Dish Network 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

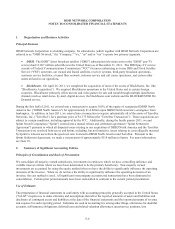

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-15

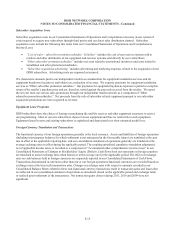

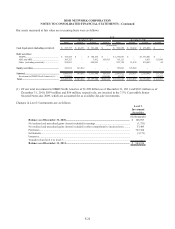

Subscriber Acquisition Costs

Subscriber acquisition costs in our Consolidated Statements of Operations and Comprehensive Income (Loss) consist of

costs incurred to acquire new subscribers through third parties and our direct sales distribution channel. Subscriber

acquisition costs include the following line items from our Consolidated Statements of Operations and Comprehensive

Income (Loss):

x “Cost of sales – subscriber promotion subsidies - EchoStar” includes the cost of our receiver systems sold to

retailers and other distributors of our equipment and receiver systems sold directly by us to subscribers.

x “Other subscriber promotion subsidies” includes net costs related to promotional incentives and costs related to

installation and other promotional subsidies.

x “Subscriber acquisition advertising” includes advertising and marketing expenses related to the acquisition of new

DISH subscribers. Advertising costs are expensed as incurred.

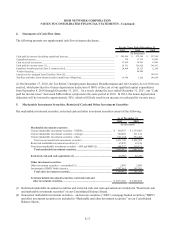

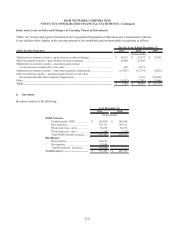

We characterize amounts paid to our independent retailers as consideration for equipment installation services and for

equipment buydowns (incentives and rebates) as a reduction of revenue. We expense payments for equipment installation

services as “Other subscriber promotion subsidies.” Our payments for equipment buydowns represent a partial or complete

return of the retailer’s purchase price and are, therefore, netted against the proceeds received from the retailer. We report

the net cost from our various sales promotions through our independent retailer network as a component of “Other

subscriber promotion subsidies.” Net proceeds from the sale of subscriber related equipment pursuant to our subscriber

acquisition promotions are not recognized as revenue.

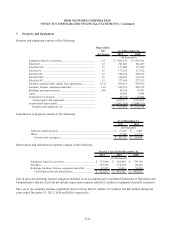

Equipment Lease Programs

DISH subscribers have the choice of leasing or purchasing the satellite receiver and other equipment necessary to receive

our programming. Most of our new subscribers choose to lease equipment and thus we retain title to such equipment.

Equipment leased to new and existing subscribers is capitalized and depreciated over their estimated useful lives.

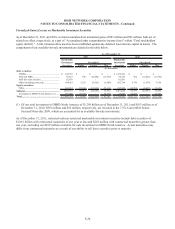

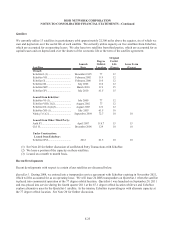

Foreign Currency Translation and Transactions

The functional currency of our foreign operations generally is the local currency. Assets and liabilities of foreign operations

(including intercompany balances for which settlement is not anticipated in the foreseeable future) are translated at the spot

rate in effect at the applicable reporting date, and our consolidated statements of operations generally are translated at the

average exchange rates in effect during the applicable period. The resulting unrealized cumulative translation adjustment,

net of applicable income taxes, is recorded as a component of “Accumulated other comprehensive income (loss)” in our

Consolidated Statements of Changes in Stockholders’ Equity (Deficit). Cash flows from our operations in foreign countries

are translated at actual exchange rates when known or at the average rate for the applicable period. The effect of exchange

rates on cash balances held in foreign currencies are separately reported in our Consolidated Statements of Cash Flows.

Transactions denominated in currencies other than our or our foreign operations functional currencies are recorded based on

exchange rates at the time such transactions arise. Changes in exchange rates with respect to amounts recorded in our

Consolidated Balance Sheets related to these non-functional currency transactions result in transaction gains and losses that

are reflected in our consolidated statement of operations as unrealized (based on the applicable period end exchange rates)

or realized upon settlement of the transactions. Net transaction gains (losses) during 2011, 2010 and 2009 were not

significant.