Energizer 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Page 32 ENR 2003 ANNUAL REPORT

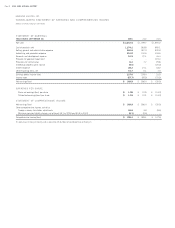

8. INCOME TAXES

The provisions for income taxes consisted of the following for the years

ended September 30:

2003 2002 2001

Consolidated Consolidated Consolidated

Currently payable:

Federal $ 48.5 $ 52.5 $ 42.8

State 7.4 8.4 5.4

Foreign 36.5 24.4 22.0

Total current 92.4 85.3 70.2

Deferred:

Federal (5.2) 7.7 1.2

State (0.5) 1.2 0.1

Foreign (19.0) (2.2) (1.0)

Total deferred (24.7) 6.7 0.3

Provision for income taxes $ 67.7 $ 92.0 $ 70.5

The source of pre-tax earnings was:

2003 2002 2001

Consolidated Consolidated Consolidated

United States $ 141.9 $ 191.3 $ 118.2

Foreign 95.7 87.1 (86.7)

Pre-tax earnings $ 237.6 $ 278.4 $ 31.5

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Continued

(Dollars in millions, except per share data)

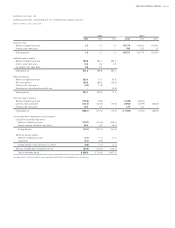

A reconciliation of income taxes with the amounts computed at the statutory federal rate follows:

2003 2002 2001

Computed tax at federal statutory rate $ 83.2 35.0% $ 97.4 35.0%$ 11.0 35.0%

State income taxes, net of federal tax benefit 4.5 1.9 6.2 2.2 3.9 12.4

Foreign tax in excess of/(less than) the domestic rate (5.0) (2.1) (5.6) (2.0) 9.4 29.7

Foreign benefits recognized related to prior years’ losses (12.2) (5.1) (6.7) (2.4) (3.5) (11.1)

Taxes on repatriation of foreign earnings 1.7 0.8 2.5 0.9 5.2 16.5

Nondeductible goodwill ––––4.1 13.0

Provision for goodwill impairment ––––41.7 132.4

Other, net (4.5) (2.0) (1.8) (0.6) (1.3) (4.1)

Total $ 67.7 28.5% $ 92.0 33.1% $ 70.5 223.8%