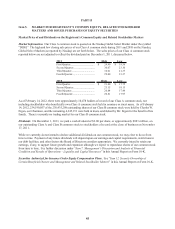

Dish Network 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

49

49

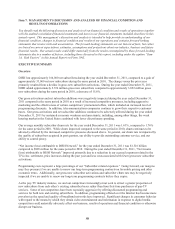

While economic factors have impacted the entire pay-TV industry, our relative performance has also been driven by

issues specific to DISH. In the past, our subscriber growth has been adversely affected by signal theft and other

forms of fraud and by operational inefficiencies at DISH. To combat signal theft and improve the security of our

broadcast system, we completed the replacement of our security access devices to re-secure our system during 2009.

We expect that additional future replacements of these devices will be necessary to keep our system secure. To

combat other forms of fraud, we continue to expect that our third party distributors and retailers will adhere to our

business rules.

While we have made improvements in responding to and dealing with customer service issues, we continue to focus

on the prevention of these issues, which is critical to our business, financial position and results of operations. To

improve our operational performance, we continue to make significant investments in staffing, training, information

systems, and other initiatives, primarily in our call center and in-home service operations. These investments are

intended to help combat inefficiencies introduced by the increasing complexity of our business, improve customer

satisfaction, reduce churn, increase productivity, and allow us to scale better over the long run. We cannot,

however, be certain that our spending will ultimately be successful in improving our operational performance.

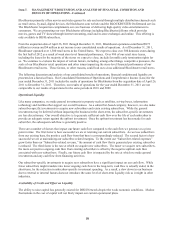

We have been deploying receivers that utilize 8PSK modulation technology and receivers that utilize MPEG-4

compression technology for several years. These technologies, when fully deployed, will allow more programming

channels to be carried over our existing satellites. Many of our customers today, however, do not have receivers that

use MPEG-4 compression and a smaller but still significant percentage do not have receivers that use 8PSK

modulation. We may choose to invest significant capital to accelerate the conversion of customers to MPEG-4

and/or 8PSK to realize the bandwidth benefits sooner. In addition, given that all of our HD content is broadcast in

MPEG-4, any growth in HD penetration will naturally accelerate our transition to these newer technologies and may

increase our subscriber acquisition and retention costs. All new receivers that we purchase from EchoStar have

MPEG-4 technology. Although we continue to refurbish and redeploy MPEG-2 receivers, as a result of our HD

initiatives and current promotions, we currently activate most new customers with higher priced MPEG-4

technology. This limits our ability to redeploy MPEG-2 receivers and, to the extent that our promotions are

successful, will accelerate the transition to MPEG-4 technology, resulting in an adverse effect on our average

subscriber acquisition costs per new subscriber activation (“SAC”).

From time to time, we change equipment for certain subscribers to make more efficient use of transponder capacity

in support of HD and other initiatives. We believe that the benefit from the increase in available transponder

capacity outweighs the short-term cost of these equipment changes.

To maintain and enhance our competitiveness over the long term, we recently introduced the Hopper that allows,

among other things, recorded programming to be viewed in HD in multiple rooms. We are also promoting a suite of

integrated products designed to maximize the convenience and ease of watching TV anytime and anywhere, which

we refer to as TV Everywhere which utilizes, among other things, online access and Slingbox “placeshifting”

technology. There can be no assurance that these integrated products will positively affect our results of operations or

our gross new subscriber activations.

Blockbuster

On April 26, 2011, we completed the Blockbuster Acquisition. We acquired Blockbuster operations in the United

States and in certain foreign countries. Our winning bid in the bankruptcy court auction was valued at $321 million.

We paid $238 million, including $226 million in cash and $12 million in certain assumed liabilities. Of the $226

million paid in cash, $20 million was placed in escrow. Subsequent to this payment, we received a $4 million

refund from escrow, resulting in a net purchase price of $234 million. This transaction was accounted for as a

business combination and therefore the purchase price was allocated to the assets acquired based on their estimated

fair value. Since the purchase prices of future inventory are expected to be higher than the fair value of the

inventory acquired, our cost of sales as a percentage of revenue will be higher in the future.