Energizer 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

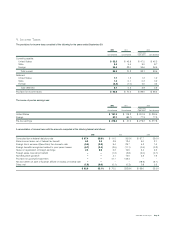

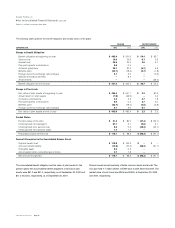

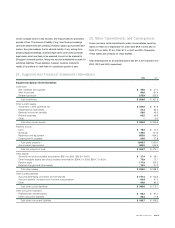

21. Supplemental Financial Statement Information

2002 2001

Supplemental Balance Sheet Information:

Inventories

Raw materials and supplies $ 44.5 $ 47.0

Work in process 98.6 91.4

Finished products 215.9 222.9

Total inventories $ 359.0 $ 361.3

Other current assets

Investment in SPE (see Note 15) $ 164.6 $ 97.9

Miscellaneous receivables 21.3 25.3

Deferred income tax benefits 56.6 46.3

Prepaid expenses 63.5 39.8

Other –0.6

Total other current assets $ 306.0 $ 209.9

Property at cost

Land $ 10.2 $ 10.1

Buildings 149.5 147.6

Machinery and equipment 855.8 834.5

Construction in progress 24.8 37.8

Total gross property 1,040.3 1,030.0

Accumulated depreciation 584.6 553.9

Total net property at cost $ 455.7 $ 476.1

Other assets

Goodwill (net of accumulated amortization: $25.4 in 2002, $25.9 in 2001) $ 37.4 $ 38.1

Other intangible assets (net of accumulated amortization: $364.2 in 2002, $364.7 in 2001) 73.9 72.7

Pension asset 117.9 106.2

Deferred charges and other assets 15.3 21.2

Total other assets $ 244.5 $ 238.2

Other current liabilities

Accrued advertising, promotion and allowances $ 141.4 $ 143.2

Accrued salaries, vacations and incentive compensation 69.4 47.2

Other 94.8 85.3

Total other current liabilities $ 305.6 $ 275.7

Other noncurrent liabilities

Postretirement benefit liability $ 90.3 $ 91.7

Other noncurrent liabilities 98.4 77.8

Total other noncurrent liabilities $ 188.7 $ 169.5

ENR 2002 Annual Report Page 41

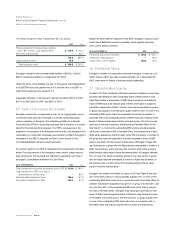

involve complex issues of law and fact, and may proceed for protracted

periods of time. The amount of liability, if any, from these proceedings

cannot be determined with certainty. However, based upon present infor-

mation, Energizer believes that its ultimate liability, if any, arising from

pending legal proceedings, asserted legal claims and known potential

legal claims which are likely to be asserted, should not be material to

Energizer’s financial position, taking into account established accruals for

estimated liabilities. These liabilities, however, could be material to

results of operations or cash flows for a particular quarter or year.

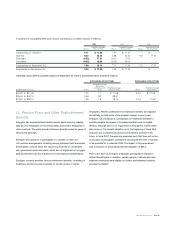

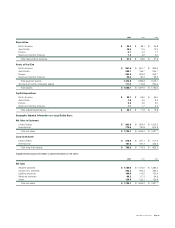

20. Other Commitments and Contingencies

Future minimum rental commitments under noncancellable operating

leases in effect as of September 30, 2002 were $9.8 in 2003, $8.4 in

2004, $7.5 in 2005, $7.5 in 2006, $7.3 in 2007 and $30.4 thereafter.

These leases are primarily for office facilities.

Total rental expense for all operating leases was $17.3, $17.9 and $17.5 in

2002, 2001 and 2000, respectively.