Energizer 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 28 ENR 2003 ANNUAL REPORT

Energizer adopted the FASB Interpretation No. 45 (FIN 45),

“Guarantor’s Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” as of the

beginning of fiscal 2003. FIN 45 clarifies the disclosures about certain

guarantees to be made by a guarantor in its interim and annual financial

statements. Also, FIN 45 clarifies that a guarantor is required to recog-

nize, at the inception of certain guarantees, a liability for the fair value

of the obligation undertaken in issuing the guarantee, but does not

prescribe a specific approach for subsequently measuring the liability

over its life. The adoption of FIN 45 did not have a material effect on

Energizer’s financial statements. Note 19 contains disclosures related

to FIN 45.

Energizer adopted SFAS 149, “Amendment of Statement 133 on

Derivative Instruments and Hedging Activities,” SFAS 150, “Accounting

for Certain Financial Instruments with Characteristics of both Liabilities

and Equity” and FASB Interpretation No. 46 (FIN 46), “Consolidation of

Variable Interest Entities, an Interpretation of ARB 51” in fiscal 2003.

Energizer had no interests, instruments or transactions governed by

these pronouncements as of and for the three years ended

September 30, 2003.

3. ACQUISITION OF SWS

On March 28, 2003, Energizer acquired the worldwide Schick-Wilkinson

Sword (SWS) business from Pfizer, Inc. for $930 plus acquisition costs

and subject to adjustment based on acquired working capital level. The

final purchase price and acquisition costs totaled $975.8. A $550.0

bridge loan which, together with existing available credit facilities and

cash, were used to fund the acquisition. In June and July of 2003,

Energizer refinanced the bridge loan into longer term financing.

SWS is the second largest manufacturer and marketer of men’s and

women’s wet shave products in the world, and its products are market-

ed in over 80 countries. Its primary markets are Europe, the United

States and Japan.

Energizer views the wet shave products category as attractive within

the consumer products industry due to the limited number of manufac-

turers, the high degree of consumer loyalty and the ability to improve

pricing through innovation. Energizer believes SWS has high-quality

products, a defensible market position and the opportunity to grow sales

and margins. The SWS business is compatible with Energizer’s business

in terms of common customers, distribution channels and geographic

presence, which should provide opportunities to leverage Energizer’s

marketing expertise, business organization and scale globally.

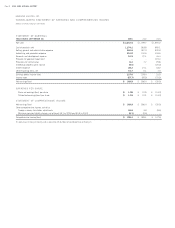

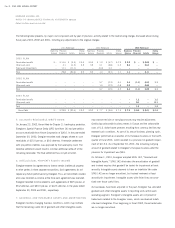

The following reflects the assets and liabilities acquired by Energizer in

the SWS acquisition. Such asset and liability amounts are based on final

appraisal information.

ACQUIRED SWS ASSETS AND LIABILITIES

AT MARCH 28, 2003

Cash $ 14.9

Receivables 139.4

Inventories 201.9

Other current assets 50.0

Total current assets 406.2

Property, plant and equipment 247.0

Goodwill 281.6

Other intangible assets 233.4

Other assets 6.6

Total assets acquired 1,174.8

Accounts payable 47.7

Other current liabilities 88.5

Total current liabilities 136.2

Other liabilities 62.8

Total liabilities 199.0

Net assets acquired $ 975.8

Energizer engaged an independent appraiser to assist in valuation of

acquired intangible assets. Preliminary estimated values published in

Energizer’s June 30, 2003 10-Q filing with the SEC for intangible

assets other than goodwill were $116.4. Subsequent to publishing

such financial statements, the final appraisal was completed and intan-

gible assets other than goodwill were valued at $233.4, an increase

of $117.0 over the previously published value. Such change in value

resulted in a corresponding decrease in valuation assigned to goodwill

of $117.0.

The final assumed liabilities may be adjusted upon completion of a

specific evaluation and development of definitive exit plans for certain

acquired business activities. Such plan will be complete no later than

March 2004.

SWS inventory acquired in the acquisition was valued as if Energizer

was a distributor purchasing the inventory. This resulted in a one-time

allocation of purchase price to acquired inventory which was $89.7

higher than the historical manufacturing costs of SWS (the SWS inven-

tory write-up). Inventory value and cost of products sold will be based

on post-acquisition SWS production costs for all product manufactured

after the acquisition date. The entire $89.7 of the SWS inventory

write-up was recognized in cost of products sold in 2003, reducing

net earnings by $58.3, after taxes.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued

(Dollars in millions, except per share data)