Dish Network 2011 Annual Report Download - page 63

Download and view the complete annual report

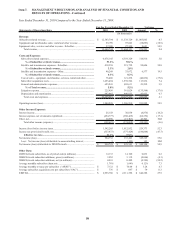

Please find page 63 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

53

53

Subscriber acquisition costs. In addition to leasing receivers, we generally subsidize installation and all or a portion

of the cost of our receiver systems to attract new DISH subscribers. Our “Subscriber acquisition costs” include the

cost of sales of receiver systems to retailers and other third-party distributors of our equipment, the cost of sales of

receiver systems directly by us to subscribers, including net costs related to our promotional incentives, costs related to

our direct sales efforts and costs related to installation and acquisition advertising. We exclude the value of equipment

capitalized under our lease program for new subscribers from “Subscriber acquisition costs.”

SAC. Subscriber acquisition cost measures are commonly used by those evaluating companies in the pay-TV

industry. We are not aware of any uniform standards for calculating the “average subscriber acquisition costs per

new subscriber activation,” or SAC, and we believe presentations of SAC may not be calculated consistently by

different companies in the same or similar businesses. Our SAC is calculated as “Subscriber acquisition costs,” plus

the value of equipment capitalized under our lease program for new subscribers, divided by gross new subscriber

activations. We include all the costs of acquiring subscribers (e.g., subsidized and capitalized equipment) as we

believe it is a more comprehensive measure of how much we are spending to acquire subscribers. We also include

all new DISH subscribers in our calculation, including DISH subscribers added with little or no subscriber

acquisition costs.

General and administrative expenses. “General and administrative expenses” consists primarily of employee-

related costs associated with administrative services such as legal, information systems, accounting and finance,

including non-cash, stock-based compensation expense. It also includes outside professional fees (e.g., legal,

information systems and accounting services) and other items associated with facilities and administration.

Litigation expense. “Litigation expense” primarily consists of legal settlements, judgments or accruals associated with

certain significant litigation.

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” primarily includes

interest expense, prepayment premiums and amortization of debt issuance costs associated with our senior debt (net

of capitalized interest), and interest expense associated with our capital lease obligations.

Other, net. The main components of “Other, net” are gains and losses realized on the sale of investments,

impairment of marketable and non-marketable investment securities, unrealized gains and losses from changes in

fair value of marketable and non-marketable strategic investments accounted for at fair value, and equity in earnings

and losses of our affiliates.

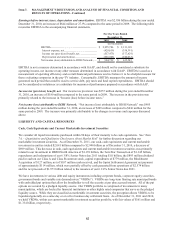

Earnings before interest, taxes, depreciation and amortization (“EBITDA”). EBITDA is defined as “Net income

(loss) attributable to DISH Network” plus “Interest expense, net of amounts capitalized” net of “Interest income,”

“Taxes” and “Depreciation and amortization.” This “non-GAAP measure” is reconciled to “Net income (loss)

attributable to DISH Network” in our discussion of “Results of Operations” below.

DISH subscribers. We include customers obtained through direct sales, third-party retailers and other third-party

distribution relationships in our DISH subscriber count. We also provide DISH service to hotels, motels and other

commercial accounts. For certain of these commercial accounts, we divide our total revenue for these commercial

accounts by an amount approximately equal to the retail price of our DISH America programming package, and

include the resulting number, which is substantially smaller than the actual number of commercial units served, in

our DISH subscriber count. Effective during the first quarter 2011, we made two changes to this calculation

methodology compared to prior periods. Beginning February 1, 2011, the retail price of our DISH America

programming package was used in the calculation rather than America’s Top 120 programming package, which had

been used in prior periods. We also determined that two of our commercial business lines, which had previously

been included in the described calculation, could be more accurately reflected through actual subscriber counts. The

net impact of these two changes was to increase our subscriber count by approximately 6,000 subscribers in the first

quarter 2011. Prior period DISH subscriber counts have not been adjusted for this revised commercial accounts

calculation as the impacts were immaterial.