EasyJet 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc Annual report and accounts 2013

88

How does the change in CEO pay for the year

compare to that for easyJet employees?

The table below shows the percentage year-on-year

change in salary, benefits and annual bonus earned

between the year ended 30 September 2013 and

the year ended 30 September 2012 for the CEO

compared to the average UK easyJet employee

during each year.

% Salary Benefits Annual Bonus

CEO 0% 0% 10% reduction

Average pay based

on all easyJet’s UK

employees13% 3% 3%

1 Reflects the change in average pay for UK employees

employed in both the year ended 30 September 2012

and the year ended 30 September 2013.

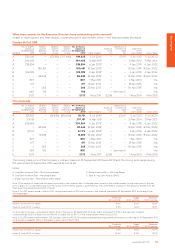

How much does easyJet spend on employee

pay each year?

The table below shows the total pay for all of easyJet’s

employees compared to other key financial indicators.

Year ended

30 September

2012

Year ended

30 September

2013

%

change

Employee costs

(£m) 476 517 8%

Ordinary dividend

(£m) 85 133 56%

Special dividend

(£m) – 175 –

Average number

of employees 8,206 8,343 2%

Revenues (£m) 3,854 4,258 10%

Profit before tax

(£m) 317 478 51%

Additional information on the number of employees,

total revenues and profit has been provided for

context. The majority of easyJet’s employees

(around 85%) perform flight and ground operations,

with the rest performing administrative and

managerial roles.

What have Executive Directors earned for

holding external appointments?

No fees were received by Executive Directors

for external appointments during the year ended

30 September 2013.

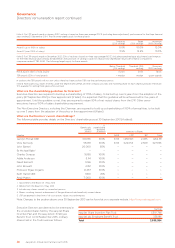

How did shareholders vote on remuneration

at the last AGM?

At the AGM in February 2013, the Directors’

remuneration report received the following votes

from shareholders:

Votes cast in favour 183,047,385 55.3%

Votes cast against 147,995,583 44.7%

Total votes cast in favour

or against 331,042,968 100.0%

Votes withheld 487,819

In line with the Company’s commitment to ongoing

dialogue with its shareholders, meetings are offered,

where appropriate, to understand the reasons for

any potential or actual opposition to the Company’s

remuneration policy. Changes are made to our policy

where it is considered appropriate to do so (e.g.

operating leases were incorporated into the definition

of ROCE used for LTIP purposes in the year under

review following feedback from the Company’s

major shareholders).

easyJet consulted extensively with shareholders

in advance of the 2013 financial year Directors’

remuneration report. In addition, we improved

disclosure to enable other shareholders to take

a fully informed view on the current remuneration

framework policies and practices at easyJet. We

met with the NAPF and the ABI, who recommended

a vote for and gave a “blue top” report respectively.

In relation to voting at our 2013 AGM, 37.3% of the

total shares able to be voted were cast against the

resolution. Two of our top twenty shareholders voted

against the resolution. However, all of our top 20

institutional shareholders voted in support of the

resolution and the next largest shareholder voting

against the resolution held just over 0.1% of the shares

able to be voted.

Where individual shareholders voted against our

policy, the Committee has sought to engage with

them to understand their concerns as part of

determining remuneration policy.

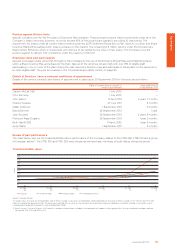

The table below shows the total remuneration figure for the CEO over the same five year period. The total remuneration figure

includes the annual bonus and LTIP awards which vested based on performance in those years. The annual bonus and LTIP

percentages show the payout for each year as a percentage of the maximum.

Year ended 30 September

2009 2010 2011 2012 2013

Single total figure of remuneration (£’000) 1,686 2,741 1,552 3,694 6,4351

Annual bonus (%) 88% 0% 63% 96% 87%

LTIP vesting (%) 0% 0% 0% 92% 100%

1 344,405 LTIP shares vesting for the period, share price is £13.254 (the average share price for the three months to 30 September 2013) an increase

of 292% on the share price at grant of £3.379.

Governance

Directors’ remuneration report continued