EasyJet 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

www.easyJet.com

Strategic report

What we

have achieved

Chief Executive’s review

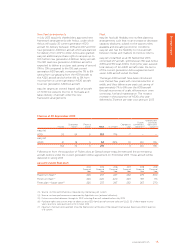

FINANCIAL PERFORMANCE

easyJet delivered record profit before tax

of £478 million up by £161 million from 2012

with a profit before tax margin of 11.2%.

Profit before tax per seat rose by £2.22 year

on year to £7.03.

Return on capital employed(1) grew by 6.1 percentage

points to 17.4% and total shareholder return grew

by 143.8%. easyJet generated operating cash of

£616 million in the year. In light of the continued

strong financial performance, cash generation

and the robustness of the easyJet balance sheet,

the Board has decided, in addition to the regular

ordinary dividend of 33.5 pence per share, to

recommend a special dividend of 44.1 pence per

share, equivalent to £175 million.

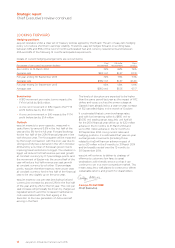

The strong performance in the year was driven by:

• a benign capacity environment in many

key markets;

• strong revenue performance across the UK,

Switzerland, Germany, France, Italy and Portugal;

• the successful introduction of allocated

seating across the easyJet network which

drove incremental revenue without impacting

on-time performance or unit costs;

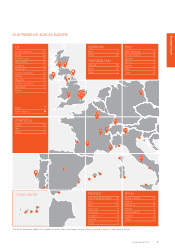

• returns focused changes to the easyJet

network including the reallocation of the eight

Madrid based aircraft to bases and routes with

the potential to drive higher returns including

Edinburgh, Manchester, London Gatwick,

Geneva, Lisbon and Lyon;

• routes and bases introduced in previous financial

years maturing and driving up overall returns; and

• a focus on maintaining easyJet’s cost advantage

driven by both the easyJet lean programme and

the scale advantages from increasing the

proportion of the larger A320 aircraft in the fleet.

Carolyn

McCall OBE

Chief Executive

(1) Unless otherwise stated Return on Capital Employed (ROCE) shown is adjusted for leases with

leases capitalised at seven times.

£478m

profit before tax

(2012: £317m)

17.4%

ROCE

(2012: 11.3%)

33.5

pence per share

proposed ordinary dividend

(2012: 21.5 pence per share)

44.1

pence per share

proposed special dividend

(2012: nil)