Energizer 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2003 ANNUAL REPORT Page 35

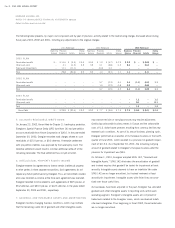

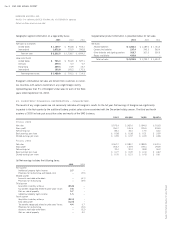

11. PENSION PLANS AND OTHER

POSTRETIREMENT BENEFITS

Energizer has several defined benefit pension plans covering

substantially all of its employees in the United States and certain

employees in other countries. The plans provide retirement benefits

based on years of service and earnings. In 2003, Energizer assumed

defined benefits for certain active SWS employees at the acquisition

date. Such employees were covered by Energizer’s defined benefit plans

following the acquisition.

Energizer also sponsors or participates in a number of other non-U.S.

pension arrangements, including various retirement and termination ben-

efit plans, some of which are required by local law or coordinated with

government-sponsored plans, which are not significant in the aggregate

and therefore are not included in the information presented below.

Energizer currently provides other postretirement benefits, consisting

of healthcare and life insurance benefits for certain groups of retired

employees. Retiree contributions for healthcare benefits are adjusted

periodically, as total costs of the program change. In 2001, the plan was

amended such that there will not be an increase in Energizer’s contribu-

tion rate beyond the level of subsidy to be provided for in calendar 2002.

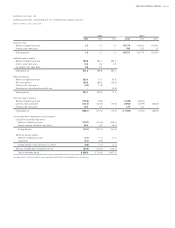

The following tables present the benefit obligation and funded status of

the plans:

Pension Postretirement

SEPTEMBER 30, 2003 2002 2003 2002

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year $ 447.7 $ 411.3 $ 49.7 $ 54.4

Service cost 20.5 16.7 0.2 0.1

Interest cost 29.0 26.9 3.1 3.6

Plan participants’ contributions 0.7 0.6 ––

Actuarial (gain)/loss 7.5 20.1 0.5 (5.7)

Benefit obligation assumed in SWS acquisition 70.1 – ––

Benefits paid (22.9) (33.0) (2.8) (2.7)

Cumulative translation adjustment 13.5 5.1 0.7 -

Benefit obligation at end of year $ 566.1 $ 447.7 $ 51.4 $ 49.7

CHANGE IN PLAN ASSETS

Fair value of plan assets at beginning of year $ 463.0 $ 495.4 $ 2.3 $ 2.3

Actual return on plan assets 78.0 (7.6) (0.4) 0.3

Company contributions 2.9 2.5 2.7 2.7

Plan participants’ contributions 0.8 0.6 3.2 2.7

Assets acquired in SWS acquisition 27.2 –– –

Benefits paid (22.9) (33.0) (5.9) (5.7)

Cumulative translation adjustment 8.3 5.1 ––

Fair value of plan assets at end of year $ 557.3 $ 463.0 $ 1.9 $ 2.3

FUNDED STATUS

Funded status of the plan $(8.8) $15.3 $ (49.5) $ (47.4)

Unrecognized net loss/(gain) 62.2 87.1 (1.7) (2.6)

Unrecognized prior service cost 4.0 0.2 (37.9) (40.3)

Unrecognized net transition asset 1.7 1.4 ––

Prepaid (accrued) benefit cost $ 59.1 $ 104.0 $ (89.1) $ (90.3)

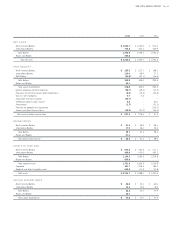

AMOUNTS RECOGNIZED IN THE CONSOLIDATED BALANCE SHEET

Prepaid benefit cost $ 117.3 $ 119.8 $ – $ –

Accrued benefit liability (72.3) (18.7) (89.1) (90.3)

Intangible asset 0.2 0.2 – –

Accumulated other comprehensive income 13.9 2.7 ––

Net amount recognized $ 59.1 $ 104.0 $ (89.1) $ (90.3)