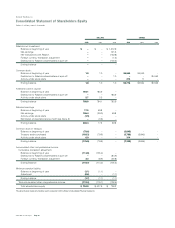

Energizer 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

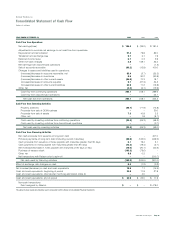

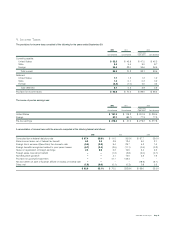

Statement of Earnings:

YEAR ENDED SEPTEMBER 30, 2002 2001 2000

Net sales $ 1,739.7 $ 1,694.2 $ 1,927.7

Cost of products sold 963.8 999.1 1,044.0

Selling, general and administrative expense 307.0 320.3 344.8

Advertising and promotion expense 124.5 133.6 164.7

Research and development expense 37.1 46.4 49.9

Provision for goodwill impairment –119.0 –

Provisions for restructuring 7.7 29.8 –

Intellectual property rights income –(20.0) –

Costs related to spin-off –– 5.5

Loss on disposition of Spanish affiliate –– 15.7

Interest expense 21.1 33.2 27.5

Net other financing items (income)/expense 0.1 1.3 (3.6)

Earnings from continuing operations before income taxes 278.4 31.5 279.2

Income taxes (92.0) (70.5) (99.0)

Earnings/(loss) from continuing operations 186.4 (39.0) 180.2

Net gain on disposition of discontinued operations –– 1.2

Net earnings/(loss) $ 186.4 $ (39.0) $ 181.4

Earnings Per Share:

Basic

Earnings/(loss) from continuing operations $ 2.05 $ (0.42) $ 1.88

Net gain on disposition of discontinued operations –– 0.01

Net earnings/(loss) $ 2.05 $ (0.42) $ 1.89

Diluted

Earnings/(loss) from continuing operations $ 2.01 $ (0.42) $ 1.87

Net gain on disposition of discontinued operations –– 0.01

Net earnings/(loss) $ 2.01 $ (0.42) $ 1.88

Statement of Comprehensive Income:

Net earnings/(loss) $ 186.4 $ (39.0) $ 181.4

Other comprehensive income, net of tax

Foreign currency translation adjustments 3.3 (8.6) (31.9)

Foreign currency reclassification adjustments –– 9.7

Minimum pension liability change, net of tax of $.3 in 2002 and $.7 in 2000 (0.6) – (1.1)

Comprehensive income/(loss) $ 189.1 $ (47.6) $ 158.1

The above financial statement should be read in conjunction with the Notes to Consolidated Financial Statements.

Energizer Holdings, Inc.

Consolidated Statement of Earnings and Comprehensive Income

(Dollars in millions except per share data)

ENR 2002 Annual Report Page 21