Energizer 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This structure is the basis for Energizer’s reportable operating segment

information presented in Note 22 to the Consolidated Financial

Statements. Prior periods have been restated for comparability. Energizer

evaluates segment profitability based on operating profit before general

corporate expenses, research and development expenses, amortization

of goodwill and intangibles, and unusual items.

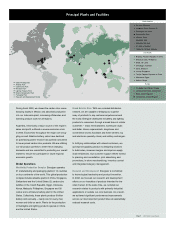

North America

Net sales increased $64.7, or 7%, in 2002 on higher

volume. Alkaline and photo lithium battery unit sales increased 7% and

22%, respectively. Pricing and product mix was slightly unfavorable for the

year. Gross margin increased $75.4 in 2002 on lower product cost and

higher sales. Segment profit increased $83.8, or 41%, reflecting higher

margins and lower overhead and advertising expenses, partially offset by

the $15.0 write-off of Kmart pre-bankruptcy accounts receivable.

Net sales decreased $152.3, or 14%, in 2001 with lower volume

accounting for slightly more than half of the decline. Alkaline, carbon

zinc and lighting products unit volume decreased 5%, 4% and 13%,

respectively, from 2000, compared to heavy Y2K demand in 2000, and

reflecting retail inventory reductions in 2001. Unfavorable pricing and

product mix accounted for the remainder of the sales decline, reflecting

increased promotional spending. Gross margin decreased $118.9 in

2001 on unfavorable pricing and product mix, lower volume and higher

product cost rates associated with lower production levels. Segment

profit decreased $104.1, or 34%, as lower gross margin was partially

offset by lower advertising and promotion expense.

Asia Pacific

Net sales decreased $1.9, or 1%, in 2002 as unfavorable

currency translation of $5.1 and lower volume from non-alkaline product

lines were nearly offset by improved pricing and higher alkaline volume.

Alkaline volume increased 25% in 2002 on significantly increased sales

to equipment manufacturers and a 6% increase in unit sales to retail

channels, while carbon zinc and lighting products unit volume declined

5% and 15%, respectively. In 2002, segment profit increased $11.9, or

18%, primarily on lower product and overhead costs.

Net sales decreased $46.6, or 13%, in 2001. Excluding currency deval-

uation of $30.3, net sales decreased $16.3, or 4%, on lower volume

reflecting unfavorable economic conditions in the region. Alkaline,

carbon zinc and lighting products unit volume decreased 5%, 8% and

2%, respectively, from 2000. Segment profit for Asia Pacific decreased

$20.8, or 24%, in 2001 with unfavorable currency effects accounting for

$19.0 of the decline. Absent currencies, segment profit decreased $1.8,

or 2%, on lower volume and higher product cost, partially offset by

lower advertising and promotion and overhead expenses.

Europe

In 2002, net sales increased $16.0, or 6%, on improved pricing

and product mix and favorable currency translation of $9.9, partially

offset by lower carbon zinc volume. Favorable pricing and product mix

reflects the launch of higher priced, higher performing Energizer Ultra+

in late 2001. In 2002, alkaline unit volume increased 2%, while

carbon zinc continued to decline with a 16% decrease. Segment profit

increased in 2002 by $14.7, including favorable currency of $1.8, due

to higher sales and lower product costs.

Net sales for Europe decreased $13.1, or 5%, in 2001, which included

currency devaluation of $24.2. Absent currency effect, sales increased

$11.1, or 4%, on higher volume, partially offset by unfavorable pricing and

product mix in the first three quarters of the year. Alkaline unit volume

increased 19% during 2001 while carbon zinc volume declined 12%.

Much of the volume increase and unfavorable pricing was due to heavy

promotional activity early in the year. Segment results for Europe

improved $.5 in 2001, which included unfavorable currency effects of

$13.4. Absent currencies, segment profit increased $13.9, with higher

sales, lower advertising and promotion expense, and lower product cost

accounting for the majority of the increase. In addition, prior year results

included an unfavorable adjustment related to estimates for promotional

and rebate programs, as well as costs related to reorganization activities.

South and Central America

Net sales for 2002 decreased $33.3, or

25%, due to currency devaluation of $23.7 and significantly lower volumes,

partially offset by higher prices. Argentina accounted for $26.0 of the total

net sales decline. Alkaline and carbon zinc volume declined 15% and 2%,

respectively, in 2002. In the first quarter of fiscal 2002, Energizer took

deliberate actions to reduce sales and accounts receivable in Argentina

in anticipation of currency devaluation. Following devaluation, demand has

declined sharply, however Energizer has maintained its market share in

Argentina. Segment profit fell $3.6, or 27%, in 2002 as unfavorable currency

impacts of $12.4 and lower volumes were partially offset by higher pricing

and lower product and overhead costs.

Net sales increased $6.9, or 5%, in 2001 primarily on higher volume, par-

tially offset by currency devaluation. Alkaline volume increased 5% in 2001

while carbon zinc volume declined 2%. Segment profit decreased $3.1, or

19%, virtually all on currency impacts. Higher sales volumes were offset by

higher product costs.

Future sales and segment profit for the South and Central America region

will be significantly impacted by economic and market conditions in

Argentina, which accounted for approximately 16% of South and Central

America’s net sales for the fiscal year ended September 30, 2002 com-

pared to approximately 30% for the fiscal year ended September 30, 2001.

In addition, following the economic crisis in Argentina, other Latin

American countries have experienced currency and economic declines. If

such conditions continue to worsen, Energizer’s results for that segment

are likely to decline accordingly.

Energizer Holdings, Inc.

Management’s Discussion and Analysis of Results of Operations and Financial Condition Continued

(Dollars in millions except per share and percentage data)

ENR 2002 Annual Report Page 12