Energizer 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The FASB issued SFAS No. 145, “Rescission of FASB Statements No. 4, 44,

and 64, Amendment of FASB Statement No. 13, and Technical Corrections.”

SFAS 145 updates, clarifies and simplifies existing accounting pronouncements.

Energizer is required to adopt SFAS 145 no later than the first quarter of fiscal

2003. Energizer determined that the adoption of SFAS 145 will not have a

material effect on its financial statements.

The FASB issued SFAS No. 146, “Accounting for Exit or Disposal

Activities.” SFAS 146 supercedes EITF Issue No. 94-3 and provides direc-

tion for accounting and disclosure regarding specific costs related to an

exit or disposal activity. This standard requires companies to recognize

costs associated with exit or disposal activities when they are incurred

rather than at the date of a commitment to an exit or disposal plan.

Examples of costs covered by the standard include, but are not limited to

lease termination costs and certain employee severance costs that are

associated with a restructuring, discontinued operation, plant closing, or

other exit or disposal activity. Energizer is required to adopt SFAS 146 for

any disposal activities initiated after December 31, 2002, although early

adoption is allowed. Energizer determined that the adoption of SFAS 146

will not have a material effect on its financial statements, but it may

change the period in which future restructuring provisions are recorded.

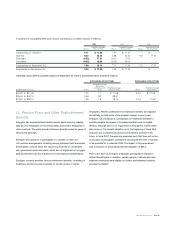

The Emerging Issues Task Force (EITF) issued EITF 00-10, “Accounting

for Shipping and Handling Fees and Costs,” which provides guidance on

earnings statement classification of amounts billed to customers for ship-

ping and handling. Energizer adopted EITF 00-10 in its fourth quarter of

fiscal 2001. Reclassifications were necessary from net sales to cost of

products sold and were $34.4 and $36.1 for 2001 and 2000, respectively.

In addition, warehousing costs in selling, general and administrative

expense of $31.1 and $33.2 in 2001 and 2000, respectively, were reclassi-

fied to cost of products sold. There was no impact to net earnings.

The EITF also issued EITF 00-14 and 00-25. EITF 00-14, “Accounting for

Certain Sales Incentives,” provides guidance on accounting for discounts,

coupons, rebates and free product. EITF 00-25, “Vendor Income Statement

Characterization of Consideration from a Vendor to a Retailer,” provides

guidance on accounting for considerations other than those directly

addressed in EITF 00-14. Energizer adopted EITF 00-14 and 00-25 in its

fourth quarter of fiscal 2001. Reclassifications were necessary from adver-

tising and promotion expense to net sales and were $28.3 and $22.7 for

2001 and 2000, respectively. There was no impact to net earnings.

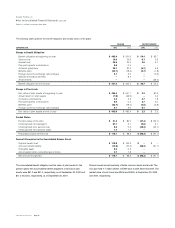

3. Related Party Activity

Cash Management Prior to the spin-off, Energizer participated in a cen-

tralized cash management system administered by Ralston. Cash deposits

from Energizer were transferred to Ralston on a daily basis and Ralston

funded Energizer’s disbursement bank accounts as required. Unpaid

balances of checks were included in accounts payable. No interest was

charged or credited on transactions with Ralston.

Shared Services Energizer and Ralston entered into a Bridging

Agreement under which Ralston continued to provide certain general

and administrative services to Energizer, including systems, benefits and

advertising. Ralston also provided facilities for Energizer’s headquarters

through July 31, 2001, when Energizer relocated its headquarters. Prior to

the spin-off, the expenses related to shared services listed above, as well

as legal and financial support services, were allocated to Energizer gener-

ally based on utilization, which management believes to be reasonable.

Costs of these shared services charged to Energizer were $9.6 for the six

months ended March 31, 2000.

Ralston’s Net Investment Included in Ralston’s Net Investment are

cumulative translation adjustments for non-hyperinflationary countries of

$84.6 as of March 31, 2000 representing net devaluation of currencies

relative to the U.S. dollar over the period of investment. Also included in

Ralston’s Net Investment are accounts payable and receivable between

Energizer and Ralston.

4. Discontinued Operations

On November 1, 1999, Energizer’s OEM rechargeable battery business

was sold to Moltech Corporation and was recorded as a discontinued

operation in Energizer’s consolidated financial statements. In fiscal

2000, Energizer recognized an after-tax gain of $1.2 on the disposition

of discontinued operations related to the final settlement of the sale to

Moltech Corporation.

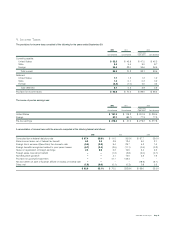

5. Restructuring Activities

In March 2002, Energizer adopted a restructuring plan to reorganize

certain European selling, management, administrative and packaging

activities. The total cost of this plan was $6.7 before taxes, of which

$4.5, or $2.9 after-tax, was recorded in the second quarter of fiscal

2002 and $2.2, before and after-tax, was recorded during the fourth

quarter of fiscal 2002. These restructuring charges consist of $5.2 for

cash severance payments, $1.0 of other cash charges and $.5 in

enhanced pension benefits. As of September 30, 2002, 10 of a total

of 64 employees have been terminated in connection with the 2002

plans. The plan is expected to be complete by the end of fiscal 2003.

Because of a continued migration of consumer demand from carbon

zinc to alkaline batteries, Energizer undertook and completed in the

fourth quarter of fiscal 2001 a comprehensive study of its carbon zinc

manufacturing plant locations and capacities. Energizer also reviewed

its worldwide operations in light of competitive market conditions and

ENR 2002 Annual Report Page 27