Energizer 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FY 2002 Financial Results

For our fiscal year ended September 30, 2002,

net earnings, excluding unusual items, reached

$192 million, an increase of 88 percent over net

earnings of $102 million the prior year. Earnings

per share, excluding unusual items, rose 90 percent

to $2.07 from $1.09 the year before. Reflecting these

solid advances, our share price climbed from

$16.62 at the end of fiscal 2001 to $30.40 on

September 30, 2002.

In May 2002, we completed our previously author-

ized repurchase of 5 million shares, and our Board of

Directors authorized the repurchase of an additional

5 million shares of common stock. We intend to

make occasional repurchases on the open market

or through privately arranged transactions, subject

to corporate objectives and management’s discretion.

In August 2002, we conducted a modified “Dutch

auction”tender offer and were able to purchase a

total of 2.6 million shares at a price of $29.00 per

share. In fiscal 2002, we repurchased a total of 3.8

million shares representing nearly 4 percent of the

shares outstanding.

Progress in Our Key Initiatives

Fiscal 2002 was a year of solid performance. We

attained targeted profitability while protecting our

relatively strong market share position throughout the

world. Some markets were up, some were down and

some were sideways, but for the most part, we’re

very pleased with our competitive position.

In our pursuit of improved results, we followed the

four initiatives detailed here last year to address

the business climate and adapt to the new realities

of the marketplace. We have achieved significant

progress in each area:

1. Managing our business to maximize cash

returns. Net cash flow, as defined by EBITDA

before unusual items, increased 37 percent from

$275 million to $376 million. This improvement

reflects our improved operating performance and

our focus on managing working capital. Over the

last two years, we’ve been able to reduce working

capital by 12 percent, primarily by reducing our

inventory levels by focusing on manufacturing

to consumption levels.

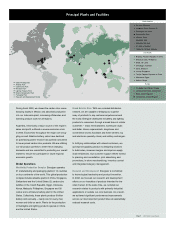

2. Streamlining our global operations to reduce

costs and rationalize capacity. Based on a

comprehensive review of Energizer’s worldwide

operations and capacity utilization completed in

late fiscal 2001, we implemented restructuring

plans to consolidate carbon zinc production

capacity. We closed our facility in Mexico and

now supply Latin American markets from our

Asian production complex, where we achieve lower

production costs and improved product quality.

to our shareholders

Throughout fiscal 2002, we focused squarely on the actions needed to be

successful and eliminated those activities that were not value producing.

The outcome of these efforts is clearly reflected in our strong financial

results. While Energizer’s 2001 fiscal year was very disappointing, we

used it as a stepping stone to regear the company, drive for improved

performance and return to an appropriate trend line in 2002.

ENR 2002 Annual Report Page 2