Dish Network 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

67

67

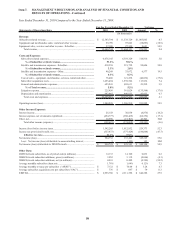

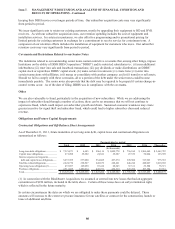

The table above does not include $267 million of liabilities associated with unrecognized tax benefits which were

accrued, as discussed in Note 12 in the Notes to our Consolidated Financial Statements in Item 15 of this Annual

Report on Form 10-K, and are included on our Consolidated Balance Sheets as of December 31, 2011. We do not

expect any portion of this amount to be paid or settled within the next twelve months.

Other than the “Guarantees” disclosed in Note 16 in the Notes to our Consolidated Financial Statements in Item 15

of this Annual Report on Form 10-K, we generally do not engage in off-balance sheet financing activities.

Satellite-Related Obligations

Satellites Under Construction. As of December 31, 2011, we have agreed to lease capacity on one satellite from

EchoStar that is currently under construction. Future commitments related to this satellite are included in the table

above under “Satellite-related obligations.”

x EchoStar XVI. During December 2009, we entered into a ten-year transponder service agreement with

EchoStar to lease all of the capacity on EchoStar XVI, a DBS satellite, which is expected to be launched

during the second half of 2012.

Satellite Insurance

We generally do not have commercial insurance coverage on the satellites we use. We do not use commercial

insurance to mitigate the potential financial impact of in-orbit failures because we believe that the premium costs are

uneconomical relative to the risk of satellite failure. While we generally have had in-orbit satellite capacity

sufficient to transmit our existing channels and some backup capacity to recover the transmission of certain critical

programming, our backup capacity is limited. In the event of a failure or loss of any of our satellites, we may need

to acquire or lease additional satellite capacity or relocate one of our other satellites and use it as a replacement for

the failed or lost satellite.

Purchase Obligations

Our 2012 purchase obligations primarily consist of binding purchase orders for receiver systems and related

equipment, digital broadcast operations, satellite and transponder leases, engineering and for products and services

related to the operation of DISH. Our purchase obligations also include certain guaranteed fixed contractual

commitments to purchase programming content. Our purchase obligations can fluctuate significantly from period to

period due to, among other things, management’s control of inventory levels, and can materially impact our future

operating asset and liability balances, and our future working capital requirements.

Programming Contracts

In the normal course of business, we enter into contracts to purchase programming content in which our payment

obligations are fully contingent on the number of subscribers to whom we provide the respective content. These

programming commitments are not included in the “Contractual obligations and off-balance sheet arrangements”

table above. The terms of our contracts typically range from one to ten years with annual rate increases. Our

programming expenses will continue to increase to the extent we are successful growing our subscriber base. In

addition, our margins may face further downward pressure from price increases and the renewal of long term

programming contracts on less favorable pricing terms.

Future Capital Requirements

We expect to fund our future working capital, capital expenditure and debt service requirements from cash generated

from operations, existing cash and marketable investment securities balances, and cash generated through raising

additional capital. The amount of capital required to fund our future working capital and capital expenditure needs

varies, depending on, among other things, the rate at which we acquire new subscribers and the cost of subscriber

acquisition and retention, including capitalized costs associated with our new and existing subscriber equipment

lease programs. The majority of our capital expenditures for 2012 are driven by the costs associated with subscriber

premises equipment, included in our firm purchase obligations, as well as capital expenditures for our satellite-