Energizer 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest rate and other risks that are inherent to its business operations.

Such instruments are not held or issued for trading purposes.

Foreign exchange (F/X) instruments, including currency forwards, pur-

chased options and zero-cost option collars, are used primarily to reduce

transaction exposures and, to a lesser extent, to manage other translation

exposures. F/X instruments used are selected based on their risk reduc-

tion attributes and the related market conditions. The terms of such instru-

ments are generally 12 months or less.

For derivatives not designated as hedging instruments for accounting pur-

poses, realized and unrealized gains or losses from such instruments are

recognized currently in selling, general and administrative expenses or

other financing items, net in the Consolidated Statement of Earnings.

Energizer has not designated any financial instruments as hedges for

accounting purposes in the three years ended September 30, 2002.

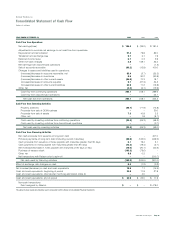

Cash Equivalents For purposes of the Consolidated Statement of Cash

Flows, cash equivalents are considered to be all highly liquid investments

with a maturity of three months or less when purchased.

Inventories Inventories are valued at the lower of cost or market, with

cost generally being determined using average cost or the first-in, first-out

(FIFO) method.

Capitalized Software Costs Capitalized software costs are included in

Other Assets. These costs are amortized using the straight-line method

over periods of related benefit ranging from three to seven years.

Property at Cost Expenditures for new facilities and expenditures that

substantially increase the useful life of property, including interest during

construction, are capitalized. Maintenance, repairs and minor renewals are

expensed as incurred. When property is retired or otherwise disposed of,

the related cost and accumulated depreciation are removed from the

accounts, and gains or losses on the disposition are reflected in earnings.

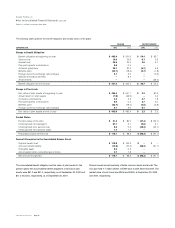

Depreciation Depreciation is generally provided on the straight-line basis

by charges to costs or expenses at rates based on estimated useful lives.

Estimated useful lives range from two to 25 years for machinery and

equipment and three to 30 years for buildings. Depreciation expense was

$57.4, $58.6 and $57.9 in 2002, 2001 and 2000, respectively.

Goodwill and Other Intangible Assets Prior to fiscal 2002, the cost of

goodwill and intangible assets was amortized on a straight-line basis, with

periods of 25 and 40 years for goodwill and seven to 40 years for intangi-

ble assets and recorded in selling, general and administrative expense.

Beginning in fiscal 2002, goodwill and indefinite-lived intangibles are no

longer amortized, but evaluated annually for impairment as part of

Energizer’s annual business planning cycle. The fair value of the reporting

unit is estimated using the discounted cash flow method.

Impairment of Long-Lived Assets Energizer reviews long-lived assets

for impairment whenever events or changes in business circumstances

indicate that the remaining useful life may warrant revision or that the

carrying amount of the long-lived asset may not be fully recoverable.

Energizer performs undiscounted cash flow analyses to determine if

impairment exists. If impairment is determined to exist, any related

impairment loss is calculated based on fair value. Impairment losses on

assets to be disposed of, if any, are based on the estimated proceeds

to be received, less costs of disposal.

Revenue Recognition Revenue is recognized in accordance with terms of

sale, which is generally upon shipment of product to or upon receipt of

product by customers. Energizer provides its customers a variety of pro-

grams designed to promote sales of its products. Promotional payments

and allowances that represent primarily a reduction in price paid by either a

retail customer, distributor, wholesaler or ultimate consumer are recorded in

net sales. The provision for doubtful accounts is included in selling, general

and administrative expenses in the Consolidated Statement of Earnings.

Advertising and Promotion Costs Energizer advertises and promotes

its products through national and regional media. Energizer expenses

advertising and promotion in the year such costs are incurred. Due to

the seasonality of the business, with typically higher sales and volume

during the holidays in the first quarter, advertising and promotion

costs incurred during interim periods are generally expensed ratably

in relation to revenues.

Reclassifications Certain reclassifications have been made to the prior

year financial statements to conform to the current presentation.

Recently Issued Accounting Pronouncements The Financial Accounting

Standards Board (FASB) issued SFAS No. 143, “Accounting for Asset

Retirement Obligations.” SFAS 143 addresses financial accounting and

reporting for obligations associated with the retirement of tangible long-

lived assets and the associated asset retirement costs. Energizer is

required to adopt SFAS 143 no later than the first quarter of fiscal 2003.

Energizer determined that the adoption of SFAS 143 will not have a mate-

rial effect on its financial statements.

The FASB issued SFAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets,” which provides guidance on the

accounting for the impairment or disposal of long-lived assets. Energizer

is required to adopt SFAS 144 no later than the first quarter of fiscal

2003. Energizer determined that the adoption of SFAS 144 will not have

a material effect on its financial statements.

Energizer Holdings, Inc.

Notes to Consolidated Financial Statements Continued

(Dollars in millions, except per share data)

ENR 2002 Annual Report Page 26