Dish Network 2011 Annual Report Download - page 79

Download and view the complete annual report

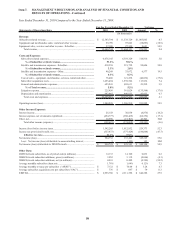

Please find page 79 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

69

69

To the extent we receive these approvals and waivers, there can be no assurance that we will be able to develop and

implement a business model that will realize a return on these spectrum investments or that we will be able to

profitably deploy the assets represented by these spectrum investments. We will likely be required to make

significant additional investments or partner with others to commercialize these licenses. Because we have not

received approval from the FCC, we do not yet know the full costs (including any build-out requirements)

associated with complying with regulations applicable to our acquisition of DBSD North America or the TerreStar

Transaction. Depending on the nature and scope of such commercialization and build-out, any such investment or

partnership could vary significantly, which may affect the carrying value of our investments and our future financial

condition or results of operations.

Voom

If Voom prevails in its breach of contract suit against us, we could be required to pay substantial damages, which

would have a material adverse affect on our financial position and results of operations. In January 2008, Voom HD

Holdings (“Voom”) filed a lawsuit against us in New York Supreme Court, alleging breach of contract and other

claims arising from our termination of the affiliation agreement governing carriage of certain Voom HD channels on

the DISH pay-TV service. At that time, Voom also sought a preliminary injunction to prevent us from terminating

the agreement. The Court denied Voom’s request, finding, among other things, that Voom had not demonstrated

that it was likely to prevail on the merits. In April 2010, we and Voom each filed motions for summary judgment.

Voom later filed two motions seeking discovery sanctions. On November 9, 2010, the Court issued a decision

denying both motions for summary judgment, but granting Voom’s motions for discovery sanctions. The Court’s

decision provides for an adverse inference jury instruction at trial and precludes our damages expert from testifying

at trial. We appealed the grant of Voom’s motion for discovery sanctions to the New York State Supreme Court,

Appellate Division, First Department. On February 15, 2011, the appellate court granted our motion to stay the trial

pending our appeal. On January 31, 2012, the appellate court affirmed the order imposing discovery sanctions and

precluding our damages expert from testifying at trial. We are seeking leave to appeal to New York’s highest state

court, the Court of Appeals. A trial date has not been set. Voom is claiming over $2.5 billion in damages.

Critical Accounting Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make

estimates, judgments and assumptions that affect amounts reported therein. Management bases its estimates,

judgments and assumptions on historical experience and on various other factors that are believed to be reasonable

under the circumstances. Actual results may differ from previously estimated amounts, and such differences may be

material to the Consolidated Financial Statements. Estimates and assumptions are reviewed periodically, and the

effects of revisions are reflected prospectively in the period they occur. The following represent what we believe are

the critical accounting policies that may involve a high degree of estimation, judgment and complexity. For a summary

of our significant accounting policies, including those discussed below, see Note 2 in the Notes to our Consolidated

Financial Statements in Item 15 of this Annual Report on Form 10-K.

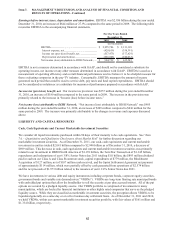

x Capitalized satellite receivers. Since we retain ownership of certain equipment provided pursuant to our

subscriber equipment lease programs, we capitalize and depreciate equipment costs that would otherwise be

expensed at the time of sale. Such capitalized costs are depreciated over the estimated useful life of the

equipment, which is based on, among other things, management’s judgment of the risk of technological

obsolescence. Because of the inherent difficulty of making this estimate, the estimated useful life of

capitalized equipment may change based on, among other things, historical experience and changes in

technology as well as our response to competitive conditions. Changes in estimated useful life may impact

“Depreciation and amortization” on our Consolidated Statements of Operations and Comprehensive Income

(Loss). For example, if we decreased the estimated useful life of our capitalized subscriber equipment by one

year, annual depreciation expense would increase by approximately $53 million.