EasyJet 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 easyJet plc Annual report and accounts 2013

Strategic report

Chief Executive’s review continued

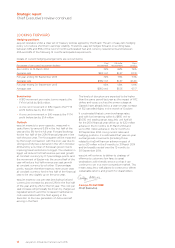

Drive demand, conversion and yields

across Europe

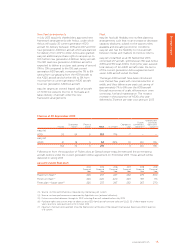

Over the course of the year, easyJet has progressed

a number of initiatives to drive demand and improve

unit revenue. Average revenue per seat was £62.58,

increasing by 7.1% year-on-year on a constant

currencybasis.

Core to the improvement in unit revenues is a

strong understanding of easyJet’s customers and

their needs and preferences. easyJet balances a

low cost base with strong customer experience

to optimise customer satisfaction and loyalty.

Low fares remain the primary focus for passengers,

but the ability to fly to primary airports in a family

environment is increasingly important. easyJet is

a pan-European airline with 56% of easyJet’s

passengers originating from outside of the UK.

easyJet is attracting more affluent older passengers,

with the average age of customers on the easyJet

database increasing by 1.2 years since 2009 to 41.5.

easyJet has also adapted its network, schedules

and offer, including allocated seating to become

increasingly relevant to business travellers.

The ‘europe by easyJet’ campaign has established

a resonant brand positioning that is effective across

all key markets and has continued to drive visits

to easyJet.com. During the year, easyJet targeted

consumers through a range of channels and

successfully used television advertising whilst

reducing marketing cost per seat.

The ‘generation easyJet’ campaign was launched

in September and was well received in all markets.

These actions have driven universally strong brand

awareness scores in all of the core markets and

easyJet is the preferred airline for more than 20%

of consumers in the UK, France, Italy, Switzerland,

Portugal and Spain(8).

easyJet is the third most searched for airline

globally(9) generating over 370 million annual visits

to easyJet.com, which accounts for 85% of sales.

The site has a high proportion of personalised

content based on browsing history and a rigorous

multi-variant testing programme ensures new

features are trialled with up to 20% of the

customer base before going live.

The easyJet mobile app was launched in December

2011, has been downloaded by over six million people

and now accounts for 5% of overall sales. Mobile

boarding cards are now available via the app and

makes travel easier for customers. Similarly, we have

automated our disrupted flight handling as a way of

improving the passenger experience and reducing

contact centre costs.

easyJet has a bespoke revenue management

system which has been developed over a number

of years to optimise revenue per aircraft. Each

flight has its own specific selling profile and

individual fare bands based on multiple variables

and pricing is altered according to demand, with

pricing increasing closer to departure as load

factors increase with the aim of selling the last

seat the day before departure.

Allocated seating was rolled out across the easyJet

network in November 2012 and has been a strong

success. Research conducted by easyJet suggested

that certain customer groups including business

travellers and affluent retired people were put off

flying with easyJet due to the boarding experience(9)

associated with free seating. Allocated seating drove

a 5 percentage point improvement in customer

satisfaction with the boarding experience(9) and

has contributed 0.9 percentage points of the 7.1%

constant currency increase in revenue per seat

without adversely impacting turn times. From

November 2013 easyJet will be yield managing

allocated seating, altering prices on certain routes

depending on levels of demand.

Another important revenue driver has been the

business traveller initiative. There has been good

progress enhancing the products available including

offering fast track security for flexi-fare customers

at 26 airports and a new inclusive fare, which is

available only through indirect channels. easyJet

has in excess of ten million business passengers(10)

travelling on a rolling 12 month basis and has

increased its share of the business travel

market by4%(11).

£62.58

revenue per seat

(2012: £58.51)