Energizer 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Page 14 ENR 2003 ANNUAL REPORT

ENERGIZER HOLDINGS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION Continued

(Dollars in millions except per share and percentage data)

the United States and South and Central America. The 2001 restruc-

turing plan yielded pre-tax savings of $14.3 in 2002 and $16.5 in

2003 and beyond.

The restructuring charges for the 2001 plan consisted of non-cash

fixed asset impairment charges of $10.6 for the closed carbon zinc

plant and production equipment, enhanced pension benefits for

certain terminated U.S. employees of $8.3, cash severance payments

of $7.6, other cash charges of $4.2, and $2.6 of other related costs

for accelerated depreciation and inventory obsolescence recorded in

cost of products sold.

The carrying value of assets held for disposal under restructuring plans

was $1.3 at September 30, 2003.

Energizer continues to review its battery production capacity and

its business structure in light of pervasive global trends, including

the evolution of technology. Future restructuring activities and

charges may be necessary to optimize its production capacity. Such

charges may include impairment of production assets and employee

termination costs.

See Note 4 to the Consolidated Financial Statements for a table that

presents, by major cost component and by year of provision, activity

related to the restructuring charges discussed above during fiscal

years 2003, 2002 and 2001 including any adjustments to the

original charges.

GOODWILL AND INTANGIBLES

As part of its annual business planning cycle, Energizer performed an

evaluation of its European business in the fourth quarter of 2001, which

resulted in an impairment charge for $119.0 of related goodwill. At

September 30, 2001, the carrying amount of goodwill related to

Energizer’s European business was $8.5.

Energizer adopted Statement of Financial Accounting Standards 142,

“Goodwill and Other Intangible Assets” as of October 1, 2001. As a

result, Energizer no longer amortizes its goodwill and certain indefinite-

lived intangible assets, which consist of tradenames. As part of its

business planning cycle in the fourth quarter of fiscal 2003, Energizer

completed its impairment test of goodwill and intangibles, which result-

ed in no significant impairment. See Note 7 to the Consolidated

Financial Statements for further discussion.

INTELLECTUAL PROPERTY RIGHTS INCOME

Energizer entered into agreements to license certain intellectual property

to other parties in three separate transactions. Such agreements do not

require any future performance by Energizer. Thus, all committed consider-

ation was recorded as income at the time each agreement was executed.

Energizer recorded income related to such agreements of $8.5 pre-tax, or

$5.2 after-tax, and $20.0 pre-tax, or $12.3 after-tax, in the years ended

September 30, 2003 and 2001, respectively.

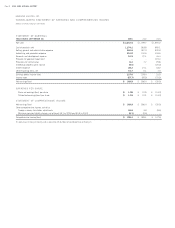

INTEREST AND OTHER FINANCIAL ITEMS

Interest expense increased $7.1 in 2003 reflecting incremental debt due

to the acquisition of SWS, partially offset by lower interest rates. Interest

expense decreased $12.1 in 2002 on lower average borrowings, as well

as lower interest rates on variable rate debt.

Other financing costs increased $15.6 in 2003, primarily due to a

$20.0 charge related to early payment of long-term debt, partially

offset by favorable currency exchange. Other financing costs declined

$1.2 in 2002 on lower discounts on the sale of accounts receivable

under a financing arrangement, partially offset by unfavorable

currency exchange.

INCOME TAXES

Income taxes, which include federal, state and foreign taxes, were

28.5%, 33.1% and 223.8% of earnings before income taxes in 2003,

2002 and 2001, respectively. Earnings before income taxes and income

taxes include certain unusual items in all years, the most significant of

which are described below:

■The tax benefit related to the write-up of acquired SWS inventory of

$89.7, all of which was recorded to cost of products sold in 2003,

was higher than the overall tax rate for the remainder of the busi-

ness, thus reduced the overall tax rate by 1.8 percentage points.

■In 2003 and 2002, $12.2 and $6.7, respectively, of tax benefits

related to prior years’ losses were recorded.

■In 2001, the provision for goodwill impairment of $119.0 has

no associated tax benefit, as the charge is not deductible for tax

purposes. The provisions for restructuring of $29.8 have an

associated tax rate of 34.9%.

■In 2001, goodwill was amortized with no associated tax benefit.

Excluding the items discussed above, the income tax percentage was

34.0% in 2003, 35.5% in 2002 and 42.3% in 2001. On this basis,

the lower tax in 2003 is due to improved foreign earnings mix. The

2002 improvement was due to reduced foreign losses and lower taxes

on repatriation of foreign earnings.

Energizer’s effective tax rate is highly sensitive to country mix from

which earnings or losses are derived. To the extent future earnings

levels and country mix are similar to the 2003 level and excluding

any unusual or non-recurring tax items, future tax rates would likely