Dish Network 2011 Annual Report Download - page 102

Download and view the complete annual report

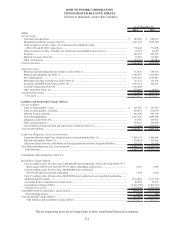

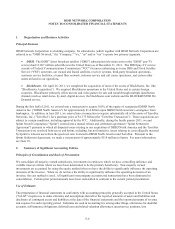

Please find page 102 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

F-8

1. Organization and Business Activities

Principal Business

DISH Network Corporation is a holding company. Its subsidiaries (which together with DISH Network Corporation are

referred to as “DISH Network,” the “Company,” “we,” “us” and/or “our”) operate two primary segments.

x DISH. The DISH® direct broadcast satellite (“DBS”) subscription television service (the “DISH” pay-TV

service) had 13.967 million subscribers in the United States as of December 31, 2011. The DISH pay-TV service

consists of Federal Communications Commission (“FCC”) licenses authorizing us to use DBS and Fixed Satellite

Service (“FSS”) spectrum, our owned and leased satellites, receiver systems, third-party broadcast operations,

customer service facilities, a leased fiber network, in-home service and call center operations, and certain other

assets utilized in our operations.

x Blockbuster. On April 26, 2011, we completed the acquisition of most of the assets of Blockbuster, Inc. (the

“Blockbuster Acquisition”). We acquired Blockbuster operations in the United States and in certain foreign

countries. Blockbuster primarily offers movies and video games for sale and rental through multiple distribution

channels such as retail stores, by-mail, digital devices, the blockbuster.com website and the BLOCKBUSTER On

Demand service.

During the first half of 2011, we entered into a transaction to acquire 100% of the equity of reorganized DBSD North

America Inc. (“DBSD North America”) for approximately $1.4 billion upon DBSD North America’s emergence from

bankruptcy. In addition, in June 2011, we entered into a transaction to acquire substantially all of the assets of TerreStar

Networks, Inc. (“TerreStar”) for a purchase price of $1.375 billion (the “TerreStar Transaction”). These acquisitions are

subject to certain conditions, including approval by the FCC. Additionally, during the fourth quarter 2011, we and

Sprint Nextel Corporation (“Sprint”) entered into a mutual release and settlement agreement (“Sprint Settlement

Agreement”) pursuant to which all disputed issues relating to our acquisition of DBSD North America and the TerreStar

Transaction were resolved between us and Sprint, including, but not limited to, issues relating to costs allegedly incurred

by Sprint to relocate users from the spectrum now licensed to DBSD North America and TerreStar. Pursuant to the

Sprint Settlement Agreement, we made a net payment of approximately $114 million to Sprint. For more information,

see Note 10.

2. Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

We consolidate all majority owned subsidiaries, investments in entities in which we have controlling influence and

variable interest entities where we have been determined to be the primary beneficiary. Non-majority owned

investments are accounted for using the equity method when we have the ability to significantly influence the operating

decisions of the investee. When we do not have the ability to significantly influence the operating decisions of an

investee, the cost method is used. All significant intercompany accounts and transactions have been eliminated in

consolidation. Certain prior period amounts have been reclassified to conform to the current period presentation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States

(“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue

and expense for each reporting period. Estimates are used in accounting for, among other things, allowances for doubtful

accounts, self-insurance obligations, deferred taxes and related valuation allowances, uncertain tax positions, loss