Energizer 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Page 10 ENR 2003 ANNUAL REPORT

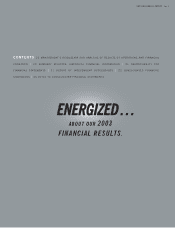

The following discussion is a summary of the key factors management

considers necessary in reviewing Energizer Holdings, Inc.’s (Energizer)

historical basis results of operations, operating segment results, and

liquidity and capital resources. This discussion should be read in con-

junction with the Consolidated Financial Statements and related notes.

BATTERY BUSINESS OVERVIEW

Energizer is one of the world’s largest manufacturers of primary batteries

and flashlights and a global leader in the dynamic business of providing

portable power. Energizer manufactures and/or markets a complete

line of primary alkaline and carbon zinc, miniature and rechargeable

batteries primarily under the brands Energizer®e2®

, Energizer ®and

Eveready ®,as well as specialty photo lithium batteries, flashlights and

other lighting products.

There has been a continuing shift in consumer preference from carbon

zinc batteries to higher-power, higher-priced alkaline and other more

advanced batteries. Alkaline batteries are the predominant primary bat-

tery in most parts of the world except Asia and Africa. However, carbon

zinc batteries continue to play a major role in less developed countries

throughout the world and offer Energizer market position in those coun-

tries. Energizer uses its full portfolio of products to meet consumer needs.

Energizer and its battery and lighting products subsidiaries operate

21 manufacturing and packaging facilities in 14 countries on four conti-

nents. Its products are marketed and sold in more than 150 countries

primarily through a direct sales force, and also through distributors, to

mass merchandisers, wholesalers and other customers.

The battery category continues to be highly competitive as manufacturers

compete for consumer acceptance and retail shelf space. Overall primary

battery consumption has been increasing for many years, however eco-

nomic weakness in particular world areas and inventory reductions by

retailers have moderated unit sales growth. Over the last three years, cate-

gory dollar sales in the United States have lagged unit sales as consumer

purchases have shifted to larger pack sizes, list prices have been reduced

and/or promotional discounting has deepened as competitors attempt to

gain or protect share. In late fiscal 2003, category pricing in the United

States has begun to stabilize and promotional discounting has moderated.

Energizer estimates its share of the total United States retail alkaline

market was approximately 31% in 2003 and 32% in 2002 and 2001.

Retail outlets experiencing the strongest battery category growth in the

United States include mass merchandisers’ super center format, home

centers and dollar stores, while traditional outlets such as food, drug and

hardware declined. Outside the United States, retail growth is generally in

larger scale, multi-national outlets. Wal-Mart Stores, Inc. and its sub-

sidiaries is Energizer’s largest customer. Energizer is well positioned to

meet the needs of customer and consumer demands in these formats,

leveraging category expertise, retail understanding and its portfolio of prod-

ucts to give Energizer a strong presence in each of the retail channels.

Internationally, economic conditions and currency valuations, relative

to the U.S. dollar, have improved in 2003, resulting in improved

International Battery segment results. The strengthening of the euro has

been a significant benefit to Energizer in 2003. Currency valuation was

generally unfavorable to Energizer during 2001 and 2002. In 2002, the

Argentine peso value declined in excess of 70%, but has improved mod-

estly in 2003. A significant portion of Energizer’s product cost is more

closely tied to the U.S. dollar than to the local currencies in which the

product is sold. As such, currency devaluation relative to the U.S. dollar

reduces margins to the extent increased costs in local currency terms

are not offset by local currency price increases. Conversely, strengthen-

ing currencies relative to the U.S. dollar are generally favorable to

Energizer’s profit margins. Changes in the value of local currencies

may continue to impact segment profitability in the future.

RAZORS AND BLADES BUSINESS OVERVIEW

On March 28, 2003, Energizer acquired the worldwide Schick-

Wilkinson Sword (SWS) business from Pfizer, Inc. SWS is the second

largest manufacturer and marketer of men’s and women’s wet shave

products in the world. SWS operates five manufacturing facilities world-

wide and its products are marketed in over 80 countries, accounting for

an estimated 18% market share of the global wet shaving business.

Its primary markets are Europe, the United States and Japan.

Energizer views the wet shave products category as attractive within

the consumer products industry due to the limited number of manufac-

turers, the high degree of consumer loyalty and the ability to improve

pricing through innovation. Energizer believes SWS has high-quality

products, a defensible market position and the opportunity to grow sales

and margins. The SWS business is compatible with Energizer’s business

in terms of common customers, distribution channels and geographic

presence, which should provide opportunities to leverage Energizer’s

marketing expertise, business organization and scale globally.

In 2003, SWS launched two major new products. The Intuition™

women’s shaving system was launched in the United States in April

2003 and QUATTRO™ was launched in the United States and part

of Europe in September 2003. Initial acceptance of these products by

retailers and consumers has been encouraging. Ultimate success of

these product launches will depend on long-term consumer acceptance

ENERGIZER HOLDINGS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

(Dollars in millions except per share and percentage data)