Dish Network 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-28

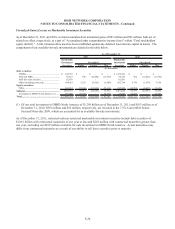

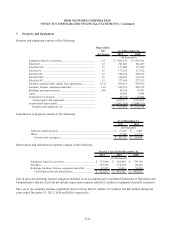

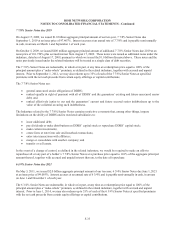

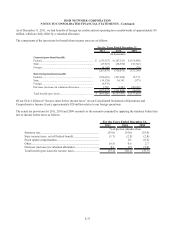

This transaction was accounted for as a business combination using purchase price accounting. The allocation of the

purchase consideration is in the table below.

Purchase

Price

Allocation

(In thousands)

Cash................................................ 107,061$

Current assets.................................. 153,258

Property and equipment.................. 28,663

Acquisition intangibles................... 17,826

Other noncurrent assets................... 12,856

Current liabilities............................ (86,080)

Total purchase price........................ 233,584$

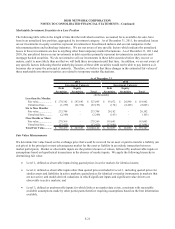

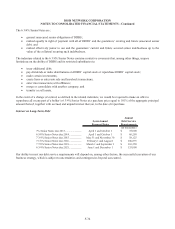

The pro forma revenue and earnings associated with the Blockbuster Acquisition are not included in this filing. Due to

the material ongoing modifications of the business, management has determined that insufficient information exists to

accurately develop meaningful historical pro forma financial information. Moreover, the historical operations of

Blockbuster materially changed during the periods preceding the acquisition as a result of Blockbuster Inc.’s bankruptcy

proceedings, and any historical pro forma information would not prove useful in assessing our post acquisition earnings

and cash flows. The cost of goods sold on a unit basis for Blockbuster in the current period was lower-than-historical

costs. The carrying values in the current period of the rental library and merchandise inventories (“Blockbuster

Inventory”) were reduced to their estimated fair value due to the application of purchase accounting. This impact on

cost of goods sold on a unit basis will diminish in the future as we purchase new Blockbuster Inventory.

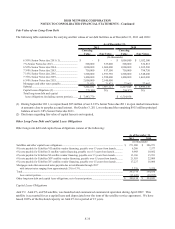

10. Spectrum Investments

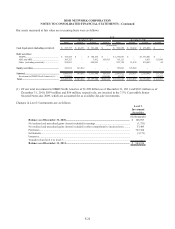

TerreStar Transaction

Gamma Acquisition L.L.C. (“Gamma”), a wholly-owned subsidiary of DISH Network, entered into the TerreStar

Transaction on June 14, 2011. On July 7, 2011, the U.S. Bankruptcy Court for the Southern District of New York

approved the asset purchase agreement with TerreStar and we subsequently paid $1.345 billion of the cash purchase

price. DISH Network is a party to the asset purchase agreement solely with respect to certain guaranty obligations. We

have paid all but $30 million of the purchase price for the TerreStar Transaction, which will be paid upon closing of the

TerreStar Transaction, or upon certain other conditions being met under the asset purchase agreement. Consummation

of the acquisition contemplated in the asset purchase agreement is subject to, among other things, approval by the FCC.

On February 7, 2012, the Canadian federal Department of Industry (“Industry Canada”) approved the transfer of the

Canadian spectrum licenses held by TerreStar to us. If the remaining required approvals are not obtained, subject to

certain exceptions, we have the right to require and direct the sale of some or all of the TerreStar assets to a third party

and we would be entitled to the proceeds from such a sale. These proceeds could, however, be substantially less than

amounts we have paid in the TerreStar Transaction. Additionally, Gamma is responsible for providing certain working

capital and certain administrative expenses of TerreStar and certain of its subsidiaries after December 31, 2011.

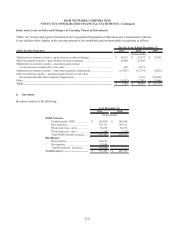

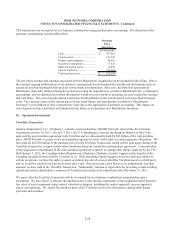

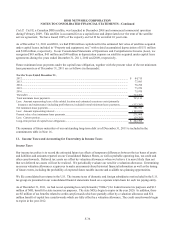

We expect that the TerreStar Transaction will be accounted for as a business combination using purchase price

accounting. We also expect to allocate the purchase price to the various components of the acquisition based upon the

fair value of each component using various valuation techniques, including the market approach, income approach

and/or cost approach. We expect the purchase price of the TerreStar assets to be allocated to, among other things,

spectrum and satellites.