EasyJet 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 71

Governance

Risk management and internal control

The Board, as a whole, including the Audit

Committee members, consider the nature and

extent of easyJet’s risk management framework

and the risk profile that is acceptable in order to

achieve the Company’s strategic objectives. As a

result, it is considered that the Board has fulfilled

its obligations under the Code.

The Audit Committee continues to be responsible

for reviewing the adequacy and effectiveness of

the Company’s on-going risk management systems

and processes.

easyJet’s system of internal controls, along with

its design and operating effectiveness, is subject

to review by the Audit Committee through reports

received from management, along with those

from both internal and external auditors.

Further details of risk management and internal

control are set out on pages 68 and 69.

Internal audit

The Audit Committee has oversight responsibilities

for the Internal Audit department. The Internal Audit

annual plan is reviewed and approved and all reports

arising therefrom are reviewed and assessed,

along with management’s actions to findings and

recommendations. Further information on the

Internal Audit department is given on page 69.

The Head of Internal Audit is invited to and attends

Audit Committee meetings and is also given the

opportunity to meet privately with the Audit

Committee without any members of management

present. During the year the Audit Committee

undertook an internal assessment of the effectiveness

and independence of the Internal Audit function.

Main activities of the Committee during the year

During the year the Audit Committee’s business has

included the following items:

• half year results;

• full year results;

• principal judgemental accounting matters affecting

the Group based on reports from both the Group’s

management and the external auditors;

• external audit plans and reports;

• risk and assurance plans and reports, including:

– key internal audit reports;

– follow up of internal audit recommendations;

– control themes;

– internal financial control assessments;

– fraud and loss prevention;

– revenue protection;

– risk assessment;

• information security and business continuity;

• delegated authorities;

• whistleblower reports;

• Internal Audit effectiveness and independence;

• external audit effectiveness, independence

and reappointment;

• anti-bribery and corruption procedures; and

• specific investigations as required.

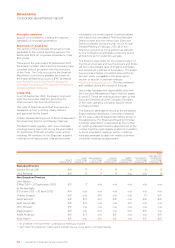

Financial reporting and significant financial issues

The Committee assesses whether suitable

accounting policies have been adopted and

whether management have made appropriate

estimates and judgements. The Committee reviews

accounting papers prepared by management which

provide details on the main financial reporting

judgements. For example, during the year the

Committee reviews the level of provisions and

accruals recorded which are judgemental in nature.

The Committee also reviews reports by the external

auditors on the full year and half year results which

highlight any issues with respect to the work

undertaken on the audit.

The two significant issues considered in the year

are detailed below:

• The Committee reviewed the maintenance

provision at the year end. A number of

judgements are used in the calculation of the

provision, primarily pricing, utilisation of aircraft

and timing of maintenance checks. The

Committee addressed these matters using

reports received from management which

underlie the basis of assumptions used. The

Committee also discussed with the external

auditors their review of the assumptions

underlying the estimates used.

• The Committee considered whether the carrying

value of goodwill and landing rights held by

easyJet should be impaired. The judgement

in relation to impairment largely relates to the

assumptions underlying the calculation of the

value in use of the business being tested for

impairment, primarily whether the strategic plan

is achievable and the overall macroeconomic

assumptions which underlie the valuation process.

The Committee addressed these matters using

reports received from management outlining

the basis for assumptions used. The strategic

plan used in the calculation was approved by

the Board.

The Committee is satisfied that the judgements made

by management are reasonable, and that appropriate

disclosures have been included in the accounts.