Energizer 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our focus remains on maximizing operating cash flow and delivering

consistent year-over-year EPS gains. We believe in maintaining a strong

balance sheet, but as in the case of the SWS acquisition, we are

willing to invest in opportunities that promise a good return.

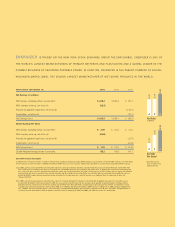

FY 2003 FINANCIAL RESULTS

For our fiscal year ended September 30, 2003, net earnings, excluding

the SWS inventory write-up, climbed 22 percent to $228.2 million

compared to $186.4 million the prior year with earnings per share for

the year rising 29 percent to $2.59 from $2.01 the year before.

*Our

initiatives to improve performance have resulted in eight quarters of

year-over-year EPS improvements.*

SWS ACQUISITION

On March 28, 2003, we acquired the worldwide Schick-Wilkinson

Sword (SWS) business from Pfizer Inc. for $930 million, plus acquisi-

tion costs and certain adjustments. We financed the purchase using

available credit facilities and cash, plus a $550 million bridge loan

which we subsequently refinanced to longer-term vehicles which pro-

vide significant flexibility to our operations in the future. For our fiscal

2003, SWS sales totaled $745 million with segment operating profit of

$57 million on a pro forma basis. Since we were able to finance the

transaction at historically low interest rates, the acquisition was imme-

diately accretive to fiscal 2003 results, adding 15 cents per share,

excluding the impact of the inventory write-up.

Simply put, the acquisition gives us two world-class brands that fit

perfectly into Energizer Holdings, Inc. and two strong, complementary

businesses as illustrated in the accompanying table. We saw SWS as a

highly attractive business in a category with stable margins and growing

sales, as well as a limited number of manufacturers and a high degree of

consumer loyalty. Of course, we were also very excited about the two

new products SWS launched in 2003 – Intuition™, the world’s first

all-in-one shaving system for women, and QUATTRO™, the world’s first

four-bladed razor providing an incredibly close and smooth shave.

The similarities between our two companies are striking – we have like

cultures, deal in consumer packaged goods and operate globally. The

potential for strategic synergies is significant, including common purchas-

ing and shared management initiatives, moving selected SWS products

through the Energizer distribution system and leveraging our top-to-top

industry relationships. Similarities and common characteristics should

provide the potential to leverage Energizer’s marketing expertise, business

Batteries and Razors and

(fiscal 2003, pro forma) Lighting Products Blades

Sales $1.8 billion $745 million

Global Market Share No. 2 No. 2

Segment Operating Margins 21% 8%

Distribution Over 150 countries Over 80 countries

Key Strengths Strong, stable Opportunity for

cash flows sales/margin

improvement

Page 2 ENR 2003 ANNUAL REPORT

LETTER TO OUR SHAREHOLDERS …

FISCAL 2003 WAS A GOOD YEAR AT ENERGIZER. THE

COMPANY CONTINUED TO GROW PROFITS IN BATTERIES,

MAINTAINING THE EARNINGS MOMENTUM ESTABLISHED

IN 2002 … AND IN MARCH, THE COMPANY ACQUIRED THE

SCHICK-WILKINSON SWORD (SWS) RAZOR AND BLADE

BUSINESS. WE BELIEVE THE ACQUISITION OF SWS ADDS

ASUBSTANTIAL GROWTH VEHICLE FOR THE COMPANY.

STRONG, COMPLEMENTARY BUSINESSES

J. PATRICK MULCAHY, Chief Executive Officer

*Net earnings and earnings per share exclude the SWS inventory write-up as noted on the inside front cover.