Energizer 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

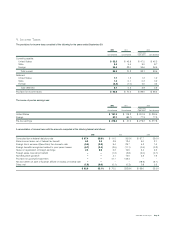

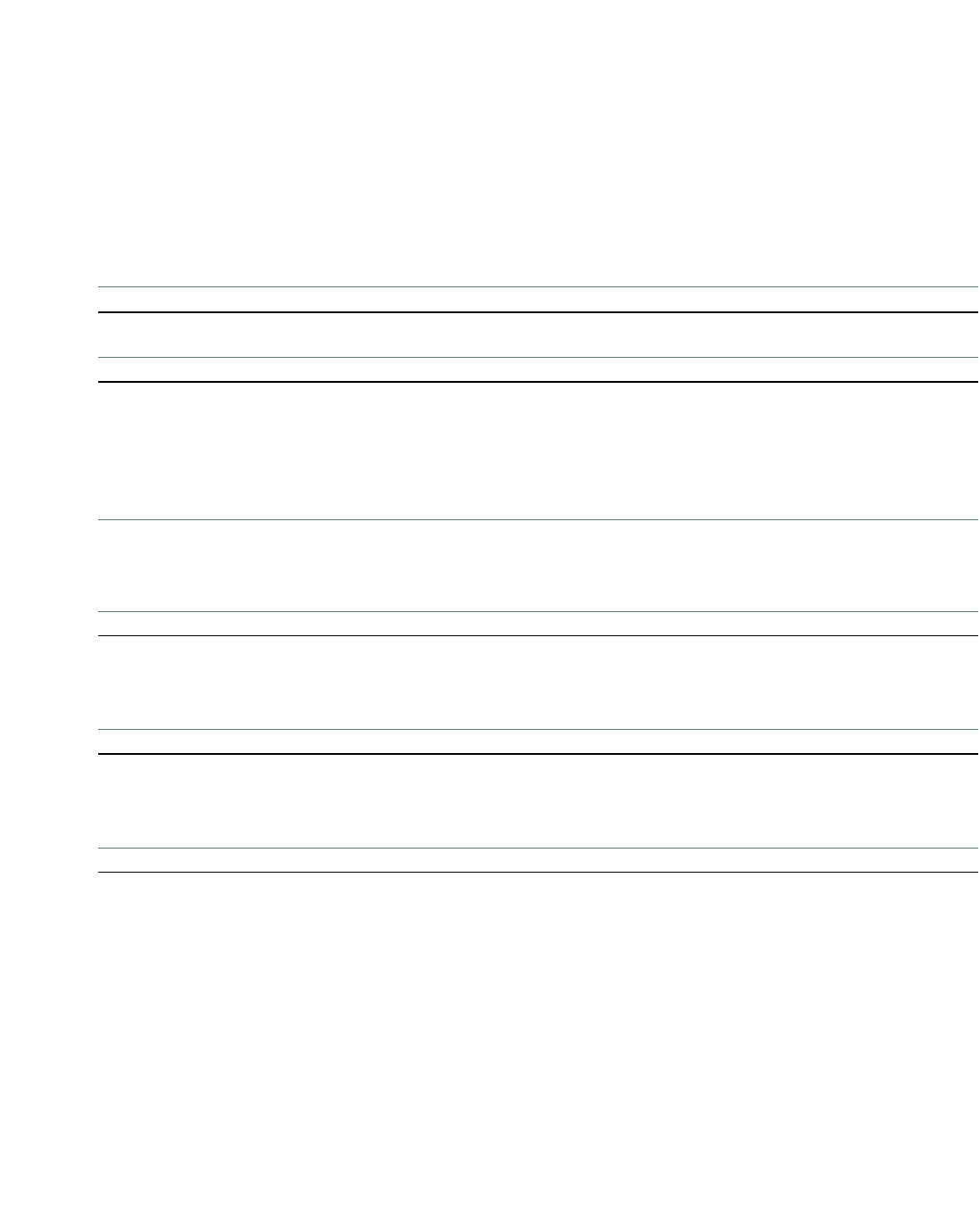

As required by SFAS 142, the results for periods prior to fiscal 2002

were not restated in the accompanying Consolidated Statement of

Earnings. A reconciliation between net earnings and earnings per

share reported by Energizer and net earnings and earnings per share

as adjusted to reflect the impact of SFAS 142 is provided below:

Energizer Holdings, Inc.

Notes to Consolidated Financial Statements Continued

(Dollars in millions, except per share data)

ENR 2002 Annual Report Page 30

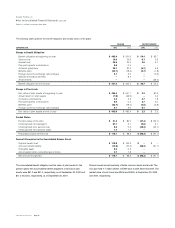

The following table represents the carrying amount of goodwill and trademarks by segment at September 30, 2002:

North South & Central

America Asia Europe America Total

Goodwill $ 24.7 $ 0.9 $ 9.1 $ 2.7 $ 37.4

Trademarks – Gross 413.8 24.3 – – 438.1

Trademarks – Accum. amortization (354.4) (9.8) – – (364.2)

Trademarks – Net carrying amount $ 59.4 $ 14.5 $ – $ – $ 73.9

YEAR ENDED SEPTEMBER 30, 2001 2000

Net earnings/(loss):

As reported $ (39.0) $ 181.4

Goodwill amortization, net of tax 12.1 13.6

Intangible asset amortization, net of tax 3.0 3.0

Adjusted net earnings/(loss) $ (23.9) $ 198.0

Basic earnings/(loss) per share:

As reported $ (0.42) $ 1.89

Goodwill amortization, net of tax 0.13 0.14

Intangible asset amortization, net of tax 0.03 0.03

Adjusted basic earnings/(loss) per share $ (0.26) $ 2.06

Diluted earnings/(loss) per share (a):

As reported $ (0.42) $ 1.88

Goodwill amortization, net of tax 0.13 0.14

Intangible asset amortization, net of tax 0.03 0.03

Adjusted diluted earnings/(loss) per share $ (0.26) $ 2.05

Basic shares 92.6 96.1

Diluted shares 94.1 96.3

(a) For fiscal year 2001, the potentially dilutive securities were not included in the dilutive earnings

per share calculation due to their anti-dilutive effect.