Energizer 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2002 Annual Report Page 37

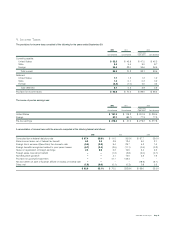

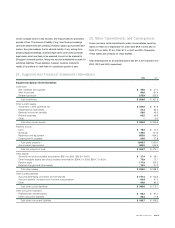

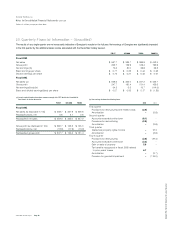

The following table presents pension and postretirement expense for fiscal 2002 and 2001:

PENSION POSTRETIREMENT

SEPTEMBER 30, 2002 2001 2002 2001

Service cost $ 16.6 $ 16.6 $ 0.1 $ 0.2

Interest cost 26.5 24.5 3.6 6.1

Expected return on plan assets (48.9) (46.9) – –

Amortization of unrecognized prior service cost – – (2.4) (0.3)

Amortization of unrecognized transition asset 0.3 0.3 – –

Recognized net actuarial (gain)/loss (1.3) (3.3) – –

Net periodic benefit cost/(income) $ (6.8) $ (8.8) $ 1.3 $ 6.0

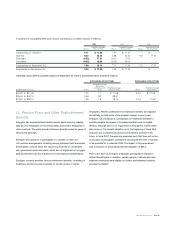

The following table presents assumptions, which reflect weighted-averages for the component plans, used in determining the above information:

PENSION POSTRETIREMENT

2002 2001 2002 2001

Discount rate 6.2% 6.6% 6.5% 7.0%

Expected return on plan assets 8.3% 8.7% ––

Compensation increase rate 4.7% 5.2% ––

Assumed healthcare cost trend rates have been used in the valuation of

postretirement health insurance benefits for the beginning of the 2001

valuation. The trend rate used for those periods was 6.5%. Due to the

amendment to the postretirement plan discussed above, cost trend

rates no longer materially impact the plan.

Pre-Spin Pension Plans and Other Postretirement Benefits

Prior to the spin-off, Energizer participated in Ralston’s noncontributory

defined benefit pension plans (Plans), which covered substantially all

regular employees in the United States and certain employees in other

countries. Effective January 1, 1999, assets of the Plans provide

employee benefits in addition to normal retirement benefits. The addi-

tional benefit was equal to a 300% match on participants’ after-tax

contributions of 1% or 1.75% to the Savings Investment Plan. The

amount allocated to Energizer was based on Energizer’s percentage

of the total liability of the Plans and was income of $2.1 in 2000.

Prior to the spin-off, Ralston provided healthcare and life insurance

benefits for certain groups of retired Energizer employees. The cost

of these benefits was allocated to Energizer based on Energizer’s

percentage of the total liability related to these benefits. Ralston also

sponsored plans whereby certain management employees could defer

compensation for cash benefits after retirement. The cost of these

postretirement benefits was $3.3 in 2000.

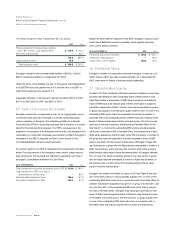

13. Defined Contribution Plan

Energizer sponsors employee savings plans, which cover substantially

all U.S. employees. Energizer matches 50% of participants’ before-tax

contributions up to 6% of compensation. In addition, participants can

make after-tax contributions of 1% of compensation into the savings

plan. The participant’s after-tax contribution is matched within the pen-

sion plan at 325%. Amounts charged to expense during fiscal 2002 and

2001 were $4.0 and $3.8, respectively. Subsequent to the spin-off from

Ralston, Energizer charged $1.8 to expense in fiscal 2000.

Prior to the spin-off, substantially all regular Energizer employees in the

United States were eligible to participate in the Ralston-sponsored

defined contribution plans. Participant contributions were matched in

accordance with Ralston’s plan terms. Prior to the spin-off, Energizer

recorded costs as allocated by Ralston. The amount of such costs was

$1.2 for the six months ended March 31, 2000.

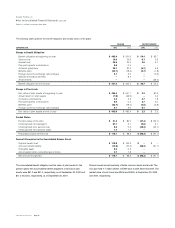

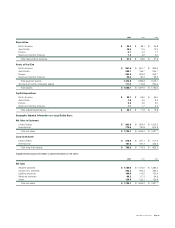

14. Debt

Immediately prior to the spin-off, Ralston borrowed $478.0 through

several interim-funding facilities and assigned all repayment obligations

of those facilities to Energizer. In April and May 2000, Energizer entered

into separate financing agreements, including an agreement to sell

domestic trade receivables as discussed in Note 15 below, and repaid

the interim-funding facilities.

Notes payable at September 30, 2002 and 2001 consisted of notes

payable to financial institutions with original maturities of less than one

year of $94.6 and $110.3, respectively, and had a weighted-average

interest rate of 3.8% and 6.9%, respectively.