Energizer 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.energizer.com

energizer holdings, inc.

2002 Annual Report

Table of contents

-

Page 1

energizer holdings,inc. 2002 Annual Report www.energizer.com -

Page 2

... reï¬,ects the period during which Energizer was operated as a business segment of Ralston. (d) The pro forma diluted weighted shares outstanding is based on the weighted-average number of shares outstanding of Ralston common stock outstanding prior to the spin-off (adjusted for the distribution of... -

Page 3

... return on invested capital. Financial Review © 2002 Energizer Energizer, e2, Energizer MAX, Eveready Super Heavy Duty, Eveready Gold, Cat and Nine Design, EZ Change, E-SNAP, Energizer Bunny, Energizer Bunny Character, Energizer Hard Case Lantern are trademarks of Eveready Battery Company... -

Page 4

...comprehensive review of Energizer's worldwide operations and capacity utilization completed in late fiscal 2001, we implemented restructuring plans to consolidate carbon zinc production capacity. We closed our facility in Mexico and now supply Latin American markets from our Asian production complex... -

Page 5

...challenging business environment, Energizer is well positioned to prosper. Our portfolio of products is the most comprehensive in the world. Our global sales, marketing and distribution resources rival those of major soft drink and tobacco companies. We have strong cash flows and low debt, giving us... -

Page 6

... - Energizer and Eveready. Our portfolio includes value,premium and super-premium alkaline;carbon zinc; lithium AA super-premium and photo lithium; miniatures; rechargeable NiMH cells; and ï¬,ashlights and lanterns. For ï¬scal 2002, alkaline batteries represent 68 percent of company sales, followed... -

Page 7

... Lithium AA and Photo Super Premium Premium Value Carbon Zinc Miniature Rechargeable Flashlights fastest-growing brand of hearing aid batteries, with dollar sales at retail up over 75 percent, as reported by A.C. Nielsen for the 52-week period ending October 5, 2002. to the 1-hour Charger... -

Page 8

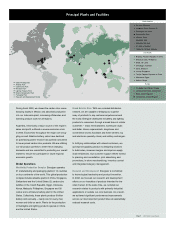

markets & operations Energizer, one of the world's largest manufacturers of dry cell batteries and ï¬,ashlights, markets and sells its products in more than 150 countries around the globe. Of the company's four primary geographic regions, North America and Asia combine for 78 percent of sales and 92... -

Page 9

... Plants and Facilities North America St. Louis, Missouri Asheboro, North Carolina (2) Bennington, Vermont Garrettsville, Ohio Marietta, Ohio Westlake, Ohio Maryville, Missouri St. Albans, Vermont Walkerton, Ontario, Canada Asia Paciï¬c Bogang, People's Republic of China Mandaue Cebu, Philippines... -

Page 10

...Company's annual meeting of shareholders is scheduled for January 27, 2003, at 2:30 p.m. at Energizer's World Headquarters, 533 Maryville University Drive, St. Louis, Missouri 63141. Common Stock Information The table below sets for the ï¬scal quarter indicated the reported high and low sale prices... -

Page 11

financial review 2002 CONTENTS 10 Management's Discussion and Analysis of Results of Operations and Financial Condition 19 Summary Selected Historical Financial Information 20 Responsibility for Financial Statements 20 Report of Independent Accountants 21 Consolidated Financial Statements 25 ... -

Page 12

... portable power. Energizer manufactures and/or markets a complete line of primary alkaline and carbon zinc, miniature and rechargeable batteries primarily under the brands Energizer e , 2 Energizer and Eveready, as well as specialty photo lithium batteries, flashlights and other lighting products... -

Page 13

...in all regions. Advertising and promotion as a percent of sales was 7.2%, 7.9% and 8.7% in 2002, 2001 and 2000, respectively. Segment Results Energizer's operations are managed via four major geographic areas - North America (the United States, Canada and Caribbean), Asia Pacific, Europe, and South... -

Page 14

... to estimates for promotional and rebate programs, as well as costs related to reorganization activities. North America Net sales increased $64.7, or 7%, in 2002 on higher volume. Alkaline and photo lithium battery unit sales increased 7% and 22%, respectively. Pricing and product mix was slightly... -

Page 15

...was $1.3 at September 30, 2002. Energizer expects to fund the remaining costs of these restructuring actions with funds generated from operations. Energizer will continue to review its battery production capacity and its business structure in light of pervasive global trends, including the evolution... -

Page 16

Energizer Holdings, Inc. Management's Discussion and Analysis of Results of Operations and Financial Condition Continued (Dollars in millions except per share and percentage data) Goodwill and Intangibles As part of its annual business planning cycle, Energizer performed an evaluation of its ... -

Page 17

... in North America. First quarter sales accounted for 33%, 33% and 35% of total net sales in 2002, 2001 and 2000, respectively. The first quarter percentage in 2000 was also higher due to Y2K-driven demand. Special Purpose Entity Energizer generates accounts receivable from its customers through... -

Page 18

... stock price. The following risk management discussion and the estimated amounts generated from the sensitivity analyses are forward-looking statements of market risk assuming certain adverse market conditions occur. Interest Rates At September 30, 2002 and 2001, the fair market value of Energizer... -

Page 19

... liability tied to the Energizer stock price. Critical Accounting Policies Energizer identified the policies below as critical to its business operations and the understanding of its results of operations. The following discussion is presented as recommended by Financial Reporting Release No. 60... -

Page 20

... of Operations and Financial Condition and other sections of this Annual Report to Shareholders that are not historical, particularly statements regarding Energizer's estimates of its share of total United States retail alkaline market, its positioning to meet consumer demand and the benefits of... -

Page 21

Energizer Holdings, Inc. Summary Selected Historical Financial Information (Dollars in millions except per share data) Statement of Earnings Data FOR THE YEAR ENDED SEPTEMBER 30, 2002 2001 2000 1999 1998 Net sales Depreciation and amortization (a) Earnings from continuing operations before income... -

Page 22

... of their operations and their cash flows for each of the three years in the period ended September 30, 2002, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of Energizer's management; our responsibility... -

Page 23

Energizer Holdings, Inc. Consolidated Statement of Earnings and Comprehensive Income (Dollars in millions except per share data) Statement of Earnings: YEAR ENDED SEPTEMBER 30, 2002 2001 2000 Net sales Cost of products sold Selling, general and administrative expense Advertising and promotion ... -

Page 24

... maturities of long-term debt Notes payable Accounts payable Other current liabilities Total current liabilities Long-term debt Other liabilities Shareholders equity Preferred stock - $.01 par value, none outstanding Common stock $.01 par value, issued 95,775,807 and 95,563,511 at 2002 and 2001... -

Page 25

Energizer Holdings, Inc. Consolidated Statement of Cash Flow (Dollars in millions) YEAR ENDED SEPTEMBER 30, 2002 2001 2000 Cash Flow from Operations Net earnings/(loss) Adjustments to reconcile net earnings to net cash flow from operations: Depreciation and amortization Translation and ... -

Page 26

..., shares in thousands) DOLLARS 2002 2001 2000 2002 SHARES 2001 2000 Ralston's net investment: Balance at beginning of year Net earnings Net transactions with Ralston Foreign currency translation adjustment Distribution to Ralston's shareholders at spin-off Ending balance Common stock: Balance at... -

Page 27

... portable power. Energizer manufactures and/or markets a complete line of primary alkaline and carbon zinc, miniature and rechargeable batteries primarily under the brands Energizer e2, Energizer and Eveready, as well as specialty photo lithium batteries, flashlights and other lighting products... -

Page 28

... as part of Energizer's annual business planning cycle. The fair value of the reporting unit is estimated using the discounted cash flow method. Impairment of Long-Lived Assets Energizer reviews long-lived assets for impairment whenever events or changes in business circumstances indicate that... -

Page 29

... manufacturing plant locations and capacities. Energizer also reviewed its worldwide operations in light of competitive market conditions and 3. Related Party Activity Cash Management Prior to the spin-off, Energizer participated in a centralized cash management system administered by Ralston. Cash... -

Page 30

... plans improved Energizer's operating efficiency, downsized and centralized corporate functions, and decreased costs. One carbon zinc production facility in Mexico was closed. A total of 539 employees were terminated, consisting of 340 production and 199 sales, 2000 ROLLFORWARD Beginning... -

Page 31

... part of its business planning cycle in the fourth quarter of fiscal 2002, Energizer completed its impairment test of goodwill and intangibles, which resulted in no impairment. The fair value of the reporting unit was estimated using the discounted cash flow method. ENR 2002 Annual Report Page 29 -

Page 32

Energizer Holdings, Inc. Notes to Consolidated Financial Statements Continued (Dollars in millions, except per share data) The following table represents the carrying amount of goodwill and trademarks by segment at September 30, 2002: North America Asia Europe South & Central America Total ... -

Page 33

...ended September 30: 2002 Consolidated 2001 Consolidated Continuing Operations...benefits recognized related to prior years' losses (6.7) Taxes on repatriation of foreign earnings 2.5 Foreign sales corporation benefit - Nondeductible goodwill - Provision for goodwill impairment - Net tax benefit on sale... -

Page 34

... Holdings, Inc. Notes to Consolidated Financial Statements Continued (Dollars in millions, except per share data) In 2001, Energizer recorded a provision for goodwill impairment of $119.0, for which there is no associated tax provision or benefit. See further discussion in Note 8. Prior to spin... -

Page 35

...of Energizer stock for each three shares of Ralston stock) and the weighted-average number of shares of Energizer stock outstanding from April 1, 2000 to September 30, 2000. The following table sets forth the computation of basic and diluted earnings per share: FOR THE YEAR ENDED SEPTEMBER 30, 2002... -

Page 36

... crediting for employees. Amounts deferred into the Energizer Common Stock Unit Fund, and vested company matching deferrals, may be transferred to other investment options offered under the plan. At the time of termination of employment, or for directors, at the time of termination of service on the... -

Page 37

...the projected benefit obligation of $39.4. Prior to the spin-off, Energizer employees participated in Ralston's defined benefit plans. In addition, certain groups of retirees and management employees were eligible for certain postretirement benefits provided by Ralston. ENR 2002 Annual Report Page... -

Page 38

Energizer Holdings, Inc. Notes to Consolidated Financial Statements Continued (Dollars in millions, except per share data) The following tables present the benefit obligation and funded status of the plans: PENSION SEPTEMBER 30, 2002 2001 POSTRETIREMENT 2002 2001 Change in Benefit Obligation: ... -

Page 39

...accordance with Ralston's plan terms. Prior to the spin-off, Energizer recorded costs as allocated by Ralston. The amount of such costs was $1.2 for the six months ended March 31, 2000. Pre-Spin Pension Plans and Other Postretirement Benefits Prior to the spin-off, Energizer participated in Ralston... -

Page 40

... cash flows in Energizer's Consolidated Statement of Cash Flows. AS OF SEPTEMBER 30, 2002 2001 equal to twice the exercise price. Energizer can redeem the Rights at a price of $.01 per Right at any time prior to the time a person or group actually acquires 20% or more of the outstanding ENR stock... -

Page 41

... stock price and is subject to market risk. In May 2002, Energizer entered into a prepaid share option transaction with a financial institution to mitigate this risk. Energizer invested $22.9 in the prepaid share option transaction and recorded it in other current assets. The change in fair value... -

Page 42

... or year. Legal Proceedings Energizer previously disclosed that Zinc Products Company, a division of Alltrista Corp., a supplier of zinc cans used in the manufacture of batteries, filed suit against Energizer, claiming breach of contract when Energizer closed its Fremont, Ohio plant. In January of... -

Page 43

... expense for all operating leases was $17.3, $17.9 and $17.5 in 2002, 2001 and 2000, respectively. 21. Supplemental Financial Statement Information 2002 2001 Supplemental Balance Sheet Information: Inventories Raw materials and supplies Work in process Finished products Total inventories Other... -

Page 44

.... Segment Information Energizer manufactures and markets dry cell batteries including alkaline, carbon zinc, miniature and specialty batteries, and flashlights and other lighting products throughout the world. Operations are managed via four major geographic areas - North America (the United States... -

Page 45

...North America Asia Pacific Europe South and Central America Total capital expenditures Geographic Segment Information on a Legal Entity Basis: Net Sales to Customers United States International Total net sales Long-Lived Assets United States International Total long-lived assets Supplemental product... -

Page 46

...Tax benefits recognized in fiscal 2002 related to prior years' losses Amortization Provision for goodwill impairment (2.9) - (6.1) (2.9) - - - (2.0) (3.2) 5.0 6.7 - - - (3.8) - - (3.8) 12.3 (3.8) (19.4) - - - (3.7) (119.0) ENR 2002 Annual Report Page 44 Design: Falk Harrison Creative, St. Louis... -

Page 47

Energizer Holdings, Inc. 533 Maryville University Dr. St. Louis, Missouri 63141 314.985.2000 www.energizer.com