed rate debt is callable by the compa-

ny, subject to a “make whole” premium, which would be required to

the extent the underlying benchmark United States treasury yield has

declined since issuance.

ENR 2003 ANNUAL REPORT Page 15