EasyJet 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8easyJet plc Annual report and accounts 2013

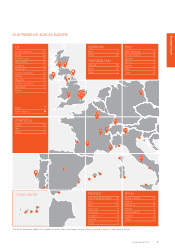

Customers

easyJet’s customer proposition consists of a

network of convenient airports, our friendly service,

website and mobile app and industry leading

on-time performance, all of which we have

continued to deliver in the year to a high standard.

We have also improved our proposition by the

addition of 25 new routes and the introduction

of allocated seating. The rollout of this has been

a great success, with good feedback from

customers and achieved without compromising

on-time performance.

Regulation

The regulatory environment continues to have a

significant impact on easyJet and whilst there has

been progress in some areas such as airspace costs

and increased competition on restricted routes,

there continues to be protectionism such as state

subsidy of failing carriers. Thus easyJet continues

to work constructively with governments and

regulators to build a regulatory framework for

aviation which rewards efficient behaviour. In

particular the European Commission needs to

create and enforce a system of legislation that

ensures a full and fair competitive environment

for airports, airlines and ground handlers. easyJet

welcomes the Davies Commission as it is clear

that the UK needs a coherent roadmap for aviation

capacity, however any future investment needs to

be cost effective and not subsidised by passengers.

People

As a frequent traveller on easyJet, I was delighted

to be given the opportunity to become the

Company’s Chairman. The Company’s performance

over the past few years has been remarkable.

For that, we owe much thanks to Mike Rake,

my predecessor, but also Carolyn McCall, her

management team and the hard work, commitment

and loyalty of all the people at easyJet.

Conclusion

easyJet’s leading European network and cost

advantage combined with a disciplined approach

to use of capital means that it is well placed to

continue to make travel easy and affordable for

customers and generate sustainable returns and

growth for shareholders.

John Barton

Non-Executive Chairman

Chairman’s

introduction

Strategic report

Chairman’s statement

John Barton

Non-Executive

Chairman

DEAR SHAREHOLDER

I am pleased to report that your Company

continued to deliver an exceptionally strong

performance with pre-tax profits growing by

50.9% to £478 million.

Platform for future success

The Company’s platform for future success was

also secured as our shareholders approved a ten

year fleet framework arrangement with Airbus.

This deal will enable easyJet to continue to grow

profitably and will be a significant platform of our

ability to continue to be competitive on cost and

therefore fares. As we said in June, when we

announced our fleet decision, the deal will be

funded without recourse to shareholders.

Returns to shareholders

The Board is proposing an ordinary dividend of

33.5 pence per share, due to the strong performance

of the business in the year, and a special dividend of

44.1 pence per share. Thus the Board is proposing to

return £308 million to shareholders, an increase of

262% over the dividend paid last year.