Energizer 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YEAR ENDED SEPTEMBER 30, 2002 2001 2000

Net Earnings (in millions)

Net Earnings, Excluding Unusuals $ 191.8 $ 102.2 $ 170.7 (a)(b)

Provisions for restructuring (7.8) (19.4) –

Accounts receivable write-down (9.3) ––

Sale of international property 5.0 ––

Tax benefits recognized in 2002 related to prior years’ losses 6.7

Intellectual property rights income –12.3 –

Provision for goodwill impairment –(119.0) –

Amortization –(15.1) (16.6)

Loss on disposition of Spanish affiliate –– (15.7)

Elimination of international operations one month lag –– 9.0

Net effects of pro forma interest, spin-off and other pro forma costs –– 8.4

Capital loss tax benefits –– 24.4

Net gain from discontinued operations –– 1.2

Net Earnings/(Loss) $ 186.4 $ (39.0) $ 181.4 (c)

Diluted Earnings Per Share

Net Earnings, Excluding Unusuals $ 2.07 $ 1.09 $ 1.77 (a)(b)

Provisions for restructuring (0.08) (0.21) –

Accounts receivable write-down (0.10) ––

Sale of international property 0.05 ––

Tax benefits recognized in 2002 related to prior years’ losses 0.07 –

Intellectual property rights income –0.13 –

Provision for goodwill impairment –(1.27) –

Amortization –(0.16) (0.17)

Loss on disposition of Spanish affiliate –– (0.16)

Elimination of international operations one month lag –– 0.09

Net effects of pro forma interest, spin-off and other pro forma costs –– 0.09

Capital loss tax benefits –– 0.25

Net gain from discontinued operations –– 0.01

Net Earnings/(Loss) $ 2.01 $ (0.42) $ 1.88 (c)

Diluted Weighted-Average Shares Outstanding 92.8 94.1 96.3 (d)

(a) Energizer Holdings, Inc. was spun off from Ralston Purina Company (Ralston) on April 1, 2000. Amounts represent pro forma fiscal 2000 financial data presented

as if the spin-off had occurred as of October 1, 1999.

(b) Fiscal 2000 reflects the elimination of the one month lag in international operations’ reporting period. See discussion in Note 2 to the financial statements.

(c) The historical financial information for fiscal year 2000 reflects the period during which Energizer was operated as a business segment of Ralston.

(d) The pro forma diluted weighted shares outstanding is based on the weighted-average number of shares outstanding of Ralston common stock outstanding prior to

the spin-off (adjusted for the distribution of one share of Energizer stock for each three shares of Ralston stock) and in fiscal 2000, the diluted weighted-average

number of shares of Energizer stock outstanding from April 1, 2000 to September 30, 2000.

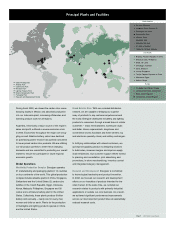

energizer at a glance