Dish Network 2011 Annual Report Download - page 78

Download and view the complete annual report

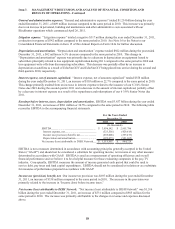

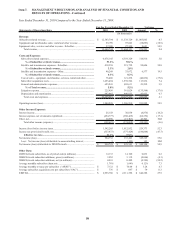

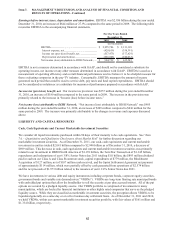

Please find page 78 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

68

68

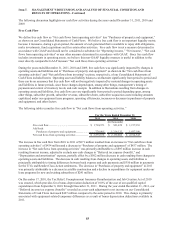

related obligations. These expenditures are necessary to operate and maintain the DISH pay-TV service.

Consequently, we consider them to be non-discretionary. The amount of capital required will also depend on the

levels of investment necessary to support potential strategic initiatives, including our plans to expand our national

HD offerings and other strategic opportunities that may arise from time to time. Our capital expenditures vary

depending on the number of satellites leased or under construction at any point in time, and could increase

materially as a result of increased competition, significant satellite failures, or sustained economic weakness. These

factors could require that we raise additional capital in the future.

Volatility in the financial markets has made it more difficult at times for issuers of high-yield indebtedness, such as

us, to access capital markets at acceptable terms. These developments may have a significant effect on our cost of

financing and our liquidity position.

Spectrum Investments

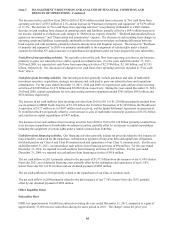

In 2008, we paid $712 million to acquire certain 700 MHz wireless licenses, which were granted to us by the FCC in

February 2009. Part or all of these licenses may be terminated if the associated FCC build-out requirements are not

satisfied.

During the first half of 2011, we entered into a transaction to acquire 100% of the equity of reorganized DBSD

North America for approximately $1.4 billion upon DBSD North America’s emergence from bankruptcy, which

included capital stock and convertible securities of, and certain claims related to, DBSD North America. In

addition, in June 2011, we entered into the TerreStar Transaction for a purchase price of $1.375 billion. We have

paid all but $30 million of the purchase price for the TerreStar Transaction (included in the table above), which will

be paid upon closing of the TerreStar Transaction, or upon certain other conditions being met under the asset

purchase agreement. Additionally, during the fourth quarter 2011, we and Sprint entered into the Sprint Settlement

Agreement pursuant to which all disputed issues relating to our acquisition of DBSD North America and the

TerreStar Transaction were resolved between us and Sprint, including, but not limited to, issues relating to costs

allegedly incurred by Sprint to relocate users from the spectrum now licensed to DBSD North America and

TerreStar. Pursuant to the Sprint Settlement Agreement, we made a net payment of approximately $114 million to

Sprint. Our ultimate acquisition of 100% of the equity of reorganized DBSD North America and consummation of

the TerreStar Transaction are subject to certain conditions, including approval by the FCC.

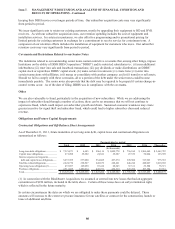

Under our agreements to acquire DBSD North America and purchase TerreStar’s assets, we paid substantially all of

the purchase price for both transactions prior to the receipt of certain regulatory approvals (the FCC with respect to

DBSD North America, and the FCC and Industry Canada with respect to TerreStar). On February 7, 2012, Industry

Canada approved the transfer of the Canadian spectrum licenses held by TerreStar to us. If the remaining required

approvals are not obtained, subject to certain exceptions, we have the right to require and direct the sale of some or

all of the TerreStar assets to a third party and we would be entitled to the proceeds from such a sale. These proceeds

could, however, be substantially less than amounts we have paid in the respective transactions.

In addition, our consolidated FCC applications for approval of the license transfers from DBSD North America and

TerreStar were accompanied by requests for waiver of the integrated service requirement, the spare satellite

requirement and various technical provisions. Waiver of the integrated service requirement would allow DISH to

offer single-mode terrestrial terminals to customers who do not desire satellite functionality. The spectrum licenses

currently held by DBSD North America and TerreStar do not include a waiver of this integrated service

requirement. Our integrated service requirement waiver request has been opposed by certain parties, and there can

be no assurance that the FCC will approve it. If our FCC applications and waiver requests are not granted by the

FCC, or are granted in a manner that varies from the form we have requested, it could cause the value of these assets

to be impaired, potentially requiring us to take significant write-downs on these assets. We assess potential

impairments to these assets annually, or more often if indicators of impairment arise, to determine whether an

impairment condition may exist. We use a probability weighted analysis considering estimated future cash flows

discounted at a rate commensurate with the risk involved and market based data to assess potential impairments.