Energizer 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

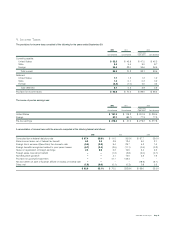

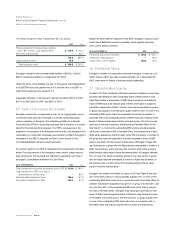

6. Accounts Receivable Write-down

On January 23, 2002, Kmart filed for Chapter 11 bankruptcy protection.

Energizer’s Special Purpose Entity (SPE) (see Note 15) had pre-petition

accounts receivable from Kmart Corporation of $20.0. In the year ended

September 30, 2002, Energizer recorded total charges related to such

receivables of $15.0 pre-tax, or $9.3 after-tax. It is not yet known what por-

tion, if any, of the balance will be collected.

7. Intellectual Property Rights Income

In fiscal 2001, Energizer recorded income of $20.0 pre-tax, or $12.3 after-

tax, related to the licensing of intellectual property rights.

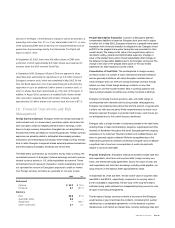

8. Goodwill and Intangible Assets and

Amortization

Energizer monitors changing business conditions, which may indicate

that the remaining useful life of goodwill and other intangible assets

may warrant revision or carrying amounts may require adjustment.

Continuing unfavorable business trends in Europe and the unfavorable

costs of U.S. dollar-based products resulting from currency declines

represented such conditions. As part of its annual business planning

cycle, Energizer performed an evaluation of its European business in

the fourth quarter of fiscal 2001, which resulted in a provision for

goodwill impairment of $119.0. As of September 30, 2001, the remain-

ing carrying amount of goodwill related to Energizer’s European busi-

ness after the provision for impairment was $8.5.

On October 1, 2001, Energizer adopted Statement of Financial Accounting

Standards No. 142, “Goodwill and Intangible Assets” (SFAS 142). SFAS

142 eliminates the amortization of goodwill and instead requires goodwill

be tested for impairment at least annually. Intangible assets deemed to

have an indefinite life under SFAS 142 are no longer amortized, but

instead reviewed at least annually for impairment. Intangible assets with

finite lives are amortized over its useful life.

As businesses have been acquired in the past, Energizer has allocated

goodwill and other intangible assets to reporting units within each operating

segment. Energizer’s intangible assets are comprised of trademarks related

to the Energizer name, which are deemed indefinite-lived intangibles. Thus

beginning in fiscal 2002, these trademarks are no longer amortized.

As part of the implementation of SFAS 142, Energizer completed

transitional tests in the first quarter of fiscal 2002, which resulted in no

impairment. As part of its business planning cycle in the fourth quarter

of fiscal 2002, Energizer completed its impairment test of goodwill and

intangibles, which resulted in no impairment. The fair value of the report-

ing unit was estimated using the discounted cash flow method.

ENR 2002 Annual Report Page 29