Dish Network 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

66

66

keeping their DISH service over longer periods of time. Our subscriber acquisition costs may vary significantly

from period to period.

We incur significant costs to retain our existing customers, mostly by upgrading their equipment to HD and DVR

receivers. As with our subscriber acquisition costs, our retention spending includes the cost of equipment and

installation services. In certain circumstances, we also offer free programming and/or promotional pricing for

limited periods for existing customers in exchange for a commitment to receive service for a minimum term. A

component of our retention efforts includes the installation of equipment for customers who move. Our subscriber

retention costs may vary significantly from period to period.

Covenants and Restrictions Related to our Senior Notes

The indentures related to our outstanding senior notes contain restrictive covenants that, among other things, impose

limitations on the ability of DISH DBS Corporation (“DDBS”) and its restricted subsidiaries to: (i) incur additional

indebtedness; (ii) enter into sale and leaseback transactions; (iii) pay dividends or make distributions on DDBS’

capital stock or repurchase DDBS’ capital stock; (iv) make certain investments; (v) create liens; (vi) enter into

certain transactions with affiliates; (vii) merge or consolidate with another company; and (viii) transfer or sell assets.

Should we fail to comply with these covenants, all or a portion of the debt under the senior notes could become

immediately payable. The senior notes also provide that the debt may be required to be prepaid if certain change-in-

control events occur. As of the date of filing, DDBS was in compliance with the covenants.

Other

We are also vulnerable to fraud, particularly in the acquisition of new subscribers. While we are addressing the

impact of subscriber fraud through a number of actions, there can be no assurance that we will not continue to

experience fraud, which could impact our subscriber growth and churn. Sustained economic weakness may create

greater incentive for signal theft and subscriber fraud, which could lead to higher subscriber churn and reduced

revenue.

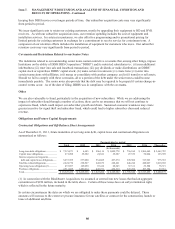

Obligations and Future Capital Requirements

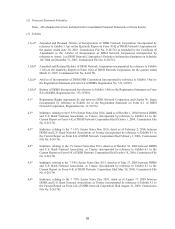

Contractual Obligations and Off-Balance Sheet Arrangements

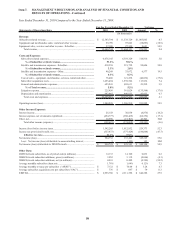

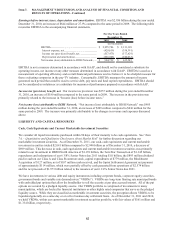

As of December 31, 2011, future maturities of our long-term debt, capital lease and contractual obligations are

summarized as follows:

Total 2012 2013 2014 2015 2016 Thereafter

Long-term debt obligations................... 7,221,871$ 6,443$ 506,114$ 1,005,778$ 756,160$ 1,504,669$ 3,442,707$

Capital lease obligations....................... 271,908 29,202 24,541 25,207 27,339 30,024 135,595

Interest expense on long-term...............

debt and capital lease obligations...... 3,257,955 537,000 534,685 497,274 399,500 313,963 975,533

Satellite-related obligations.................. 2,224,776 220,527 248,679 248,461 248,244 248,027 1,010,838

Operating lease obligations (1)............. 437,897 145,050 87,414 60,243 37,311 29,508 78,371

Purchase obligations............................. 2,911,025 1,481,014 445,771 432,319 327,286 187,304 37,331

Total...................................................... 16,325,432$ 2,419,236$ 1,847,204$ 2,269,282$ 1,795,840$ 2,313,495$ 5,680,375$

Payments due by period

(In thousands)

(1) In connection with the Blockbuster Acquisition, we assumed or entered into new leases that had an aggregate

commitment of $254 million, included in the table above. Certain of these leases have an early termination right,

which is reflected in the future maturity.

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These

amounts will increase to the extent we procure insurance for our satellites or contract for the construction, launch or

lease of additional satellites.