Dish Network 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-20

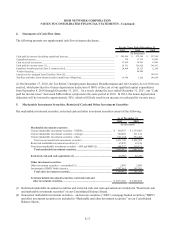

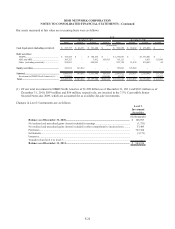

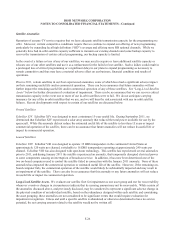

Unrealized Gains (Losses) on Marketable Investment Securities

As of December 31, 2011 and 2010, we had accumulated net unrealized gains of $91 million and $93 million, both net of

related tax effect, respectively, as a part of “Accumulated other comprehensive income (loss)” within “Total stockholders’

equity (deficit).” A full valuation allowance has been established against any deferred taxes that are capital in nature. The

components of our available-for-sale investments are detailed in the table below.

Marketable Marketable

Investment Investment

Securities Gains Losses Net Securities Gains Losses Net

Debt securities:

VRDNs.......................................................... 160,555$ -$ -$ -$ 1,334,081$ -$ -$ -$

ARS and MBS............................................... 46,657 848 (14,486) (13,638) 56,430 902 (12,262) (11,360)

ARS fair value election................................. 62,670 - - - 62,691 - - -

Other (including restricted)........................... 994,021 5,525 (6,565) (1,040) 832,798 9,330 (1,676) 7,654

Equity securities:

Other............................................................. 343,012 89,044 (61,934) 27,110 195,022 82,565 (8,429) 74,136

Subtotal............................................................ 1,606,915 95,417 (82,985) 12,432 2,481,022 92,797 (22,367) 70,430

Investment in DBSD North America (1)....... 839,009 78,749 - 78,749 55,823 22,926 - 22,926

Total................................................................. 2,445,924$ 174,166$ (82,985)$ 91,181$ 2,536,845$ 115,723$ (22,367)$ 93,356$

As of December 31,

(In thousands)

Unrealized

2011

Unrealized

2010

(1) Of our total investment in DBSD North America of $1.298 billion as of December 31, 2011 and $103 million as of

December 31, 2010, $839 million and $56 million, respectively, are invested in the 7.5% Convertible Senior

Secured Notes due 2009, which are accounted for as available-for-sale investments.

As of December 31, 2011, restricted and non-restricted marketable investment securities include debt securities of

$1.061 billion with contractual maturities of one year or less and $203 million with contractual maturities greater than

one year, excluding our $839 million available-for-sale investment in DBSD North America. Actual maturities may

differ from contractual maturities as a result of our ability to sell these securities prior to maturity.