EasyJet 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc Annual report and accounts 2013

84

Performance highlights during the year were:

• profit before tax – Achievement was up by 50.9%

to £478 million and pre-tax profit margins grew

by 3 percentage points to 11.2%, considerably

exceeding market consensus at the time the

targets were set;

• on-time performance – Strong sustained on-time

performance of 87.4% of arrivals within 15 minutes;

• customer satisfaction targets – 82.7% of

customers satisfied with the service;

• total costs per seat excluding fuel at constant

currency – 3.9% increase, reflecting increases at

regulated airports and increased use of de-icing

fluid following one of the longest periods of

adverse weather experienced across the network

in recent years; and

• CFO’s departmental objectives – These were

met in full.

86.7% of the maximum bonus was awarded to

the CEO and CFO in respect of performance for

the year ended 30 September 2013. This resulted

in a bonus payment of £1,153,110 to the CEO and

£533,205 to the CFO. One-third of the bonus is

compulsorily deferred into shares for three years

and subject to continued employment. In addition,

Executive Directors can voluntarily defer a portion

of their bonus which may be eligible for Matching

Share Awards.

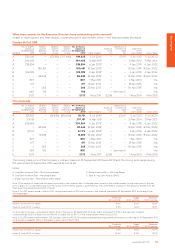

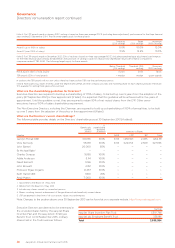

Award Type

Number of

Shares

Face value1

(percentage of salary) Performance condition2Performance period

% vesting at

threshold

performance

CEO Performance Nil cost

option

180,461 £1,329,998 (200%) 50% based on average

ROCE4 and 50%

based on relative TSR5

(versus FTSE 51-150)

3 financial years

ending 30

September 2015

25%

Matching 86,438 £637,048 (96%)3

CFO Performance Nil cost

option

83,446 £614,997 (150%)

Matching 16,878 £124,391 (30%)3

1 Face value calculated based on the grant date share price of 737p on 18 December 2012.

2 Performance conditions are set out on pages 76 and 77.

3 Matching awards are granted over an equal number of shares as the Executive Directors voluntarily defer bonus (pre-tax).

4 ROCE (including operating lease adjustments) 12% threshold to 16% maximum.

5 In addition, the TSR awards will not vest unless there has been positive TSR over the performance period.

Have there been any payments to past

Directors? (Audited)

There have been no payments made to past

directors during the year.

What about payments for loss of office? (Audited)

Sir Michael Rake stood down as Chairman of the

Board on 1 May 2013. He was paid a fee up until his

date of departure. He did not receive any payment

for loss of office.

The Committee is satisfied with the overall payments

in light of the level of performance achieved.

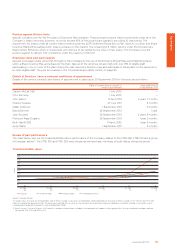

LTIP

The awards made to Executive Directors in 2011

were subject to ROCE (excluding operating lease

adjustments) performance in the financial year

ended 30 September 2013. The percentage which

could be earned was determined using the

following vesting schedule:

ROCE y/e 30

September 2013

Threshold

(25%

vesting)

Target

(50%

vesting)

Maximum

(100%

vesting)

Award One (up to

100% of salary) 7.0% 8.5% 12.0%

Award Two (over

100% of salary) 10.0% 12.0% 13.0%

There were no Matching Awards made in 2011.

ROCE (excluding operating lease adjustments)

in the year ended 30 September 2013 was 23%;

correspondingly 100% of awards are due to vest

in March 2014, subject to continued service.

What LTIP awards were granted to Directors

in the year?

Performance and Matching Share Awards were

made in the year under the LTIP scheme. Details

of the awards made to the Executive Directors are

summarised below, with further details given in the

table on outstanding share interests on page 85.

Governance

Directors’ remuneration report continued