EasyJet 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 easyJet plc Annual report and accounts 2013

MARKET OVERVIEW

Competitive landscape

Around half of capacity in the European short-haul

market is flown by the five largest carriers: the three

largest legacy airlines Air France-KLM, Lufthansa

and IAG; and the two largest low-cost carriers

easyJet and Ryanair. In general, most of the profits

generated in the European short-haul market come

from the low-cost carriers, with the large legacy

carriers’ profitability being created predominantly

through premium long-haul traffic. There are a few

regional low-cost carriers, including Norwegian and

Wizz Air, with aggressive growth plans, whilst the

other, smaller network carriers tend to be loss

making, restructuring and seeking external sources

of finance (e.g. Alitalia).

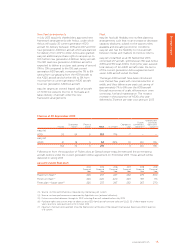

In order to stem their short-haul losses, the larger

legacy carriers have been seeking to restructure

their cost bases to become more competitive. In

addition, larger legacy carriers have been seeking

to transfer traffic to their lower cost subsidiary

airlines. Air France-KLM is transferring regional traffic

towards HOP! and Transavia; Lufthansa is using

Germanwings and IAG launched Iberia Express and

Strategic report

Chief Executive’s review continued

has recently acquired the remaining stake in Vueling.

The majority of these initiatives are at the early

stages of development with lower levels of

customer awareness of the new low-cost brands.

As these transformations progress, there is a trend

towards the products converging: easyJet has

introduced allocated seating which has broadened

its customer appeal, whilst the legacies have

started disaggregating charges with bag fees

being imposed and new lower fare bands being

introduced on a limited range of seats to try

and improve their price perception.

There is evidence that the smaller legacy, regional

and charter operator models are under significant

pressure and this has led to new sources of

funding and restructuring. For example, Etihad has

continued its investment in Europe by acquiring

airberlin’s frequent flyer programme and a stake

in JAT/Air Serbia and Korean Air has purchased a

stake in CSA Czech Airlines. In addition, Flybe has

cut costs, restructured and sold its slots at Gatwick

to easyJet, Thomas Cook has restructured its airline

division, Alitalia is seeking investment and Aegean

and Olympic are in the process of merging their

businesses. Further consolidation cannot be

ruled out.

The smaller, emerging low-cost carriers have placed

large fleet orders and have started to expand from

their traditional bases; for example Norwegian has

started to expand out of Scandinavia and Vueling

out of Barcelona. easyJet has a competitive

advantage from its network driven by its portfolio

of scarce, early slots at congested primary airports,

which has taken a number of years to build up and

cannot be readily replicated. In addition, easyJet’s

pan-European brand enables it to fill the aircraft at

both origin and destination airports whilst other

brands have lower levels of cross-European

recognition and advocacy.

easyJet expects that legacy carriers will continue

to cut capacity from their unprofitable short-haul

operations but that there will be increased

competition from the new low-cost carriers looking

to expand. Whilst the benign capacity environment

is unlikely to continue in the short-term, there will

continue to be retrenchment by less efficient airlines

and therefore opportunities for easyJet to continue

to take profitable share in its core markets.

25

slot pairs at Gatwick

acquired from Flybe