Energizer 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 16 ENR 2003 ANNUAL REPORT

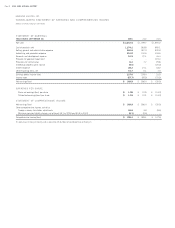

Energizer purchased shares of its common stock under various Board of

Director approved repurchase plans as follows:

FISCAL YEAR SHARES COST

2003 5.0 $ 131.4

2002 3.8 $ 103.3

2001 3.8 $ 79.6

At a meeting of the Board’s Executive Committee held on July 30,

2003, an authorization for the repurchase of up to an additional 10.0

million shares was approved; subsequent to September 30, 2003 and

through November 18, 2003, approximately 1.4 million shares were

purchased for $50.5 under this authorization.

Energizer believes that cash flows from operating activities and periodic bor-

rowings under existing credit facilities will be adequate to meet short-term

and long-term liquidity requirements prior to the maturity of Energizer’s

credit facilities, although no guarantee can be given in this regard.

Special Purpose Entity

Energizer generates accounts receivable from its customers through the

ordinary course of business. A pool of domestic trade accounts receivable

are routinely sold to Energizer Receivables Funding Corporation (the SPE),

which is a wholly owned, bankruptcy-remote special purpose entity sub-

sidiary of Energizer. The SPE’s only business activities relate to acquiring

and selling interests in Energizer’s receivables, and it is used as an

additional source of liquidity. The SPE sells an undivided percentage

ownership interest in each individual receivable to an unrelated party

(the Conduit) and uses the cash collected on these receivables to purchase

additional receivables from Energizer.

The trade receivables sale facility represents “off-balance sheet financ-

ing,” since the Conduit’s ownership interest in the SPE’s accounts

receivable results in assets being removed from our balance sheet, rather

than resulting in a liability to the Conduit. Upon the facility’s termina-

tion, the Conduit would be entitled to all cash collections on the SPE’s

accounts receivable until its purchased interest has been repaid.

The terms of the agreements governing this facility qualify trade receivables

sale transactions for “sale treatment” under generally accepted accounting

principles. As such, Energizer is required to account for the SPE’s transac-

tions with the Conduit as a sale of accounts receivable instead of reflecting

the Conduit’s net investment as debt with a pledge of accounts receivable

as collateral. Absent this “sale treatment,” Energizer’s balance sheet would

reflect additional accounts receivable and short-term debt and lower other

current assets. See further discussion in Note 14 to the Consolidated

Financial Statements.

INFLATION

Management recognizes that inflationary pressures may have an adverse

effect on Energizer, through higher asset replacement costs and related

depreciation, and higher material, labor and other costs. Energizer tries to

minimize these effects through cost reductions and productivity improve-

ments as well as price increases to maintain reasonable profit margins. It

is management’s view, however, that inflation has not had a significant

impact on operations in the three years ended September 30, 2003.

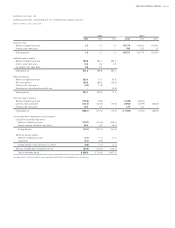

SEASONAL FACTORS

Energizer’s battery segment results are significantly impacted in the first

quarter of the fiscal year by the additional sales volume associated with

the December holiday season, particularly in North America. First quar-

ter battery sales accounted for 32%, 33% and 33% of total battery net

sales in 2003, 2002 and 2001, respectively.

ENVIRONMENTAL MATTERS

The operations of Energizer, like those of other companies engaged in

the battery and shaving products businesses, are subject to various fed-

eral, state, foreign and local laws and regulations intended to protect the

public health and the environment. These regulations primarily relate to

worker safety, air and water quality, underground fuel storage tanks and

waste handling and disposal.

Energizer has received notices from the United States Environmental

Protection Agency, state agencies and/or private parties seeking contribu-

tion, that it has been identified as a “potentially responsible party” (PRP)

under the Comprehensive Environmental Response, Compensation and

Liability Act, and may be required to share in the cost of cleanup with

respect to seven federal “Superfund” sites. It may also be required to share

in the cost of cleanup with respect to a state-designated site. Liability

under the applicable federal and state statutes which mandate cleanup is

strict, meaning that liability may attach regardless of lack of fault, and joint

and several, meaning that a liable party may be responsible for all of the

costs incurred in investigating and cleaning up contamination at a site.

However, liability in such matters is typically shared by all of the financially

viable responsible parties, through negotiated agreements. Negotiations

with the United States Environmental Protection Agency, the state agency

that is involved on the state-designated site, and other PRPs are at various

stages with respect to the sites. Negotiations involve determinations of the

actual responsibility of Energizer and the other PRPs at the site, appropri-

ate investigatory and/or remedial actions and allocation of the costs of

such activities among the PRPs and other site users.

The amount of Energizer’s ultimate liability in connection with those sites

may depend on many factors, including the volume and toxicity of materi-

ENERGIZER HOLDINGS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION Continued

(Dollars in millions except per share and percentage data)