Energizer 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

exercise of the Rights. If the threshold is reduced it cannot be lowered to a

percentage that is less than 10% or, if any shareholder holds 10% or more

of the outstanding ENR stock at that time, the reduced threshold must be

greater than the percentage held by that shareholder. The Rights will

expire on April 1, 2010.

At September 30, 2002, there were 300 million shares of ENR stock

authorized, of which approximately 8.9 million shares were reserved for

issuance under the 2000 Incentive Stock Plan.

In September 2000, Energizer’s Board of Directors approved a share

repurchase plan authorizing the repurchase of up to 5 million shares of

Energizer’s common stock, which was completed in May 2002. At that

time, the Board approved a new share repurchase plan authorizing the

repurchase of up to an additional 5 million shares of common stock, of

which no shares have been repurchased as of the date of this report. In

addition, in August 2002, pursuant to a modified Dutch Auction tender

offer, and under a separate Board authorization, Energizer acquired

approximately 2.6 million shares of its common stock at a cost of $77.0.

18. Financial Instruments and Risk

Management

Foreign Currency Contracts Energizer enters into foreign exchange for-

ward contracts and, to a lesser extent, purchases options and enters into

zero-cost option collars to mitigate potential losses in earnings or cash

flows on foreign currency transactions. Energizer has not designated any

financial instruments as hedges for accounting purposes. Foreign currency

exposures are primarily related to anticipated intercompany purchase

transactions and intercompany borrowings. Other foreign currency transac-

tions to which Energizer is exposed include external purchase transactions

and intercompany receivables, dividends and service fees.

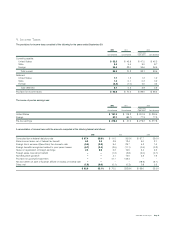

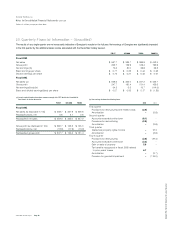

The table below summarizes, by instrument and by major currency, the

contractual amounts of Energizer’s forward exchange contracts and pur-

chased currency options in U.S. dollar equivalents at year-end. These

contractual amounts represent transaction volume outstanding and do

not represent the amount of Energizer’s exposure to credit or market

loss. Foreign currency contracts are generally for one year or less.

2002 2001

Instrument

Options $ 25.8 $ 16.0

Forwards 8.7 121.3

Currency

Euro 25.8 27.5

Australian dollar 8.6 –

Swiss franc –105.7

Other currencies 0.1 4.1

Prepaid Share Option Transaction A portion of Energizer’s deferred

compensation liabilities is based on Energizer stock price and is subject

to market risk. In May 2002, Energizer entered into a prepaid share option

transaction with a financial institution to mitigate this risk. Energizer invest-

ed $22.9 in the prepaid share option transaction and recorded it in other

current assets. The change in fair value of the prepaid share option is

recorded in selling, general and administrative expenses. Changes in

value of the prepaid share option should substantially offset changes in

the deferred compensation liabilities tied to the Energizer stock price. The

change in fair value of the prepaid share option for the year ended

September 30, 2002 resulted in income of $2.6.

Concentration of Credit Risk The counterparties to foreign currency

contracts consist of a number of major international financial institutions

and are generally institutions with which Energizer maintains lines of

credit. Energizer does not enter into foreign exchange contracts through

brokers nor does it trade foreign exchange contracts on any other

exchange or over-the-counter markets. Risk of currency positions and

mark-to-market valuation of positions are strictly monitored at all times.

Energizer continually monitors positions with, and credit ratings of,

counterparties both internally and by using outside rating agencies.

Energizer has implemented policies that limit the amount of agreements

it enters into with any one party. While nonperformance by these coun-

terparties exposes Energizer to potential credit losses, such losses are

not anticipated due to the control features mentioned.

Energizer sells to a large number of customers primarily in the retail trade,

including those in mass merchandising, drugstore, supermarket and other

channels of distribution throughout the world. Energizer performs ongoing

evaluations of its customers’ financial condition and creditworthiness, but

does not generally require collateral. While the competitiveness of the

retail industry presents an inherent uncertainty, Energizer does not believe

a significant risk of loss from a concentration of credit risk exists with

respect to accounts receivable.

Financial Instruments Energizer’s financial instruments include cash and

cash equivalents, short-term and long-term debt, foreign currency con-

tracts, and interest rate swap agreements. Due to the nature of cash and

cash equivalents and short-term borrowings, including notes payable, car-

rying amounts on the balance sheet approximate fair value.

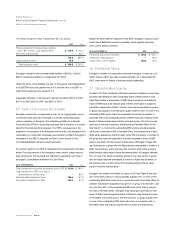

At September 30, 2002 and 2001, the fair market value of long-term debt

was $200.0 and $242.2, respectively, compared to its carrying value of

$175.0 and $225.0, respectively. The fair value of the long-term debt is

estimated using yields obtained from independent pricing sources for simi-

lar types of borrowing arrangements.

The fair value of foreign currency contracts is the amount that Energizer

would receive or pay to terminate the contracts, considering first, quoted

market prices of comparable agreements, or in the absence of quoted

market prices, such factors as interest rates, currency exchange rates and

ENR 2002 Annual Report Page 39