Energizer 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

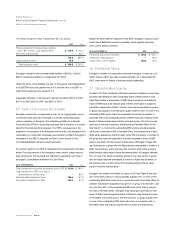

available technologies and techniques. During fiscal 2001, Energizer

adopted restructuring plans to eliminate carbon zinc capacity, and

to reduce and realign certain selling, production, research and admin-

istrative functions. The total cost associated with this plan was $33.4

before taxes, of which $29.8, or $19.4 after-tax, was recorded in the

fourth quarter of fiscal 2001. In the first quarter of fiscal 2002,

Energizer ceased production and terminated substantially all of its

employees at its Mexican carbon zinc production facility. Energizer

also continued execution of other previously announced restructuring

actions. Energizer recorded provisions for restructuring of $1.4, or

$0.9 after-tax, as well as related costs for accelerated depreciation and

inventory obsolescence of $2.6, or $2.0 after-tax, which was recorded

in cost of products sold in the first quarter of fiscal 2002. In addition,

Energizer recorded net reversals of previously recorded excess

restructuring charges of $.4, or $.2 after-tax, during the fourth

quarter of fiscal 2002.

The 2001 restructuring plans improved Energizer’s operating efficiency,

downsized and centralized corporate functions, and decreased costs.

One carbon zinc production facility in Mexico was closed. A total of 539

employees were terminated, consisting of 340 production and 199 sales,

research and administrative employees, primarily in the United States and

South and Central America.

The restructuring charges for the 2001 plan consist of non-cash fixed

asset impairment charges of $10.6 for the closed carbon zinc plant and

production equipment, enhanced pension benefits for certain terminated

U.S. employees of $8.3, cash severance payments of $7.6, other cash

charges of $4.2, and $2.6 of other related costs for accelerated depreci-

ation and inventory obsolescence recorded in cost of products sold.

Prior to fiscal 2000, Energizer adopted restructuring plans. All activities

associated with such plans, except disposition of certain assets held for

disposal, had been completed as of September 30, 2000.

The carrying value of assets held for disposal under restructuring plans

was $1.3 at September 30, 2002.

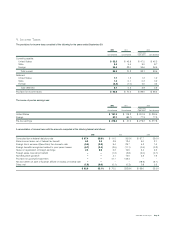

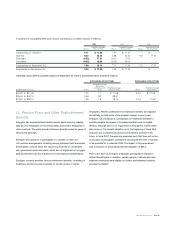

The following table presents, by major cost component and by year of

provision, activity related to the restructuring charges discussed above

during fiscal years 2002, 2001 and 2000, including any adjustments to

the original charges:

Energizer Holdings, Inc.

Notes to Consolidated Financial Statements Continued

(Dollars in millions, except per share data)

ENR 2002 Annual Report Page 28

2000 ROLLFORWARD 2001 ROLLFORWARD 2002 ROLLFORWARD

Beginning Provision/ Ending Beginning Provision/ Ending Beginning Provision/ Ending

Balance (Reversals) Activity Balance Balance (Reversals) Activity Balance Balance (Reversals) Activity Balance

Prior Plans

Termination benefits $ 6.4 $ – $ (6.4) $ – $ – $ – $ – $ – $– $– $ – $ –

Other cash costs 4.9 – (1.0) 3.9 3.9 – (3.9) – – – – –

Total 11.3 – (7.4) 3.9 3.9 – (3.9) – – – – –

2001 Plan

Termination benefits – – – – – 14.6 (9.3) 5.3 5.3 1.3 (5.7) 0.9

Other cash costs – – – – – 4.1 (0.2) 3.9 3.9 0.1 (3.8) 0.2

Fixed asset impairments – – – – – 11.1 (11.1) – – (0.4) 0.4 –

Total – – – – – 29.8 (20.6) 9.2 9.2 1.0 (9.1) 1.1

2002 Plan

Termination benefits – – – – – – – – – 5.7 (0.3) 5.4

Other cash costs – – – – – – – – – 1.0 (0.2) 0.8

Total – – – – – – – – – 6.7 (0.5) 6.2

Grand Total $ 11.3 $ – $ (7.4) $ 3.9 $ 3.9 $ 29.8 $ (24.5) $ 9.2 $ 9.2 $ 7.7 $ (9.6) $ 7.3