Energizer 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Energizer Holdings, Inc.

Management’s Discussion and Analysis of Results of Operations and Financial Condition Continued

(Dollars in millions except per share and percentage data)

ENR 2002 Annual Report Page 14

Goodwill and Intangibles

As part of its annual business planning cycle, Energizer performed an

evaluation of its European business in the fourth quarter of fiscal 2001,

which resulted in an impairment charge for $119.0 of related goodwill.

At September 30, 2001, the carrying amount of goodwill related to

Energizer’s European business was $8.5.

Energizer adopted SFAS No. 142, “Goodwill and Other Intangible

Assets” as of October 1, 2001. As a result, Energizer no longer amor-

tizes its goodwill and intangible assets, which consist of tradenames. As

part of its business planning cycle in the fourth quarter of fiscal 2002,

Energizer completed its impairment test of goodwill and intangibles,

which resulted in no impairment. See Note 8 to the Consolidated

Financial Statements for further discussion.

Intellectual Property Rights Income

In fiscal 2001, Energizer recorded income of $20.0 pre-tax, or $12.3

after-tax, related to the licensing of intellectual property rights.

Loss on Disposition of Spanish Affiliate

In fiscal 2000, Energizer recorded a $15.7 pre-tax loss on the sale of its

Spanish affiliate prior to the spin-off. The loss was a non-cash write-off of

goodwill and cumulative translation accounts of the Spanish affiliate.

Ralston recognized capital loss tax benefits related to the Spanish sale of

$24.4, which are reflected in Energizer’s historical financial statements and

resulted in a net after-tax gain of $8.7 on the Spanish transaction. Energizer

would not have realized such capital loss benefits on a stand-alone basis.

Interest and Other Financial Items

Interest expense decreased $12.1 in 2002, on lower average borrowings,

as well as lower interest rates on variable rate debt. Interest expense

increased $5.9 in 2001 from 2000 as the cost of incremental debt

assumed by Energizer immediately prior to the spin-off was partially offset

by lower average borrowings and lower interest rates in the second half of

2001, compared to the same period in 2000.

Other financing-related costs declined $1.2 in 2002, on lower discounts

on the sale of accounts receivable under a financing arrangement, par-

tially offset by net exchange losses versus net exchange gains in 2001.

Other financing-related costs increased $5.9 in 2001, reflecting the dis-

count on the sale of accounts receivable under a financing arrangement

and lower net exchange gains.

Income Taxes

Income taxes, which include federal, state and foreign taxes, were 33.1%,

223.8% and 35.5% of earnings from continuing operations before income

taxes in 2002, 2001 and 2000, respectively. Earnings before income taxes

and income taxes include certain unusual items in all years the most sig-

nificant of which are described as follows:

■In 2002, $6.7 of tax benefits related to prior years’ losses was

recorded.

■In 2001, the provision for goodwill impairment of $119.0 has no

associated tax benefit, as the charge is not deductible for tax pur-

poses. The provisions for restructuring of $29.8 have an associated

tax rate of 34.9%.

■In 2001 and 2000, goodwill was amortized with no associated tax

benefit.

■In 2000, the income tax percentage was favorably impacted by the

recognition of $24.4 U.S. capital loss tax benefits related to the dis-

position of Energizer’s Spanish affiliate.

Excluding the items discussed above, the income tax percentage was

35.5% in 2002, 42.3% in 2001 and 39.9% in 2000. In 2002, the rate

improved due to reduced foreign losses and lower taxes on repatriation of

foreign earnings. The higher effective tax rate in 2001 compared to 2000

reflects pre-tax losses in foreign tax jurisdictions for which no tax benefits

were realized. The year-over-year increase was the result of the fixed

dollar impact of these items being spread over a smaller earnings base.

Energizer’s effective tax rate is highly sensitive to country mix from

which earnings or losses are derived. To the extent future earnings

levels and country mix are similar to the 2002 level, future tax rates

would likely be in the 36% range. Shifts of earnings from lower to

higher tax rate countries or higher losses in countries where tax

benefits cannot be recognized could increase future tax rates.

Conversely, favorable country earnings mix or reduced foreign

losses could reduce future tax rates.

Liquidity and Capital Resources

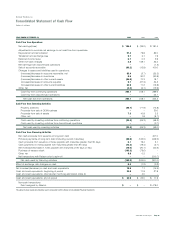

Cash flows from continuing operations totaled $206.1 in 2002, $318.1 in

2001 and $289.6 in 2000. The decrease in cash flows from operations in

2002 was primarily due to the absence of a significant inventory reduction,

as was experienced in 2001 and lower proceeds from the sale of accounts

receivable. Cash flows from operations in 2001 increased modestly due

to significant inventory reduction in 2001 compared to a significant

inventory increase in 2000, and other working capital improvements in

2001, partially offset by substantially lower cash earnings in 2001 and

lower proceeds from sale of accounts receivable.

Working capital was $353.3 and $288.1 at September 30, 2002 and 2001,

respectively. Capital expenditures totaled $40.7, $77.9 and $72.8 in 2002,

2001 and 2000, respectively. These expenditures were funded by cash

flow from operations. Capital expenditures decreased in 2002 as several

major projects were completed in late 2001 and early 2002. Capital