Dish Network 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-17

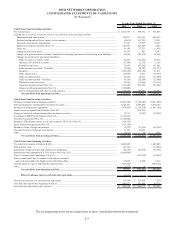

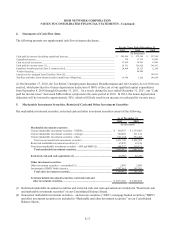

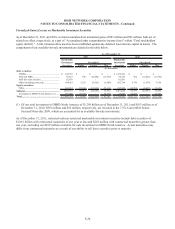

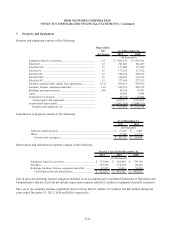

4. Statements of Cash Flow Data

The following presents our supplemental cash flow statement disclosure.

2011 2010 2009

Cash paid for interest (including capitalized interest)............................................................................ $ 545,406 $ 472,586 $ 357,990

Capitalized interest................................................................................................................................ 120 17,139 19,685

Cash received for interest...................................................................................................................... 37,502 36,853 19,489

Cash paid for income taxes (1).............................................................................................................. 38,761 525,028 348,931

Employee benefits paid in Class A common stock................................................................................ 24,804 29,127 12,198

Vendor financing................................................................................................................................... - 40,000 -

Launch service assigned from EchoStar (Note 20)................................................................................ - - 102,913

Satellites and other assets financed under capital lease obligations....................................................... 10,548 5,282 140,109

For the Years Ended December 31,

(In thousands)

(1) On December 17, 2010, the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010 was

enacted, which provides for a bonus depreciation deduction of 100% of the cost of our qualified capital expenditures

from September 8, 2010 through December 31, 2011. As a result, during the year ended December 31, 2011, our “Cash

paid for income taxes” decreased $486 million compared to the same period in 2010. In 2012, the bonus depreciation

deduction will be lowered to approximately 50%, which will likely result in an increase in cash paid for income taxes.

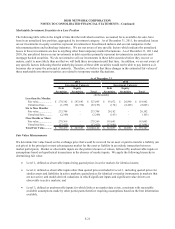

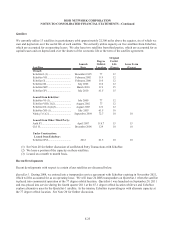

5. Marketable Investment Securities, Restricted Cash and Other Investment Securities

Our marketable investment securities, restricted cash and other investment securities consist of the following:

As of December 31,

2011 2010

(In thousands)

Marketable investment securities:

Current marketable investment securities - VRDNs............................................. 160,555$ 1,334,081$

Current marketable investment securities - strategic............................................. 360,052 211,141

Current marketable investment securities - other.................................................. 911,138 754,483

Total current marketable investment securities.............................................. 1,431,745 2,299,705

Restricted marketable investment securities (1).................................................... 65,843 62,196

Noncurrent marketable investment securities - ARS and MBS (2)....................... 109,327 119,121

Total marketable investment securities........................................................ 1,606,915 2,481,022

Restricted cash and cash equivalents (1)........................................................... 66,592 82,241

Other investment securities:

Other investment securities - cost method (2)....................................................... 2,805 2,805

Investment in DBSD North America.................................................................... 1,297,614 102,591

Total other investment securities.................................................................. 1,300,419 105,396

Total marketable investment securities, restricted cash and

other investment securities.............................................................................. 2,973,926$ 2,668,659$

(1) Restricted marketable investment securities and restricted cash and cash equivalents are included in “Restricted cash

and marketable investment securities” on our Consolidated Balance Sheets.

(2) Noncurrent marketable investment securities – auction rate securities (“ARS”), mortgage backed securities (“MBS”)

and other investment securities are included in “Marketable and other investment securities” on our Consolidated

Balance Sheets.