Energizer 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

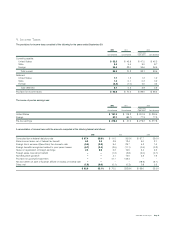

In 2001, Energizer recorded a provision for goodwill impairment of $119.0,

for which there is no associated tax provision or benefit. See further dis-

cussion in Note 8.

Prior to spin-off, U.S. income tax payments, refunds, credits, provision

and deferred tax components have been allocated to Energizer in

accordance with Ralston’s tax allocation policy. Such policy allocates

tax components included in the consolidated income tax return of

Ralston to Energizer to the extent such components were generated

by or related to Energizer. Subsequent to the spin-off, taxes are provided

on a stand-alone basis.

Had the Energizer tax provision been calculated as if Energizer was a

separate, independent U.S. taxpayer, the income tax provision would

have been higher by approximately $23.4 in 2000. The higher provision

is due primarily to the $24.4 of capital loss benefits related to the sale

of Energizer’s Spanish affiliate that would not have been realized on a

stand-alone basis.

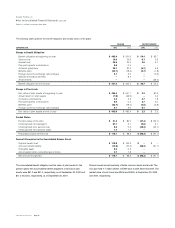

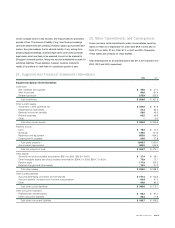

The deferred tax assets and deferred tax liabilities recorded on the bal-

ance sheet as of September 30 are as follows and include current and

noncurrent amounts:

2002 2001

Deferred tax liabilities:

Depreciation and property differences $ (74.2) $ (61.1)

Pension plans (43.2) (38.4)

Other tax liabilities, noncurrent (28.1) (14.5)

Gross deferred tax liabilities (145.5) (114.0)

Deferred tax assets:

Accrued liabilities 72.0 58.8

Tax loss carryforwards and tax credits 38.1 28.6

Intangible assets 48.3 46.9

Postretirement benefits other than pensions 34.6 35.3

Inventory differences 3.5 4.0

Other tax assets, noncurrent 7.1 7.5

Gross deferred tax assets 203.6 181.1

Valuation allowance (32.5) (35.1)

Net deferred tax assets $ 25.6 $ 32.0

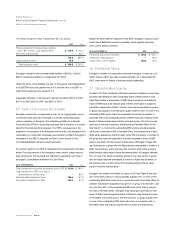

Tax loss carryforwards of $.9 expired in 2002. Future expiration of tax

loss carryforwards and tax credits, if not utilized, are as follows: 2003,

$2.8; 2004, $3.3; 2005, $4.5; 2006, $3.0; 2007, $7.2; thereafter or no

expiration, $17.3. The valuation allowance is primarily attributed to

certain accrued liabilities, tax loss carryforwards and tax credits out-

side the United States. The valuation allowance decreased $2.6 in

2002 primarily due to tax loss carryforwards and tax credits utilized

in 2002.

At September 30, 2002, approximately $121.5 of foreign subsidiary net

earnings was considered permanently invested in those businesses.

Accordingly, U.S. income taxes have not been provided for such earn-

ings. It is not practicable to determine the amount of unrecognized

deferred tax liabilities associated with such earnings.

Energizer Holdings, Inc.

Notes to Consolidated Financial Statements Continued

(Dollars in millions, except per share data)

ENR 2002 Annual Report Page 32